When it comes to financial independence, the journey can be as daunting as it is rewarding. It’s a path that requires careful planning, discipline, and a clear understanding of where you stand and where you want to go. Here’s how you can start building your roadmap to financial freedom.

Understanding Your Financial Independence Number

The first step in any journey is knowing your destination. For financial independence, this means calculating your Financial Independence Number (FIN). This number represents the amount of money you need to save and invest to cover your living expenses without needing a traditional income. It’s a personal figure, influenced by your lifestyle, location, and financial goals.

To calculate your FIN, consider your annual expenses and multiply them by 25 to 30, assuming a 4% withdrawal rate from your investments. For example, if you spend $50,000 a year, your FIN could be around $1.25 million to $1.5 million. This figure serves as your North Star, guiding your financial decisions and efforts.

Assessing Your Current Financial Situation

Before you can plan for the future, you need to understand your current financial landscape. This involves more than just checking your bank balance; it’s about getting a comprehensive view of your assets, liabilities, and cash flow.

Start by calculating your net worth – the difference between what you own and what you owe. List all your assets, including cash, investments, and property, and subtract your liabilities, such as debts and loans. A positive net worth is a good sign, but a negative one indicates you need to focus on reducing debt and increasing savings.

Tracking your expenses is also crucial. Use budgeting tools or simple spreadsheets to categorize your spending and identify areas where you might be overspending. This insight will help you make informed adjustments and allocate more money towards savings and debt repayment.

Developing Multiple Income Streams

Financial independence isn’t just about saving money; it’s also about generating wealth. One of the most effective ways to do this is by developing multiple income streams. This could include starting a side business, investing in real estate, or even creating digital products.

As the saying goes, “Don’t put all your eggs in one basket.” Having multiple income streams reduces your reliance on a single source of income and provides a safety net in case one of them falters. It also gives you the freedom to pursue opportunities that align with your passions and interests.

Optimizing Your Investment Strategy

Investing is a key component of building wealth over time. However, it requires more than just throwing money into the stock market or buying real estate. It demands a thoughtful and informed approach.

Educate yourself on different investment strategies and consider diversifying your portfolio. This could include a mix of stocks, bonds, real estate, and other assets. The goal is to balance risk and reward, ensuring that your investments grow steadily over the long term.

Automating your investments can also be beneficial. Set up automatic transfers from your checking account to your investment accounts to ensure consistent contributions. This habit helps you build wealth incrementally, without the need for constant intervention.

Implementing Aggressive Debt Reduction Techniques

Debt, especially high-interest debt, can be a significant barrier to financial independence. It’s essential to tackle this head-on with aggressive debt reduction techniques.

Consider the debt avalanche method, where you focus on paying off the debts with the highest interest rates first. This approach saves you money on interest in the long run and frees up more of your income for savings and investments.

Alternatively, you might prefer the debt snowball method, which involves paying off the smallest debts first to build momentum and motivation. Both methods have their merits, so choose the one that best fits your personality and financial situation.

Creating a Flexible Timeline with Milestones

Financial independence is not a sprint; it’s a marathon. It requires patience, persistence, and a clear timeline with achievable milestones.

