The FIRE Movement: Redefining Retirement for Millennials

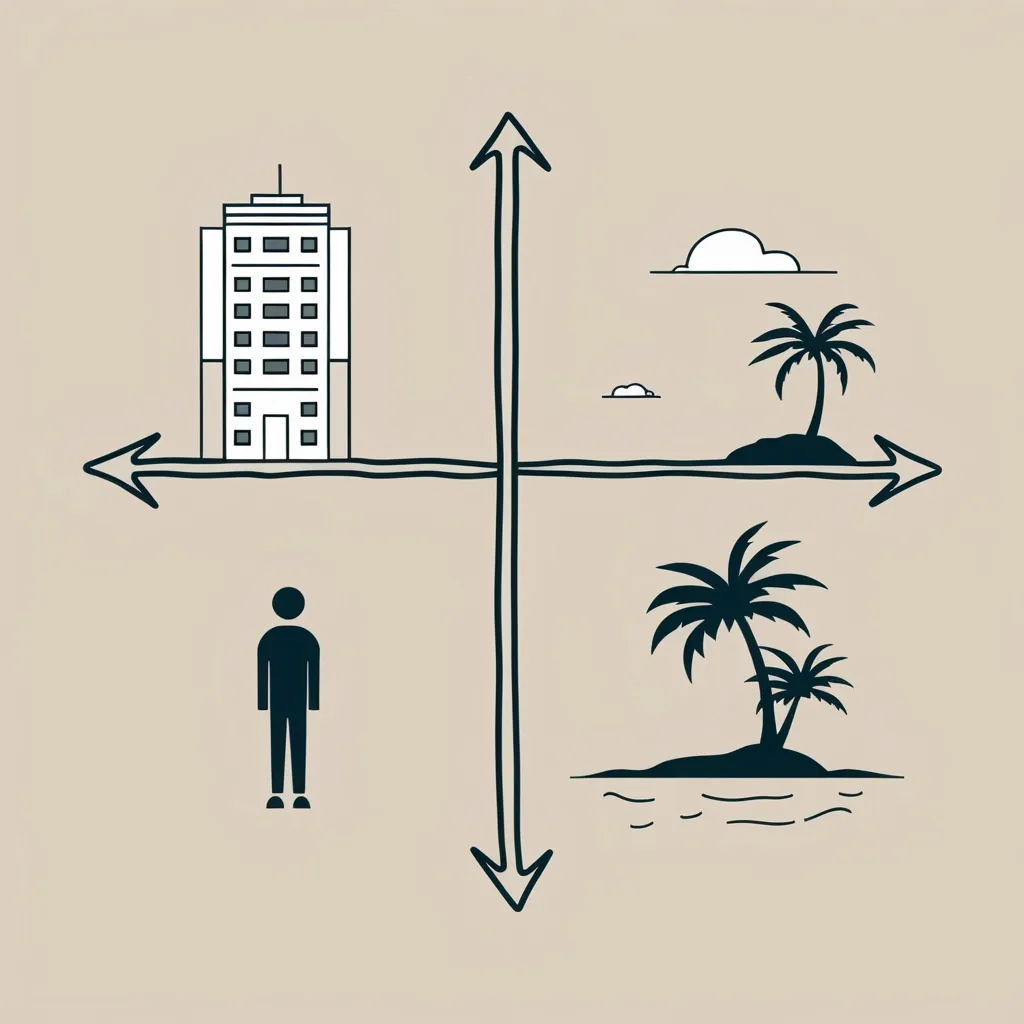

Retirement isn’t what it used to be. Gone are the days of working until 65 and then kicking back on a beach. For millennials, the game has changed. Enter the FIRE movement - Financial Independence, Retire Early. It’s not just a trend; it’s a whole new way of thinking about work, money, and life.

So, what’s the big deal with FIRE? Well, imagine ditching your 9-to-5 grind in your 30s or 40s. Sounds pretty sweet, right? That’s the dream FIRE followers are chasing. But it’s not all about sipping piña coladas on a beach (though that’s definitely an option). It’s about freedom - the freedom to choose how you spend your time and your life.

