Investing can be a daunting task, especially for those who are just starting out or don’t have the time to actively manage their portfolios. However, with the advent of technology and innovative financial tools, it’s now possible to create a self-maintaining investment portfolio that grows passively over time. Let’s explore six practical ways to automate your investment strategy and set yourself up for long-term financial success.

First and foremost, consider setting up automatic recurring investments from your checking account to your investment accounts. This simple yet powerful technique ensures that you’re consistently investing, regardless of market conditions or your emotional state. By scheduling these transfers to occur immediately after payday, you’re effectively paying yourself first and building wealth without even thinking about it. As the saying goes, “The best time to plant a tree was 20 years ago. The second best time is now.” The same principle applies to investing – the sooner you start, the more time your money has to grow.

But how much should you invest automatically? A good rule of thumb is to aim for at least 10-15% of your income, but don’t be discouraged if you can’t reach that right away. Start with what you can afford and gradually increase your contributions over time. Remember, consistency is key when it comes to long-term investing success.

Next, let’s talk about maintaining your target asset allocation through threshold-based rebalancing. This involves configuring your brokerage account to trigger rebalancing when any asset class deviates more than a certain percentage (typically 5%) from its target. By doing so, you’re essentially forcing yourself to buy low and sell high, which is the cornerstone of successful investing.

For example, let’s say your target allocation is 60% stocks and 40% bonds. If stocks perform exceptionally well and grow to represent 67% of your portfolio, your automated system would sell some stocks and buy bonds to bring the allocation back to 60/40. This not only maintains your desired risk level but also takes advantage of market fluctuations without requiring constant monitoring on your part.

Have you ever heard of dividend reinvestment plans, or DRIPs? These powerful tools allow you to automatically purchase additional shares with dividend payments, accelerating compound growth without any manual intervention. It’s like planting a money tree that continuously bears fruit and uses that fruit to grow even bigger.

By reinvesting dividends, you’re not only increasing your stake in the company but also taking advantage of dollar-cost averaging. This means you’re buying more shares when prices are low and fewer when prices are high, potentially lowering your average cost per share over time.

Now, let’s delve into the world of tax-efficient investing. By creating an algorithm that establishes rules for which types of assets belong in specific account types (taxable vs. tax-advantaged), you can minimize your tax burden and maximize your after-tax returns.

For instance, you might place high-yield bonds and dividend-paying stocks in tax-advantaged accounts like IRAs or 401(k)s, while keeping growth stocks and municipal bonds in taxable accounts. This strategy takes advantage of the different tax treatments for various types of investment income and can significantly impact your long-term wealth accumulation.

As Warren Buffett once said, “If you don’t find a way to make money while you sleep, you will work until you die.” Automating your investment strategy is one of the most effective ways to make your money work for you, even while you’re sleeping.

