In the realm of economic forecasting, traditional methods often fall short when it comes to capturing the intricate and nonlinear dynamics of financial markets. However, by embracing the concept of fractals, we can uncover a new dimension of predictive modeling that leverages the self-similar patterns found in nature.

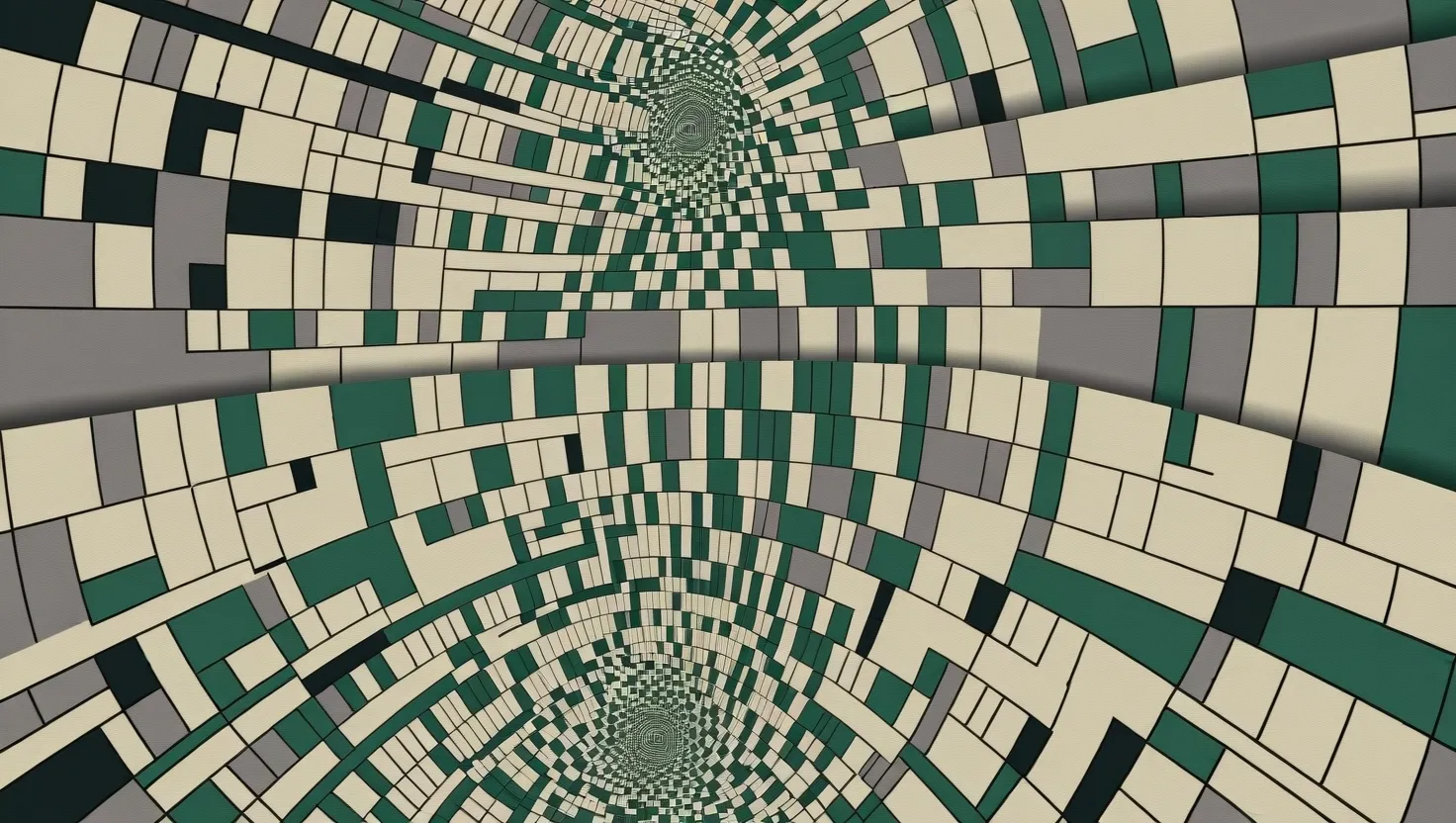

Imagine looking at a financial chart and seeing patterns that repeat themselves at different scales – a day’s fluctuations mirroring a year’s trends, or a company’s quarterly earnings reflecting the broader industry’s cycle. This is the world of fractal forecasting, where economic cycles are viewed as fractals, exhibiting self-similar structures across various time scales and magnitudes.