At its core, FIRE is simple: save like crazy, live frugally, and invest smartly. We’re talking saving 50% to 70% of your income. Yeah, you read that right. It’s a far cry from the measly savings most of us manage. But here’s the kicker - it’s not just about pinching pennies. It’s about rethinking every expense. That $100 dinner? In FIRE terms, that’s five hours of work if you’re earning $20 an hour. Makes you think twice about that fancy meal, huh?

Now, you might be wondering, “How much do I need to save?” That’s where the FIRE number comes in. It’s typically 25 times your annual expenses. So, if you’re living on $40,000 a year, you’re looking at a cool $1 million. Once you hit that magic number, you can start living off your savings, typically withdrawing 3% to 4% each year. It’s not about never working again; it’s about having the choice.

But here’s the thing - FIRE isn’t one-size-fits-all. There are flavors of FIRE to suit different tastes. You’ve got “Fat FIRE” for those who want to keep living large while saving big. Then there’s “Lean FIRE” for the minimalists out there, living on as little as $25,000 a year. And for those who want a middle ground, there’s “Barista FIRE” - mixing part-time work with savings to keep the lifestyle comfy without touching the nest egg.

Let’s talk real life for a sec. Take Jace Mattison. He sold his lumber company for big bucks in his early 30s. But instead of going full retirement mode, he found his sweet spot balancing work and play. Golfing, lake trips, and hobbies he never had time for before - that’s his new normal. It’s a common theme among FIRE achievers. They don’t just quit working; they redefine what work means to them.

Or look at Lauren and Steven Keys. They ditched their full-time gigs in their 20s. Now they’re freelancing, tutoring online, and managing rental income. They’re living proof that early retirement doesn’t mean never earning another dime. It’s about having the freedom to earn on your own terms.

But here’s the real talk - FIRE isn’t just about the money. It’s a mind game too. Many folks define themselves by their work. So when that’s gone, what’s left? Studies show the average retiree gets bored within a year. That’s why finding purpose beyond the paycheck is crucial.

Take it from a 37-year-old VP who found out the hard way - financial freedom doesn’t fix everything. Anxiety and depression don’t magically disappear when your bank account is full. The key is figuring out what to do with all that free time. It’s about building a life, not just a nest egg.

The FIRE community gets this. That’s why there are massive online forums where FIRE enthusiasts share tips, offer support, and keep each other motivated. Reddit’s FIRE subreddit? It’s huge. And then there are the finfluencers - financial influencers spreading the FIRE gospel on social media. It’s like a whole subculture.

Now, let’s be real - FIRE has its critics. Some say it’s unrealistic, especially for those not raking in the big bucks or living in pricey cities. There’s also the question of whether living on 3% to 4% of your savings is actually doable long-term. And what about those pesky tax penalties if you need to tap into retirement accounts early?

But here’s the thing - even if you can’t go full FIRE, there are lessons here for everyone. Maybe saving 25 times your annual expenses is a stretch. But what about 5 times? Or even 2 times? The principles of living below your means, automating savings, and investing wisely? That’s solid advice no matter who you are.

Take it from Jill Schlesinger, a CBS News business analyst. She says even small changes can make a big difference. Saving $10 or $20 that you might have wasted? Do that consistently, and you’re onto something. It’s about tracking where your money goes and making it work for you.

At the end of the day, FIRE is about more than just retiring early. It’s about taking control of your finances and, by extension, your life. It’s about having options. Maybe you don’t want to quit working entirely. Maybe you just want the freedom to take a sabbatical, start a business, or switch to a lower-paying job you love.

For millennials, FIRE represents a shift in thinking. It’s saying no to the traditional career path and yes to designing your own life. It’s about finding that sweet spot between work and play, between saving for tomorrow and living for today.

So, whether you’re all in on FIRE or just looking to get your finances in order, there’s something here for you. Start small. Track your spending. Automate your savings. Invest wisely. And most importantly, think about what you really want out of life. Because that’s what FIRE is really about - not just retiring early, but living intentionally.

Remember, it’s not about never working again. It’s about having the freedom to work on your terms. To pursue your passions. To live life the way you want to live it. And in a world where so much feels out of our control, that kind of freedom is priceless.

So, are you ready to light your own FIRE? It doesn’t have to be all or nothing. Start with small steps. Reassess your spending. Boost your savings. Think about what really matters to you. Because at the end of the day, FIRE isn’t just about money. It’s about creating a life that’s truly yours. And that’s a goal worth pursuing, no matter where you are on your financial journey.