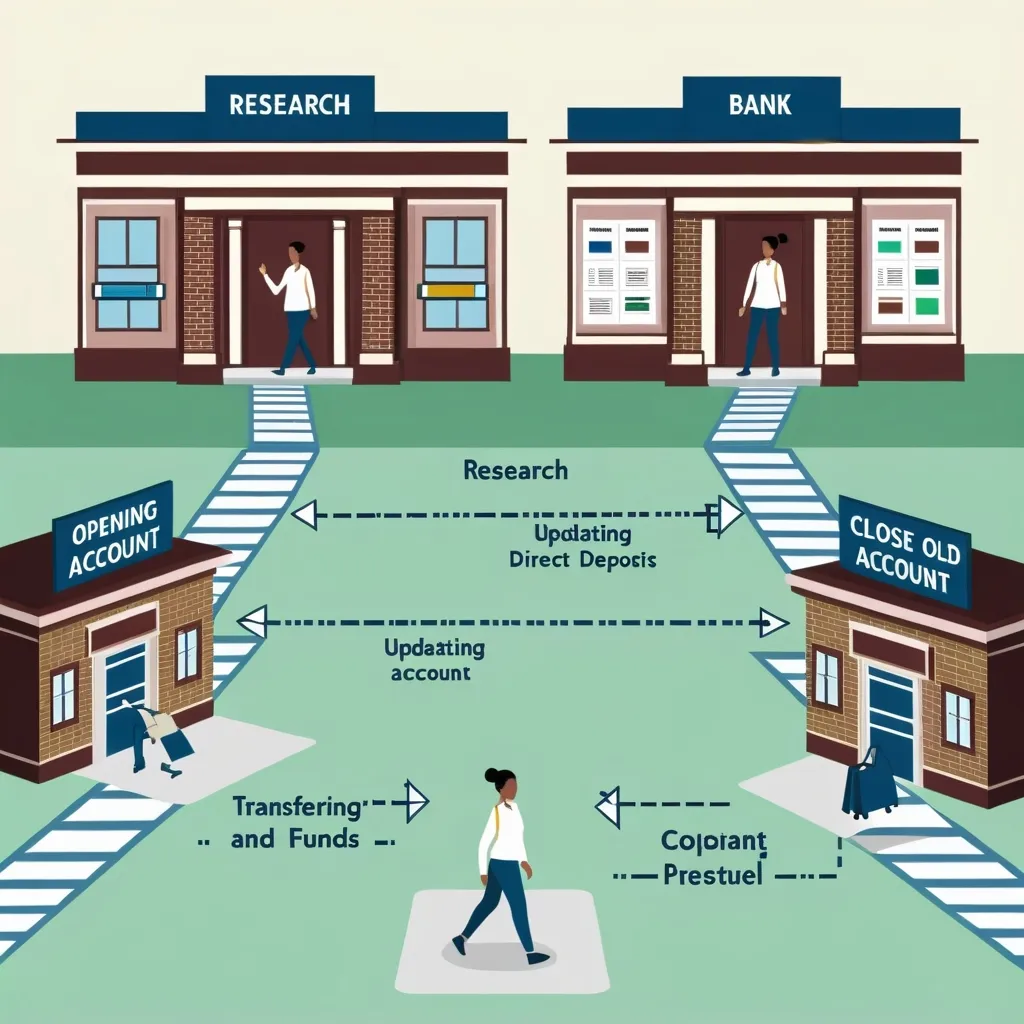

Switching banks can sound like a huge hassle, but breaking it down into simple steps makes the whole process a lot less intimidating. Here, we’ll spill the tea on making the transition from one bank to another without losing your sanity or missing any payments.

First up, you’ve gotta do your homework. Picking a new bank is akin to finding the right pair of jeans: it needs to fit perfectly! Each bank out there comes with its own perks and quirks. Online banks, for example, might give you sweet interest rates on your savings but probably won’t have a physical branch to saunter into. Conversely, a big bank might have loads of branches but could gouge you with service fees. Whether you opt for a community bank, a massive institution, or a credit union, make sure it ticks all your boxes—fees, rates, service, you name it.

Once you’ve picked your new financial friend, it’s time to actually open that shiny new account. Thanks to the magic of the internet, you can often do this part from your couch, but you might have to pop into a branch if you prefer face-to-face interaction. Keep your ID handy, along with your Social Security number and some funds to seed your new account. Just make sure you deposit enough to dodge any minimum balance fees right out of the gate.

Now, onto the gritty part—organizing your automatic transactions and direct deposits. Dig through your recent bank statements and jot down every automatic deposit (like paychecks and government benefits) and every recurring debit (like mortgage payments, utilities, or Netflix subscriptions). It’s like cleaning out your wardrobe; some stuff pops up only occasionally, but it still needs to be managed. Be meticulous here—you don’t want to miss a quarterly insurance payment or an annual membership renewal.

With your list of transactions ready, it’s time to update all those details to your new account. Notify your employer about your shiny new direct deposit details and tackle updating your automatic bill payments. Most banks have user-friendly mobile or online banking services that let you set this up swiftly. Don’t forget to update stored payment info with all your regular service providers—credit cards, utility companies, streaming services, etc. It’s like swapping out labels on your spice jars; a bit tedious, but necessary for smooth operation.

Next, you need to move your funds. Transferring money from your old account to the new one can usually be done online, via a branch visit, or through various third-party services. Make sure not to drain your old account dry just yet. You wanna leave enough dough in there to cover any outstanding checks or pending transactions that might still be hanging around.

Once you’re sure everything has switched over smoothly and all your transactions have bounced nicely through your new account, it’s time to face the music and close your old account. This too can often be done online or over the phone, but some might prefer the final branch visit. Double-check there’s no straggling transaction or fees and grab written confirmation that the account is closed. This helps you dodge any zombie accounts that might come back to haunt you.

Common pitfalls? There are a few to watch out for, like missing an automatic payment update or overdrawing your old account. Make sure you’re on top of all your transitions, leaving some buffer money in your old account. Also, remember that opening and closing accounts can give your credit score a little nudge, so handle things carefully. And keep an eye on any fees—transferring funds and closing accounts can sometimes come with hidden costs.

Switching banks isn’t all doom and gloom—there are goodies to be had! You might snag better interest rates or lower fees. Plus, if your current bank’s customer service has left you cold, a new bank could offer a much warmer experience. And hey, more convenient services like improved mobile banking might just make your financial life a lot simpler.

Taking this step also lets you take the reins on your finances. It’s a good excuse to review and streamline your transactions. You might find subscriptions or automatic payments for services you don’t even use anymore—it’s like purging your closet and finding clothes that don’t fit or went out of style years ago. This process also arms you with more banking knowledge, making you better equipped to manage your finances going forward. Knowing you can switch banks without the world crashing down around you gives you the confidence to always demand the best from your banking service.

So, if you’re unhappy with your current bank or just see a sweeter deal elsewhere, don’t shy away. Switching banks isn’t just doable—it can be a great move for your financial health. With careful planning and by watching out for those little pitfalls, you can slide seamlessly into a new banking experience and start reaping the benefits right away. Happy banking!