Cash is the lifeblood of any financial strategy, yet it’s often left languishing in low-yield accounts, slowly eroding in value due to inflation. But what if I told you there’s a way to make your cash work as hard as you do? Let’s explore six proven methods to build a high-yield cash management strategy that can significantly boost your returns while maintaining the liquidity you need.

First, let’s consider the three-tier cash system. This approach divides your cash into three distinct categories: operating cash for monthly expenses, short-term reserves for 3-6 months of expenses, and strategic cash for upcoming major purchases. By segmenting your cash this way, you can tailor your investment strategy to each tier’s specific needs and time horizons.

For your operating cash, a checking account is still the go-to option for its convenience and immediate accessibility. However, for your short-term reserves and strategic cash, it’s time to think beyond traditional savings accounts. High-yield savings accounts and money market funds are currently offering rates between 4-5% APY, a stark contrast to the paltry 0.01% offered by many traditional banks. This difference may seem small, but over time, it can add up to thousands of dollars in additional interest.

Let’s put this into perspective with a real-world example. Imagine you have $30,000 in cash savings. In a traditional savings account at 0.01% APY, you’d earn a mere $3 in interest over a year. Now, place that same amount in a high-yield savings account at 4.5% APY, and you’re looking at $1,350 in interest. That’s a difference of $1,347 – enough for a nice vacation or a significant boost to your investment portfolio.

“The art is not in making money, but in keeping it.” This quote from Proverb rings especially true when it comes to cash management. It’s not just about earning more; it’s about preserving the value of your hard-earned money against the eroding effects of inflation.

