Building a robust emergency fund is a cornerstone of financial stability, yet many of us struggle to create one that’s both effective and efficient. Let’s dive into some practical strategies that can help you build a cost-effective emergency fund without sacrificing your financial goals.

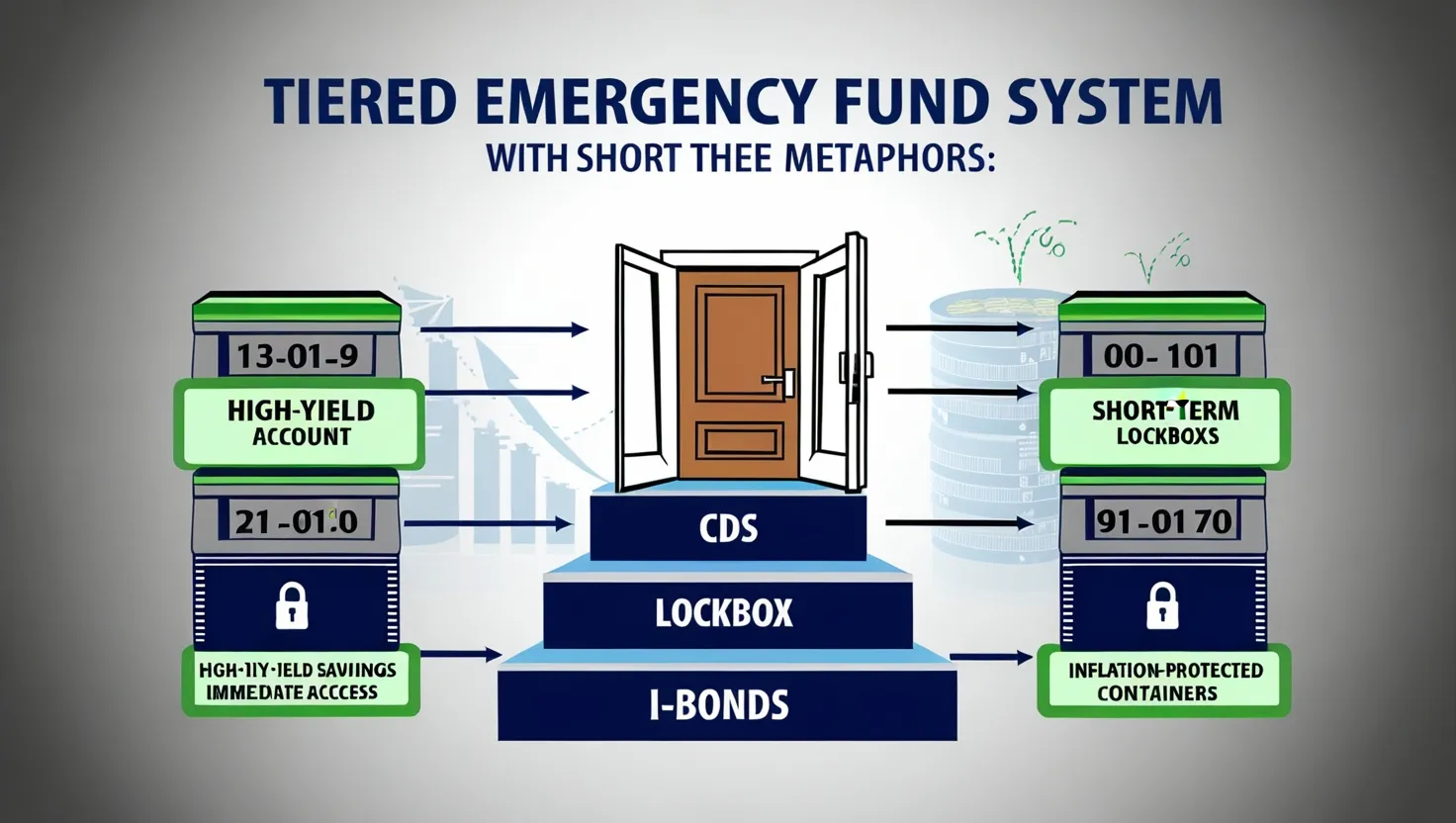

First things first, let’s consider the structure of your emergency fund. Instead of thinking about it as a single lump sum, imagine it as a series of tiers. Each tier serves a different purpose and can be stored in various financial instruments to maximize your returns while maintaining necessary liquidity.

