Buckle up, folks! We’re about to dive into the wild world of investing in 2024. It’s a rollercoaster out there, with economists throwing around words like “recession” and “growth” like confetti at a New Year’s party. But don’t worry, we’ve got your back. Let’s chat about three investment types that might just make your wallet do a happy dance this year.

First up, we’ve got high-yield savings accounts. Now, I know what you’re thinking - “Savings accounts? Boring!” But hold your horses, because these babies are like the responsible older sibling of the investment world. They’re safe, they’re steady, and they’re there for you when you need them. Plus, they’re dishing out interest rates that’ll make your grandma’s passbook savings account weep with envy.

Picture this: you’ve got ten grand sitting around, doing nothing but collecting dust. Toss that into a high-yield savings account, and boom! You’re looking at an extra 400 bucks by the end of the year. It’s not exactly “quit your job and buy a yacht” money, but hey, it’s a start. And the best part? Your money’s as safe as a kitten in a pillow fort.

Now, let’s talk about long-term corporate bond funds. These are for those of you who want to dip your toes into slightly riskier waters without going full-on skydiving without a parachute. Corporate bonds are like IOUs from big companies, and they typically offer better returns than government bonds. It’s like lending money to your rich uncle instead of your broke cousin - you’re more likely to see that cash again, with interest.

Let’s say you’ve got 50 grand burning a hole in your pocket. Stick it in a long-term corporate bond fund, and you could be looking at a cool $2,500 a year. That’s a nice little chunk of change, especially if you’re retired or just looking to add some stability to your investment portfolio. It’s like having a money tree in your backyard, but without the hassle of watering it.

But what if you’re feeling a bit more adventurous? Enter growth stocks. These are the daredevils of the investment world, the ones that make your heart race and your palms sweat. We’re talking about companies that are growing faster than a teenager in a growth spurt, often in cutting-edge industries like tech, e-commerce, and renewable energy.

Take Tesla, for example. A few years back, if you’d thrown ten grand at Tesla stock, you might be driving a shiny new electric car right now (okay, maybe not quite, but you get the idea). Or look at Nvidia - they’re like the cool kids of the semiconductor world, and they’re making waves in AI that could make Skynet jealous.

Now, investing in growth stocks isn’t for the faint of heart. It’s more of a rollercoaster ride than a lazy river. But if you’ve got the stomach for it and you catch the right wave, you could be surfing all the way to the bank.

