When I think about financial stacking, my mind immediately moves away from the traditional advice scattered in personal finance books. Most people treat everyday transactions as isolated events—a couple of groceries here, a monthly subscription there—rarely questioning if these outflows can be manipulated to produce tangible, compounding benefits. Yet, with the right method, these “routine transactions” can build wealth over the years without demanding extra effort or a change in lifestyle.

What fascinates me is the way stacking leverages layers—like a well-built club sandwich, each bite rewarding you with more than just substance. Let’s start with online shopping. Before clicking ‘Buy Now’ on any item, get into the habit of checking cashback portals like Rakuten or Honey. It’s surprising how many retailers offer bonuses, and stacking those with credit card rewards, especially during rotating bonus categories, adds up. For example, a $200 purchase could suddenly generate $10 from the cashback portal and $4 from the card rewards, giving you a near-instant 7% return. Now, imagine investing this return instead of spending it. “Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn’t, pays it.” This quote, often attributed to Einstein, highlights a reality: stacking benefits and investing them amplifies the effect unnecessarily overlooked by most.

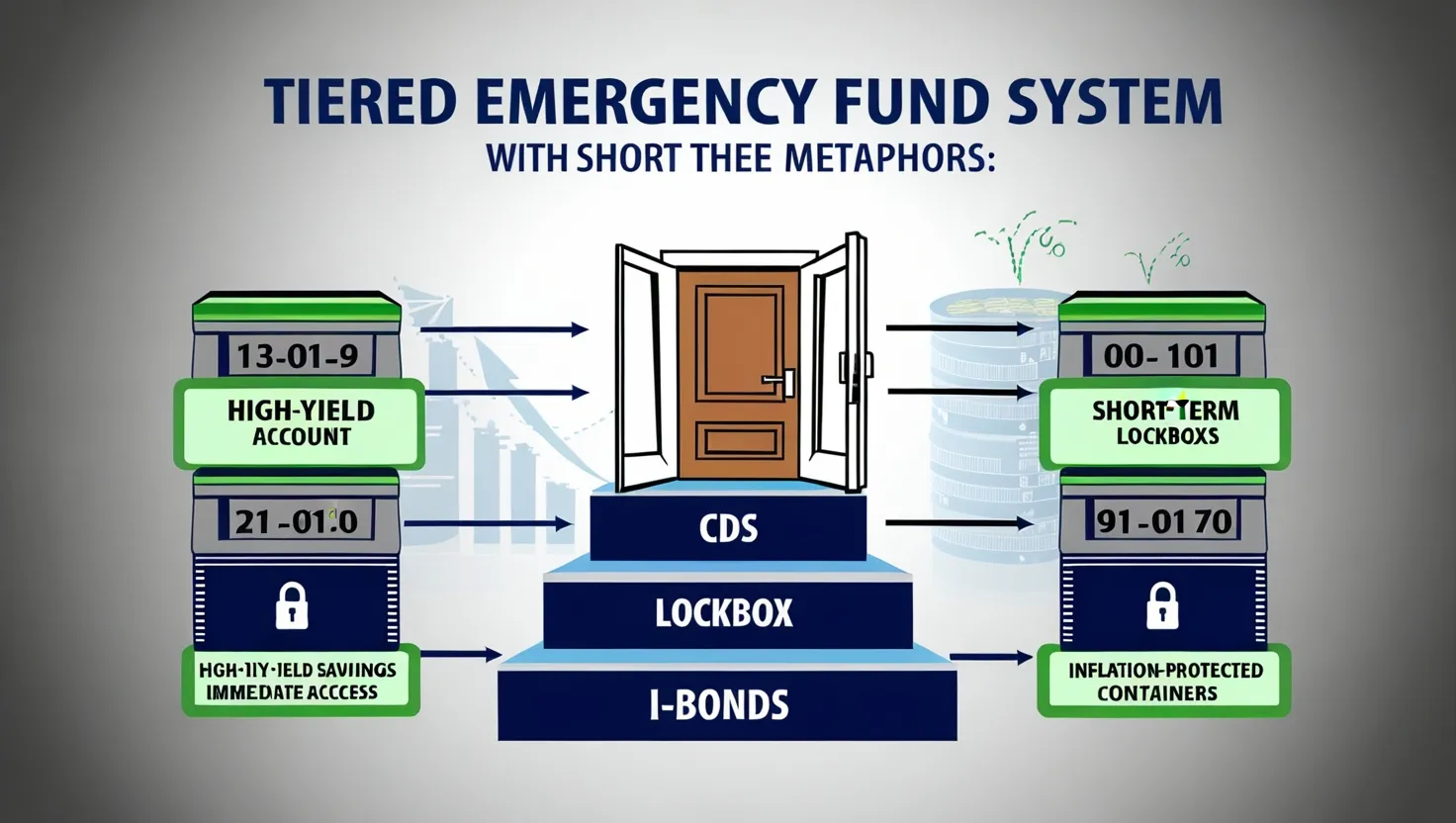

The discussion around stacking often jumps to credit card points and cashback, but let’s consider interest arbitrage stacking. I like to keep my emergency fund in a high-yield savings account, earning 4-5%. For larger planned expenses, instead of dipping into savings, I prefer using a 0% APR credit card when available. The cash equivalent then goes into short-term treasuries or a money market fund, earning that yield difference. The result: risk-free returns on money that would have been spent—the definition of thinking several steps ahead. Have you ever considered the real cost of using your own cash versus borrowed money when interest rates work in your favor?