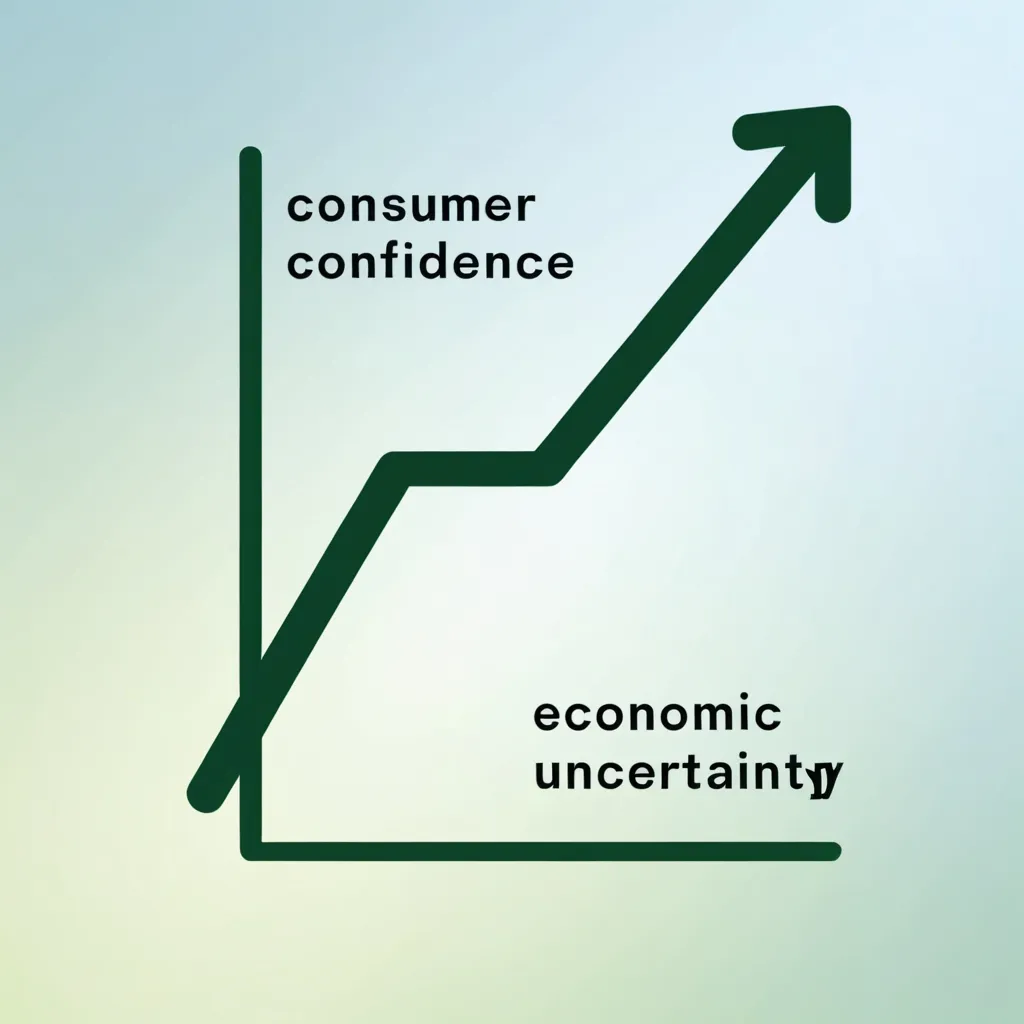

But what about as your investment balance grows? That’s where a systematic investment upgrade path comes into play. This involves automatically shifting funds from higher-fee investments to lower-cost alternatives as your balance grows and qualifies for institutional-class funds.

Many mutual fund companies offer different share classes with lower expense ratios for larger investment amounts. By setting up automatic transfers to these lower-cost options once you reach certain thresholds, you’re ensuring that you’re always getting the best deal possible and maximizing your returns.

Lastly, let’s consider the withdrawal phase of investing, particularly for those approaching or in retirement. Establishing automatic withdrawal rates based on portfolio performance rather than fixed dollar amounts can help ensure sustainable income throughout retirement.

This approach, often referred to as a dynamic withdrawal strategy, adjusts your withdrawals based on market conditions. In years when your portfolio performs well, you might withdraw a bit more, while in down years, you’d withdraw less. This flexibility can help your portfolio last longer and provide more stable income over time.

As you implement these automation strategies, it’s important to remember that they’re not set-it-and-forget-it solutions. While they can significantly reduce the time and effort required to manage your investments, it’s still crucial to periodically review your overall strategy and make adjustments as needed.

Ask yourself: Are my financial goals still the same? Has my risk tolerance changed? Are there new investment opportunities I should consider? Regular check-ins, perhaps once or twice a year, can help ensure your automated system continues to serve your needs effectively.

In conclusion, automating your investment portfolio is a powerful way to build wealth over time while minimizing the emotional and time-intensive aspects of investing. By implementing these six strategies – automatic recurring investments, threshold-based rebalancing, dividend reinvestment, tax-efficient allocation, systematic upgrades, and dynamic withdrawals – you’re setting yourself up for long-term financial success.

Remember, the goal of investing isn’t to get rich quick, but to get rich slowly and steadily. As Christopher Browne wisely stated, “The surest way to build wealth is to keep investment expenses low, diversify broadly, and wait.” By automating your investment strategy, you’re doing just that – creating a disciplined approach that works continuously while requiring minimal ongoing management.

So, are you ready to take control of your financial future and let automation work its magic? The power to create a self-maintaining, growth-oriented investment portfolio is in your hands. Why not start today?