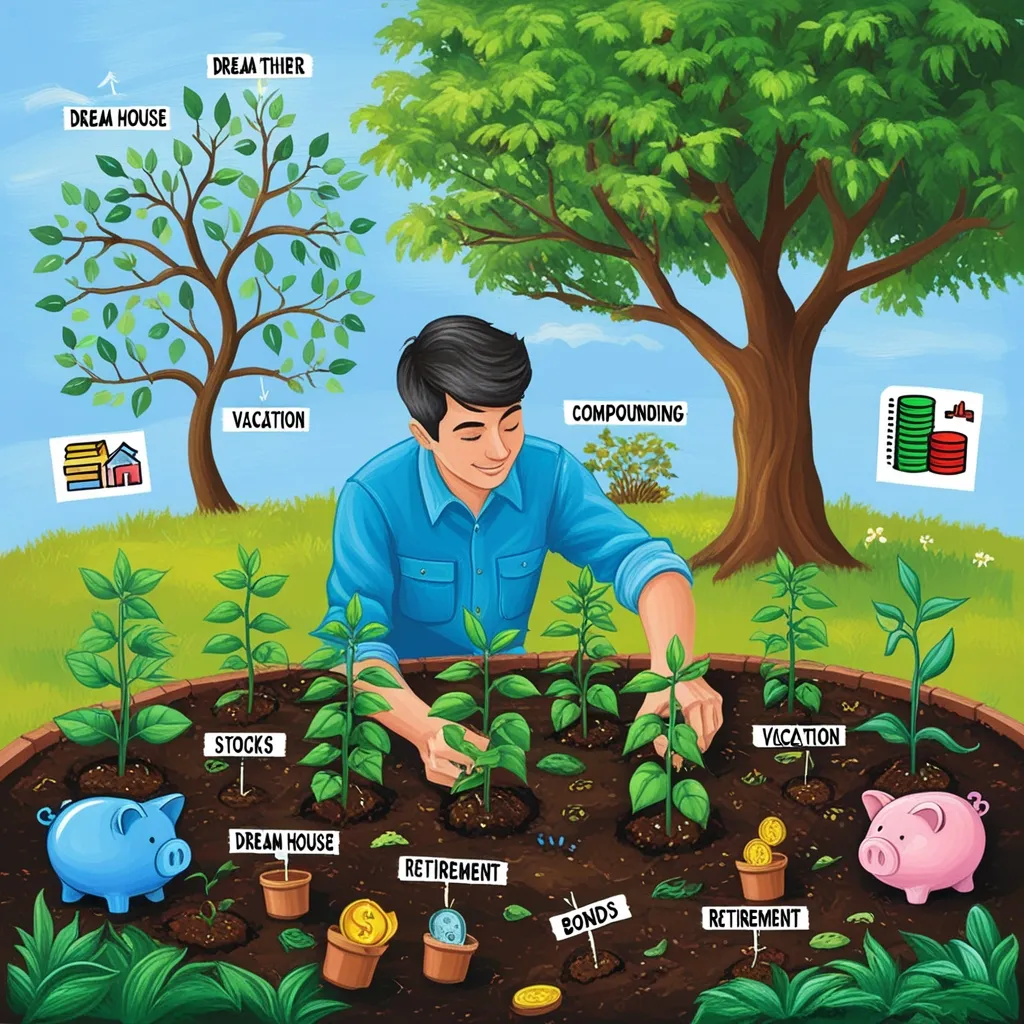

But here’s the thing - and listen closely because this is important - don’t put all your eggs in one basket. Diversification isn’t just a fancy word to impress your friends at dinner parties; it’s the secret sauce of smart investing. It’s like going to a buffet - you don’t just load up on desserts (tempting as that may be). You get a bit of everything to keep your plate (and your portfolio) balanced.

Maybe you put 30% of your money in those cozy high-yield savings accounts, 40% in steady corporate bond funds, and 30% in exciting growth stocks. That way, if one part of your investment menu turns sour, you’ve still got plenty of other flavors to enjoy.

Speaking of flavors, let’s talk about what’s hot in the investment kitchen right now. AI and cloud computing are sizzling like bacon on a Sunday morning. Companies like Microsoft, Alphabet, and Amazon are serving up some tasty investment opportunities. They’re not just big names; they’re like the Avengers of the tech world - powerful, resilient, and always ready for the next big challenge.

And speaking of AI, have you heard about Nvidia? They’re the ones making the chips that help AI models like ChatGPT learn to talk (and sometimes sass us). It’s like they’re building the brains for the robots of the future. Creepy? Maybe a little. Exciting investment opportunity? You bet your bottom dollar.

But before you go all Wolf of Wall Street, let’s talk about some practical stuff. First things first - make sure you’ve got an emergency fund. It’s like having a spare tire for your finances. Aim for enough to cover six months of living expenses. That way, if life throws you a curveball (or a global pandemic), you’re not caught with your pants down.

Next up, debt. If you’ve got high-interest debt hanging around, it’s like trying to fill a leaky bucket. Take care of that before you start investing, or you’ll just be pouring money down the drain.

Remember, investing is a marathon, not a sprint. Don’t freak out every time the stock market hiccups. Keep your eyes on the prize - your long-term financial goals. It’s like planting a tree. You don’t dig it up every day to check the roots; you water it, give it time, and watch it grow.

And for the love of all that is holy, do your homework before you invest. Don’t just throw your money at something because your neighbor’s cousin’s dog walker said it was a good idea. Research the company, understand what they do, and make sure you’re comfortable with the risks.

If all this sounds like too much work, or if you’re just not sure where to start, there’s no shame in asking for help. A good financial advisor can be like a personal trainer for your money - they’ll help you set goals, create a plan, and keep you on track.

So there you have it, folks. Investing in 2024 is all about balance. It’s like making the perfect sandwich - you need the safe and stable bread (high-yield savings), the filling middle (corporate bonds), and the exciting flavor kick (growth stocks). Mix it all together, and you’ve got a recipe for financial success.

Remember, investing isn’t about getting rich quick or finding the next big thing. It’s about building a solid foundation for your future. It’s about making your money work for you, so you can focus on the important things in life - like figuring out why your cat insists on sitting on your keyboard every time you try to work.

So take a deep breath, do your research, and get ready to make 2024 your year. Who knows? Maybe by this time next year, you’ll be the one giving out investment advice. Just remember us little people when you’re sipping cocktails on your yacht, okay?