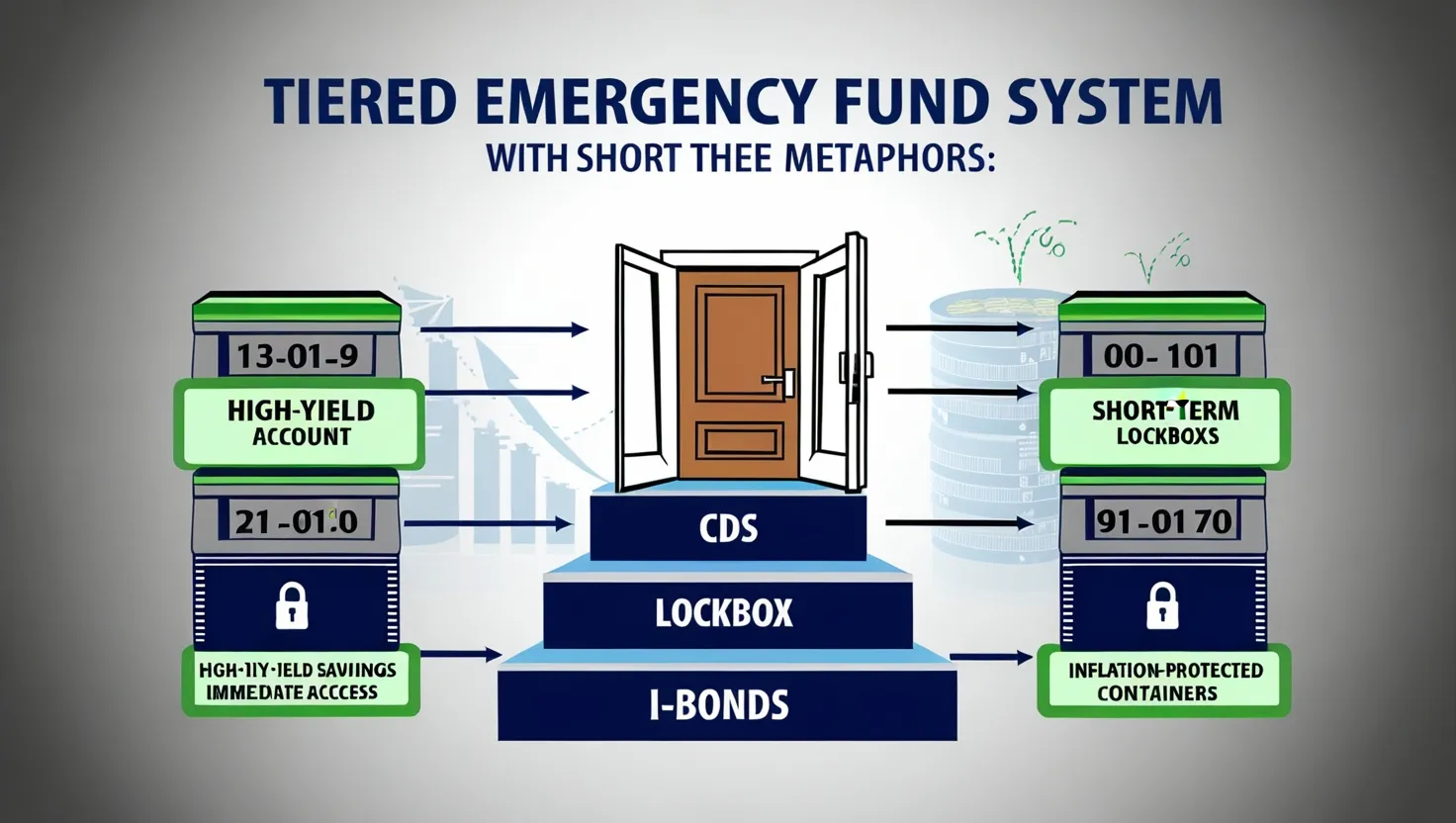

Now, let’s talk about CD laddering. This strategy involves splitting your funds across CDs with different maturity dates, typically 3, 6, 9, and 12 months. As each CD matures, you can either reinvest it or use the funds if needed. This approach allows you to take advantage of higher interest rates offered by longer-term CDs while still maintaining regular access to your funds.

But what about taxes? This is where treasury bills come into play. For those in high tax brackets, treasury bills offer a tax-efficient way to manage cash. The interest earned on these securities is exempt from state and local taxes, potentially resulting in a higher after-tax yield compared to other fixed-income investments.

Have you ever considered the impact of minimum balance requirements and transfer limitations on your cash management strategy? These factors can significantly affect your ability to move funds quickly and take advantage of better rates. That’s why it’s crucial to monitor rates monthly and be prepared to transfer funds to capture higher yields. However, always weigh the potential gains against any fees or penalties for early withdrawal or account closure.

“Money is a terrible master but an excellent servant.” This quote from P.T. Barnum reminds us that with proper management, our money can work for us rather than the other way around.

Let’s consider a practical application of these strategies. Imagine you’re saving for a down payment on a house, with a target of $50,000 in two years. You could structure your cash holdings like this:

Tier 1 (Monthly Expenses): $5,000 in a checking account (0.01% APY) for bills and daily expenses.

Tier 2 (Short-term Reserves): $15,000 in a high-yield savings account (4.5% APY) for emergencies and unexpected costs.

Tier 3 (Strategic Cash): $30,000 in a CD ladder, with $7,500 each in 3, 6, 9, and 12-month CDs (average 4.8% APY).

This structure allows you to earn a blended yield of about 4.3% on your total cash holdings while maintaining liquidity for immediate needs and flexibility for your house purchase timeline.

But remember, the financial landscape is always changing. What works today may not be the best strategy tomorrow. That’s why it’s essential to regularly review and adjust your cash management approach. Are you taking full advantage of current interest rate trends? How might upcoming life events affect your cash needs?

“The best investment you can make is in yourself.” This wisdom from Warren Buffett applies not just to personal development, but also to financial education. The more you understand about cash management strategies, the better equipped you’ll be to make informed decisions about your money.

In conclusion, building a high-yield cash management strategy is about more than just chasing the highest interest rates. It’s about creating a system that balances your need for liquidity, your appetite for yield, and your long-term financial goals. By implementing these six proven methods – the three-tier cash system, high-yield accounts, CD laddering, treasury bills, regular rate monitoring, and strategic fund transfers – you can transform your cash from a stagnant asset into a powerful tool for wealth building.

So, I challenge you: take a look at your current cash holdings. Are they working as hard as they could be? If not, it’s time to put these strategies into action. Your future self will thank you for the extra financial cushion you’ve built through smart cash management.