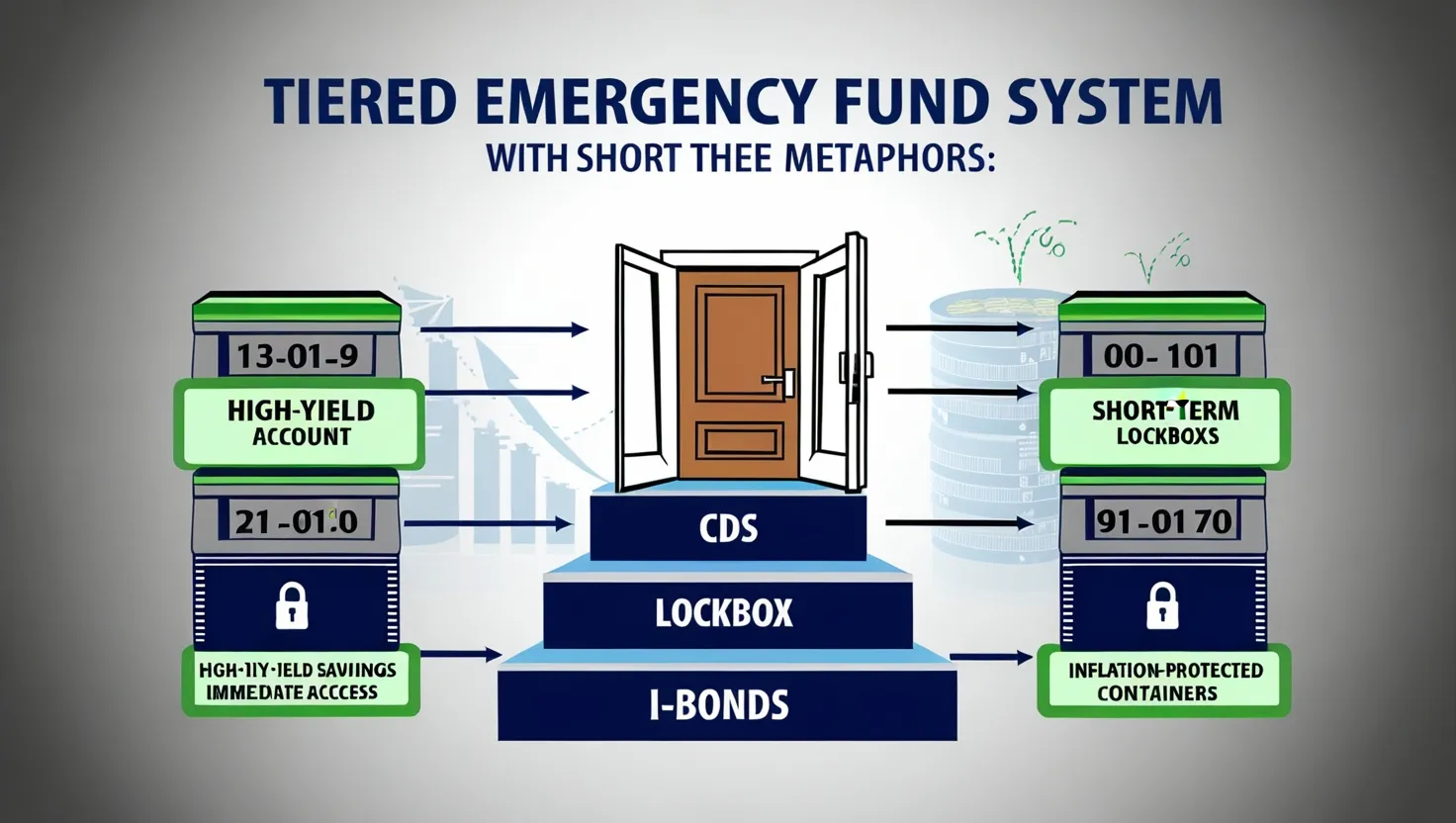

Start by setting short-term and long-term goals. Short-term goals might include saving for an emergency fund, paying off a credit card, or building a small investment portfolio. Long-term goals could be more ambitious, such as buying a home, funding your child’s education, or retiring comfortably.

Make your goals SMART – Specific, Measurable, Achievable, Relevant, and Time-bound. For example, instead of saying “I want to save more money,” set a goal like “Save $10,000 for an emergency fund within the next 18 months by setting aside $556 per month.”

As you progress, celebrate your milestones. These small victories will keep you motivated and focused on your larger goals.

The Power of Flexibility

Financial independence plans are not set in stone; they need to be flexible. Life is unpredictable, and your plan should be able to adapt to changes in your income, expenses, or personal circumstances.

For instance, if you lose your job or face a medical emergency, your emergency fund can serve as a safety net. Having this cushion allows you to adjust your plan without derailing your entire journey.

The Role of Mindset

Achieving financial independence is as much about mindset as it is about strategy. It requires a shift in how you think about money and wealth.

As Warren Buffett once said, “Price is what you pay. Value is what you get.” This mindset helps you focus on the value you’re creating rather than just the price you’re paying.

Engaging with Your Goals

To stay motivated, it’s crucial to engage deeply with your financial goals. Ask yourself questions like:

- What does financial independence mean to me?

- How will my life change once I achieve it?

- What sacrifices am I willing to make to get there?

These questions help you connect emotionally with your goals, making the journey more meaningful and fulfilling.

Addressing Counter-Arguments

When planning for financial independence, it’s important to consider opposing viewpoints. Some might argue that aggressive debt reduction or strict budgeting is too restrictive or that investing in the stock market is too risky.

Address these concerns by understanding both sides of the argument. For example, while budgeting might seem restrictive, it’s actually a tool for freedom – the freedom to choose how you spend your money and the freedom to pursue your dreams without financial stress.

The Journey, Not the Destination

Financial independence is a journey, not a destination. It’s about the steps you take each day, the decisions you make, and the habits you form.

As Robert Kiyosaki said, “It’s not how much money you make, but how much money you keep, how hard it works for you, and how many generations you keep it for.”

This perspective helps you stay focused on the process rather than just the end result. It’s about building a life of financial freedom, one step at a time.

In conclusion, creating a financial independence plan is a personal and ongoing process. It involves calculating your FIN, assessing your current situation, developing multiple income streams, optimizing your investments, reducing debt aggressively, and setting a flexible timeline with milestones.

Remember, financial independence is not just about money; it’s about the freedom to live the life you want. So, take the first step today, and start building your roadmap to financial freedom. As the saying goes, “The best time to plant a tree was 20 years ago. The second-best time is now.”