Creating a personal financial plan is like mapping out a journey to a place of financial security and peace. It’s totally a game-changer for managing your money, making smart choices, and hitting those financial milestones. Ready to dive in? Here’s a super chill, easy-to-follow guide to get you started.

Setting Your Financial Goals

First things first, you gotta figure out what you’re aiming for. Imagine the life you want in five, ten, or twenty years. Maybe you want to buy a house, a sweet ride, or finally kiss that debt goodbye. Short-term goals might be saving for a cool vacation or a car, while long-term goals could be all about retirement or sending your kid to college.

For instance, if you’ve got a little one running around, you might want to start saving for their education now. This sets the stage for how much you need to save each month and what budget tweaks are needed to make it happen.

Checking Out Your Current Financial Scene

It’s crucial to know where you currently stand financially. Collect stuff like your income slips, expense records, and any account statements. This gives you a clear picture of your assets, liabilities, and cash flow. Calculate your net worth by subtracting your liabilities from your assets.

Take a good look at your monthly expenses – both the fixed ones like rent and variable ones like groceries or entertainment. Understanding your spending habits will help you create a realistic budget and financial game plan.

Crafting a Budget

Budgeting is the heart of any solid financial plan. It’s all about making sure your income is properly allocated. The 50/30/20 rule is a great place to start: Allocate 50% of your earnings to needs (think rent, groceries), 30% to wants (those new shoes or dining out), and 20% to savings and debt payoff.

Imagine you’re pulling in $4,000 a month. Following this rule, $2,000 goes to essentials, $1,200 to fun stuff, and $800 towards savings and knocking out debt. Feel free to tweak the percentages to fit your life.

Building that Safety Net

Unexpected expenses can totally mess with your plans if you’re not ready. That’s why having an emergency fund is so crucial. Aim for saving three to six months’ worth of living expenses. Start small if you need to – even $500 can cover minor freakouts and keep you from racking up more debt.

Tackling Debt

Debt, especially with high-interest rates, can really hold you back. Start by focusing on paying off those high-interest debts like credit cards. There are two popular strategies: the snowball method, where you pay off smaller debts first to build momentum, and the avalanche method, which targets the highest interest rates first.

If you have a credit card with a $2,000 balance at 18% interest and another one with $500 at 12% interest, the avalanche method would have you pay off the $2,000 one first. However, the snowball method might keep you motivated by quickly eliminating the smaller debt.

