Managing your finances as a freelancer can be a bit of a rollercoaster, right? With income that swings from feast to famine, it can feel like an uphill battle to maintain financial stability. But don’t sweat it. There are some solid strategies and tools out there that can help you keep your financial house in order and ensure your freelance gig stays successful.

First things first, get a handle on where your income comes from. Freelancers often juggle multiple clients and projects, so it’s important to identify all these sources and get an estimate of your monthly earnings. Knowing this can help you build a realistic budget and make smarter financial decisions.

Speaking of budgeting, it doesn’t have to be rocket science. Start by listing all your expenses. Think about your fixed ones like rent, utilities, and those pesky subscriptions. Then, add in the variable stuff like groceries and entertainment. Having a clear picture of your expenses helps you allocate your income more effectively.

Now, let’s talk about building a safety net. One of the toughest parts of freelancing is the unpredictable income. To cushion those tough times, aim to save up at least three to six months’ worth of living expenses in a separate savings account. This buffer will be your lifeline during lean months or when unexpected expenses pop up.

Setting financial goals is another key piece of the puzzle. Whether you’re aiming to pay off a hefty debt, save for an epic vacation, or invest in your business, having clear goals keeps you motivated. Regularly review your budget and tweak it as necessary to stay on track with these goals.

Leveraging financial tools can make managing your finances way more efficient. There are loads of apps designed to help freelancers keep track of income and expenses, and even remind clients about invoices. Popular picks include QuickBooks, FreshBooks, and Wave. Utilizing these tools can make the whole process smoother.