The Fractal Nature of Markets

Financial markets are inherently chaotic, but within this chaos, fractal patterns emerge. These patterns are not random; they are repetitive and scalable, meaning the same shapes and trends appear whether you are looking at short-term or long-term data. This self-similarity is a hallmark of fractals, and it can be a powerful tool for predicting market movements.

For instance, when analyzing stock prices, you might notice that the patterns of price movements are similar whether you are looking at hourly, daily, or yearly charts. This is because markets are influenced by human behavior, which tends to follow repetitive cycles due to collective memory and psychological reactions to price changes. By recognizing these fractal patterns, you can identify potential reversal points in the market, such as bearish or bullish fractals, which are simple five-bar reversal patterns that indicate turning points in market trends.

Beyond Traditional Econometrics

Traditional econometric models often fail to capture the full complexity of economic data. They rely on linear assumptions that do not account for the nonlinear variability and extreme fluctuations that are common in financial markets. Fractal forecasting, on the other hand, is built on the understanding that financial time series exhibit fractal properties, such as inhomogeneity and scaling symmetries.

These properties mean that market data can show extreme fluctuations at irregular intervals and exhibit proportionality relationships between fluctuations over different time scales. By using models that incorporate these fractal principles, such as the state transition-fitted residual scale ratio (ST-FRSR) model, you can reduce forecast errors significantly. For example, experiments using this model on intraday exchange rate futures contracts have shown a reduction in forecast error by up to 7%, and even by nearly a quarter in some cases, especially during extreme events.

Practical Applications

In practical terms, fractal forecasting can be applied in various ways. For traders, identifying fractal patterns in price charts can help in making more informed decisions. A bearish fractal, for instance, occurs when a pattern has the highest high in the middle and two lower highs on each side, indicating a potential downturn. Conversely, a bullish fractal has the lowest low in the middle and two higher lows on each side, suggesting an upward trend.

Beyond these basic patterns, more complex fractal structures can be identified, such as those incorporated into Elliott Wave patterns or Fibonacci retracements. These tools help traders predict price movements within larger trends by recognizing the fractal nature of markets.

Multidimensional Forecasting

Fractal forecasting is not just about identifying patterns; it’s about understanding the multidimensional nature of economic cycles. By zooming in and out across different time scales, you can spot emerging trends and potential turning points that might be missed by traditional linear models.

For example, you might observe that a company’s quarterly earnings pattern mirrors the broader industry’s yearly cycle. This self-similarity can provide insights into how microcosmic trends within specific market sectors echo global economic shifts. This approach transforms economic forecasting into an art that requires a deep understanding of how different scales of time and magnitude interact.

Real-World Implications

The implications of fractal forecasting are far-reaching. During times of heightened market uncertainty, such as during financial crises, the fractal structure of market prices can collapse, leading to sudden spikes in volatility and decreases in liquidity. By understanding these fractal dynamics, you can better prepare for such events.

For instance, the fractal markets hypothesis suggests that the convergence of time horizons and information sets among investors toward the short-term can disrupt the fractal structure of market prices, leading to market crises. By recognizing these patterns, investors can take proactive steps to mitigate risks and capitalize on opportunities.

Conclusion

Fractal forecasting offers a unique lens through which to view economic cycles. By leveraging the self-similar patterns found in nature, you can develop more nuanced and adaptive forecasting models. This approach is not a replacement for traditional methods but rather a complementary tool that can enhance your ability to navigate economic uncertainties.

In a world where economic predictions are increasingly complex, fractal forecasting provides a fresh perspective. It encourages you to look beyond the immediate data and see the broader, repeating patterns that underlie financial markets. By doing so, you can gain a deeper understanding of how markets move and make more informed decisions in the ever-changing landscape of finance.

As you delve into the world of fractal forecasting, remember that it’s not just about predicting the future; it’s about understanding the intricate web of patterns that shape our economic reality. By mastering this art, you can turn economic forecasting into a powerful tool for smart living and financial success.