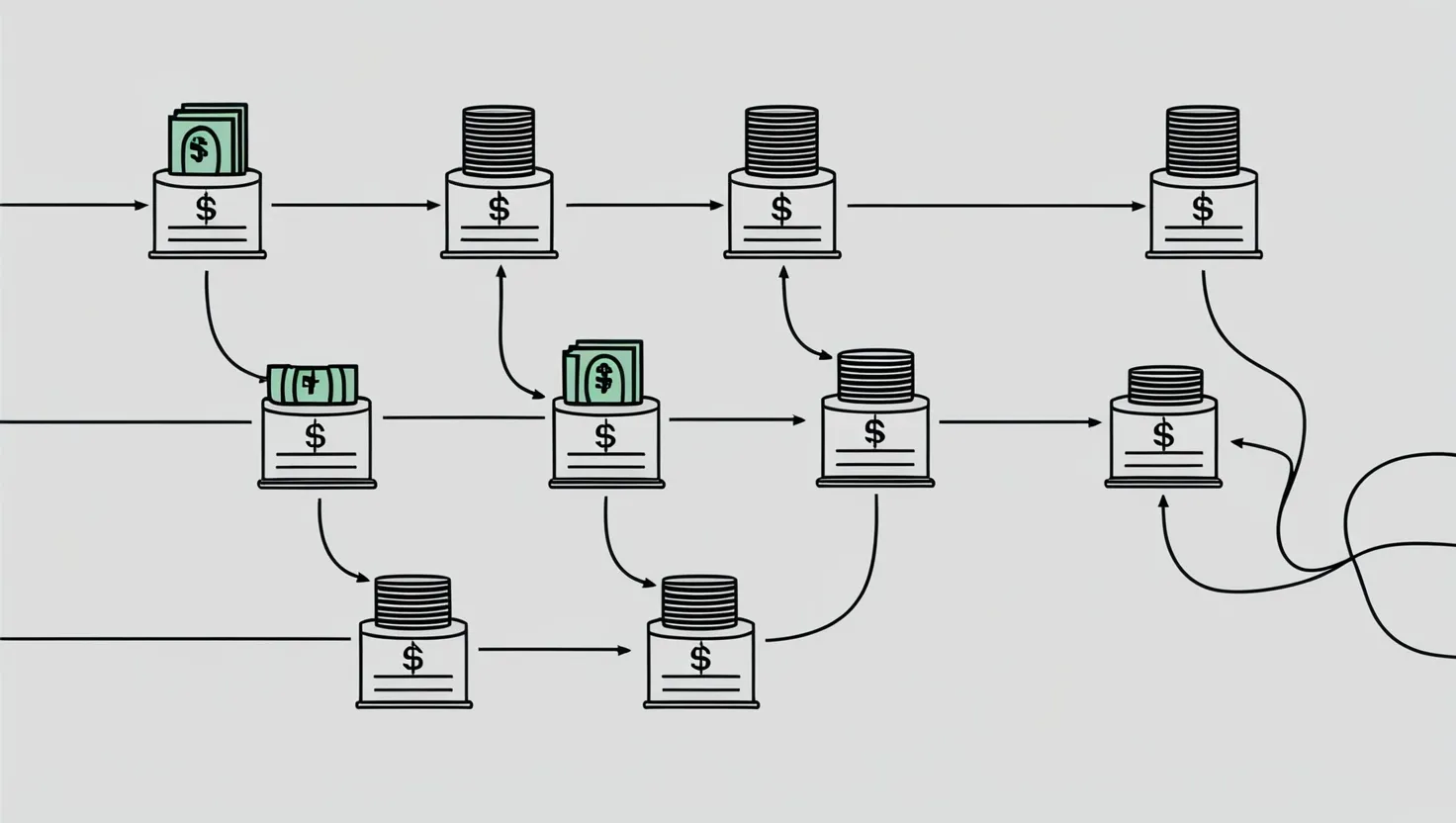

Getting Your Investments in Order

Investing is crucial for long-term goals. It helps your money grow over time, which is key for big dreams like retirement or buying a house. Determine how much you can comfortably invest each month. Options like a 401(k) or a brokerage account are great places to start. Even smaller, consistent investments can add up significantly over the years.

Imagine investing $500 every month in a diversified portfolio with an average annual return of 7%. Over time, this can grow into something substantial. Remember, investing is like planting a tree – it takes time to grow.

Planning for Retirement

Retirement planning might seem way down the road, but it’s something you should start early. Estimate how much you’ll need to live comfortably when you stop working. Think about your lifestyle, potential healthcare costs, and other expenses. Contribute to retirement accounts like 401(k)s, IRAs, or Roth IRAs. If your employer matches your 401(k) contributions, take full advantage – that’s free money!

If your employer matches 50% of your contributions up to 6% of your salary, contributing at least 6% can give your retirement savings a big boost.

Protecting What’s Yours

Another crucial part of financial planning is risk management. This means protecting your assets and income from unexpected events. Consider insurance policies like life insurance, disability insurance, and long-term care insurance. These can provide stability if unexpected disasters strike, like illness or injury.

Term life insurance, for instance, can cover your income for a set period, ensuring your dependents are financially secure if something happens to you.

Navigating Taxes

Tax planning is about minimizing the amount you owe and maximizing your savings. Understand how different investments and savings are taxed. Contributions to a traditional 401(k) might be tax-deductible, while withdrawals from a Roth IRA are typically tax-free. It might be worth consulting a tax advisor to get your strategy right.

Creating an Estate Plan

Estate planning is about making sure your assets go where you want them to after you’re gone. This includes setting up documents like a will, power of attorney, and a living will. These documents clarify who will manage your affairs if you’re incapacitated and how you want to be cared for.

Having a will, for example, prevents legal disputes among your beneficiaries and ensures your assets are divided according to your wishes.

Keeping Your Plan Fresh

Your financial plan isn’t something you set and forget. It needs regular check-ups and tweaks. Life events like getting a new job, getting married or divorced, or having kids can significantly impact your financial situation. Review your plan at least once a year or whenever you hit a significant life milestone.

If you land a promotion and your income goes up, adjust your budget and investments accordingly. If you have a baby, you might need to beef up that emergency fund and start a college savings account.

Wrapping Up

Building a financial plan is a journey, and like any journey, it takes time, patience, and regular adjustments. By following these steps, you’ll be on your way to long-term financial security and peace of mind. Remember, it’s never too early to start planning, and every step you take brings you closer to financial freedom. Stay committed, stay informed, and you’ll be cruising towards your financial goals smoothly and confidently.