The first tier, let’s call it your “immediate access” fund, should be kept in a high-yield savings account. This is the money you’d need in case of a true emergency - a sudden job loss or an unexpected medical bill. The key here is accessibility, but that doesn’t mean you can’t earn a decent return. Shop around for the best rates; online banks often offer higher yields than traditional brick-and-mortar institutions.

For the second tier, consider short-term Certificates of Deposit (CDs). These offer higher interest rates than savings accounts but come with the caveat of locking your money for a set period. A strategy here could be to create a CD ladder, where you spread your money across CDs with different maturity dates. This way, you’re always close to having a portion of your fund become available while earning higher interest.

“The art is not in making money, but in keeping it.” - Proverb

Now, let’s talk about a lesser-known option for your third tier: I-Bonds. These government-issued savings bonds are indexed to inflation, meaning they protect your purchasing power over time. They’re not as liquid as the first two tiers (you can’t cash them in for at least a year), but they offer a unique combination of safety and inflation protection that’s hard to beat for long-term emergency savings.

Have you ever considered how your emergency fund strategy might change as your income fluctuates? This is where targeted automation comes in. Instead of setting a fixed dollar amount to save each month, consider using percentage-based rules. For example, you might decide to automatically save 5% of each paycheck for your emergency fund. This way, your savings adjust naturally as your income changes, ensuring you’re always setting aside a proportional amount.

What about those unexpected windfalls? Whether it’s a tax refund, a bonus, or a generous gift, having a pre-determined allocation formula can help you make the most of these opportunities. You might decide that 50% of any windfall goes straight into your emergency fund, 30% towards debt repayment, and 20% for discretionary spending. This approach ensures you’re bolstering your financial security while still allowing yourself some flexibility.

“Do not save what is left after spending; instead spend what is left after saving.” - Warren Buffett

Let’s talk about a strategy that can help curb impulse spending and redirect that money to your emergency fund: the 72-hour rule. For any non-essential purchase over $100, give yourself a 72-hour cooling-off period before making the purchase. Often, you’ll find that the urge to buy passes, and you can instead transfer that money to your emergency fund. It’s a simple yet effective way to build your savings while also cultivating mindful spending habits.

Have you ever had to dip into your main emergency fund for a pet’s unexpected vet bill or a car repair? This is where the concept of specific emergency funds comes in handy. Consider setting up separate small funds for pet healthcare, home repairs, and vehicle maintenance. These targeted funds can prevent you from tapping into your main emergency reserve, helping you maintain financial stability across various aspects of your life.

Life is dynamic, and so should be your approach to emergency savings. Make it a habit to review and adjust your emergency fund size quarterly. Has your rent increased? Did you recently pay off a large debt? These life changes should be reflected in the size of your emergency fund. By regularly reassessing, you ensure your safety net remains adequately sized for your current circumstances.

“The habit of saving is itself an education; it fosters every virtue, teaches self-denial, cultivates the sense of order, trains to forethought, and so broadens the mind.” - T.T. Munger

Here’s an idea that might seem counterintuitive at first: maintain a separate “opportunity fund” alongside your emergency fund. While your emergency fund is there to protect you from financial setbacks, an opportunity fund allows you to capitalize on unexpected investment opportunities or career advancements without compromising your financial security. It’s about being prepared not just for the worst, but also for the best.

Implementing these strategies requires discipline and forethought, but the peace of mind that comes with a well-structured emergency fund is invaluable. Remember, the goal isn’t just to save money, but to create a financial buffer that allows you to navigate life’s uncertainties with confidence.

As you build your emergency fund, keep in mind that it’s not just about the destination, but the journey. Each dollar you save is a step towards greater financial freedom and resilience. The habits you develop in this process - mindful spending, regular saving, and strategic planning - will serve you well beyond just emergency preparedness.

What’s your next step in optimizing your emergency fund? Perhaps it’s opening that high-yield savings account you’ve been considering, or setting up that automatic transfer based on a percentage of your income. Whatever it is, remember that small, consistent actions compound over time to create significant results.

In the end, a well-structured emergency fund is more than just a financial safety net; it’s a foundation for peace of mind and future opportunities. So, are you ready to take control of your financial future and build an emergency fund that works as hard as you do?