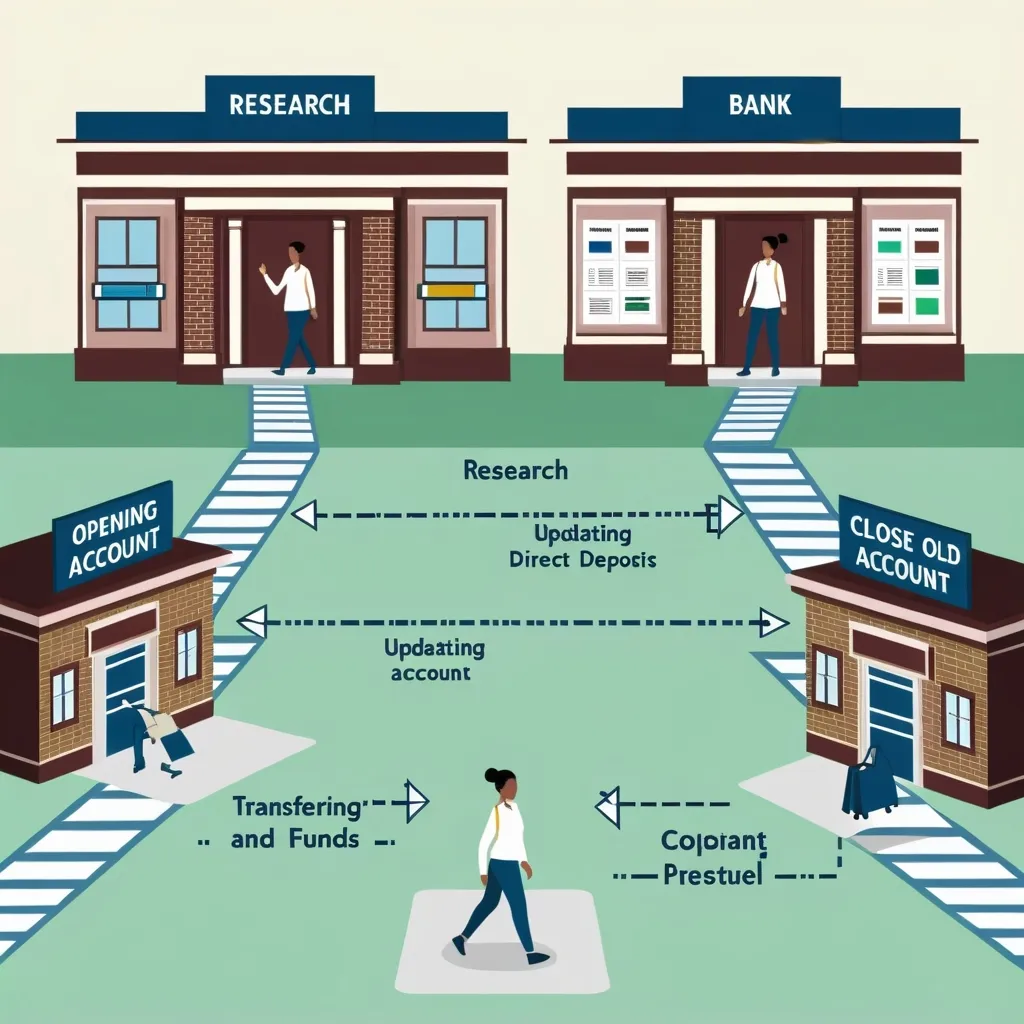

It’s crucial to keep your personal and business expenses separate. Consider getting a dedicated credit card for work-related expenses. This way, tracking your business expenses becomes easier, especially when tax season rolls around.

On the topic of taxes, as a freelancer, it’s all on you to handle them. So, make sure you set aside a portion of your income for tax payments. Depending on where you live, you may need to save a certain percentage of your earnings for taxes. And don’t forget to deduct business expenses to reduce your tax bill.

Automating your savings can be a game-changer. Set up automatic transfers from your business account to your savings account. This hands-off approach ensures you’re regularly contributing to your safety net without even thinking about it.

To deal with income variability, consider diversifying your billing methods. Billing by the hour can be unpredictable, so you might want to switch some clients to a monthly retainer. This not only provides a stable income stream but also helps clients budget their expenses more effectively.

Keeping track of every single expense is vital. Document all costs, from office supplies to those surprise expenses that pop up. Tools like Elorus can help you log your expenses and get an overview of your cash flow, making it easier to spot trends and make informed decisions.

The zero-sum budgeting method is worth considering. It means assigning every dollar a job. List all your expenses and budget for them based on the lowest income you’ve made in the past six months. Any extra cash should go towards your savings goals. This approach ensures you’re making the most of your earnings.

Establish a baseline income you’re comfortable with. This is the minimum rate you’re willing to work for. It helps you price your services correctly and ensures you’re earning enough to cover your expenses. As you gain more experience and skills, don’t hesitate to raise this baseline rate.

If you’re in debt, making debt repayment a priority is crucial. Consolidate your debts and aim to pay them off quickly. Look into options like zero-balance transfer cards to reduce debt faster. Getting a handle on debt frees up more of your income for savings and investments.

Speaking of savings, don’t forget about retirement. Without an employer contributing to a 401(k), it’s on you to save for retirement. Aim to put away a portion of your income each month into an IRA or other retirement savings plans.

Insurance is also key. Make sure you have adequate coverage, whether it’s health, life, auto, or business insurance. These policies protect your finances if something unexpected happens.

Doing regular financial audits helps you stay organized. Spend a few minutes each month reviewing your expenses, taxes, and savings. This quick audit keeps you on track and helps you adjust your budget if needed.

Create a work schedule that includes time for admin tasks, sick days, and vacation days. This helps you know how much work you need to take on to meet your income goals and ensures you’re leaving enough time for other important tasks.

When dealing with variable income, it’s often necessary to trim expenses. Regularly evaluate your recurring costs and look for cheaper alternatives without compromising on the quality of service. This proactive approach can help you manage your cash flow more effectively.

Wrapping it all up, managing finances as a freelancer takes discipline, planning, and the right tools. By understanding where your money comes from, creating a budget, building a safety net, and leveraging financial tools, you can successfully navigate the challenges of a variable income. Every dollar counts, and making smart financial decisions helps you achieve your goals and keep your freelance career thriving.