Everyday spending gives us another underused tool: automated round-up stacking. It’s one of those “set and forget” methods that add up over time. Most people know about apps and banks that round up every purchase: buy a coffee for $2.50, and the 50 cents difference gets set aside. But very few go further and set a second rule—once those round-ups hit $25 for the week, invest the whole amount immediately. Instead of a limping savings account that grows a few dollars a month, you create a pipeline funneling everyday leftovers into an investment account. I see this as a smart, stealthy way to force a saving and investing habit that doesn’t touch your lifestyle. Isn’t it exciting to have your day-to-day convenience working behind the scenes for your financial future?

“Do not save what is left after spending; spend what is left after saving.” Warren Buffett’s words echo loudly here, reminding us to automate saving at every opportunity, especially from the transactions we ignore.

Subscriptions are everywhere in modern life—streaming, news, gym, phone plans. Yet, many of us forget to audit these recurring expenses. I recommend quarterly reviews for every subscription. For those you keep, squeeze out any possible add-ons. Your cell phone provider may offer streaming services, your bank could give you travel insurance, your credit card might get you airport lounge access, and more. Cancel what’s redundant. The average household saves about $40 monthly after a single careful consolidation. But here’s the unconventional part: funnel this freed cash directly into an investment account, rather than letting it disappear into regular spending patterns.

Ask yourself: how many subscriptions do you actually know the full benefits of? Could your gym membership be offering nutrition coaching or discounted sports equipment? The little-known fact is that most companies layer perks onto basic plans but never promote them upfront. Dive into those account dashboards and see what’s hiding in plain sight.

Shopping at regular merchants offers yet another stacking opportunity, with merchant reward stacking. Here, I layer every available benefit: store rewards programs, credit card rewards, manufacturer coupons, and often digital rebate apps. A typical grocery trip could combine all these for 10-15% in savings. The trick is to automate transfers—have those savings deposited straight into your brokerage account so you’re not tempted to spend the windfall.

“It’s not your salary that makes you rich, it’s your spending habits.” Charles A. Jaffe’s famous quote underscores the silent potential of routine spending, showing that stacking doesn’t demand a higher paycheck, just a smarter approach to what you already spend.

What strikes me is that financial stacking is not only accessible, it’s remarkably resilient; it works in bull and bear markets, for spenders and savers. Unlike traditional budgeting, which feels restrictive, stacking transforms financial discipline into a passive act. Each method—whether cashback portal stacking, interest arbitrage, round-up triggers, subscription consolidation, or merchant rewards—can be combined for exponential effect.

I often get asked if this really adds up for households with modest monthly expenses. The math is clear: the typical household spending $3,000 a month could generate $1,000 to $2,000 in new investment capital annually just by stacking benefits—without spending a cent more or working a minute longer. That’s enough to seed a retirement account, cover a child’s education plan, or build a vacation fund.

The lesser-known aspect of stacking is psychological: it builds financial competence without demanding constant vigilance. You become the kind of person who gets rewarded for behaving “normally,” not the person constantly tracking every penny. In fact, an overlooked angle is how stacking helps balance the emotional side of money. When routine actions generate positive results over time, people’s attitudes toward spending shift from guilt to empowerment.

This shifts the narrative around wealth-building, which too often centers on sacrifice and restriction. The future of personal finance is not austerity, but adaptation—layering on benefits and using systems to create circles of profit from dollars already flying out the door.

So, pause for a moment and ask yourself: If every transaction in your life stacked just one extra benefit, how much richer could you become over the next decade? As I see it, financial stacking belongs to anyone willing to adopt a strategic mindset. It all starts with one routine transaction—a coffee run, a phone bill, a grocery haul—and builds into a substantial investment, quietly growing in the background.

“Beware of little expenses; a small leak will sink a great ship.” Benjamin Franklin warned us centuries ago. Today, stacking turns those leaks into productive streams, ensuring every dollar works twice as hard for you.

What small step can you take today? Would you check a cashback portal before your next purchase or audit your subscriptions this weekend? The systems are ready, the opportunities endless, and the results are waiting to be stacked—transaction by transaction.

Let’s make every dollar count, not just once, but many times over.