When it comes to investing, there are few topics as polarizing and misunderstood as cryptocurrency. The crypto hype has swept many off their feet, promising quick riches and a revolution in financial systems. However, beneath the surface, this hype is eroding some of the most fundamental principles of sound investing.

The Speculation Trap

One of the most significant issues with crypto is that it often blurs the line between investing and speculating. Investing typically involves putting money into assets that have inherent value or the potential for long-term growth, such as stocks in established companies or real estate. Speculation, on the other hand, is more akin to gambling, where the primary goal is to make a quick profit by selling the asset at a higher price than you bought it for.

Cryptocurrency falls squarely into the speculation category. The value of most cryptocurrencies is not backed by any tangible asset or real-world utility; it’s largely driven by market sentiment and the hope that someone else will buy it from you at a higher price later. This is what’s often referred to as the “greater fool theory,” where the only way to make money is by finding someone else willing to pay more for it than you did.

Volatility and Unpredictability

The crypto market is infamous for its volatility. Prices can skyrocket one day and plummet the next, making it a rollercoaster ride for investors. While some argue that this volatility can lead to significant gains, it also means that losses can be just as dramatic. Imagine waking up one morning to find that your investment has lost half its value overnight. This kind of unpredictability is not what most people would consider a stable investment.

For instance, Bitcoin, the most well-known cryptocurrency, has seen its value swing wildly over the years. In 2021, it reached an all-time high, only to drop significantly in the following months. This kind of volatility makes it difficult to use cryptocurrencies as a reliable store of value or medium of exchange, which are the primary functions of any currency.

Lack of Real-World Utility

Despite the hype, cryptocurrencies are not widely accepted as a form of payment. Most merchants and stores do not accept them, and even when they do, the process is often cumbersome and expensive. Transaction fees can be exorbitant, sometimes reaching as high as $60 or more per transaction. This makes using cryptocurrencies for everyday purchases impractical.

For example, if you wanted to buy a cup of coffee with Bitcoin, you might end up paying more in transaction fees than the coffee itself costs. This lack of real-world utility undermines one of the core reasons cryptocurrencies were created in the first place: to serve as a digital currency.

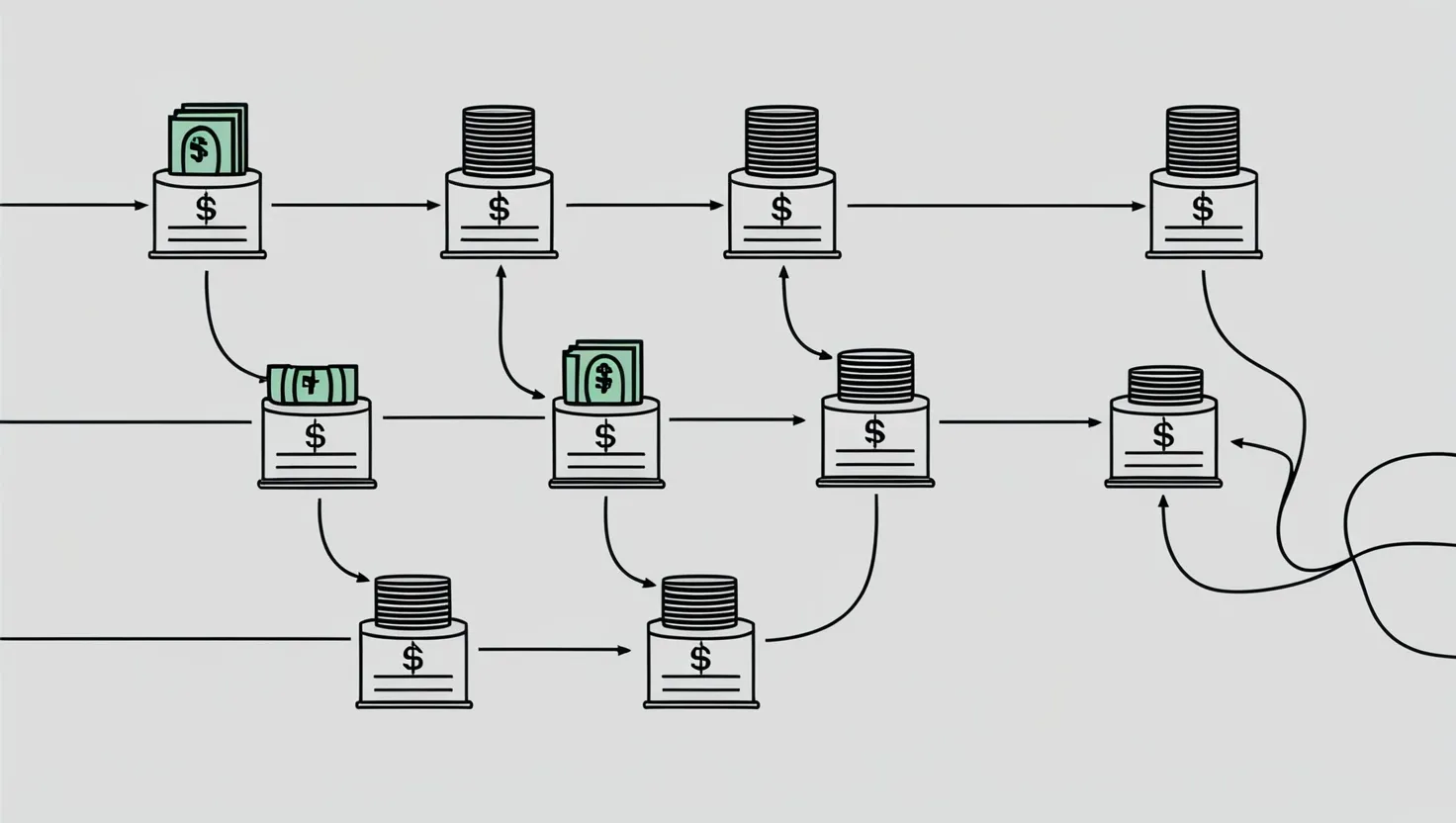

Pyramid Scheme Dynamics

The crypto market has many characteristics of a pyramid scheme. The value of cryptocurrencies often increases because more people are buying into the hype, not because the underlying asset has any inherent value. Early adopters make money by selling their coins to later entrants at higher prices, creating a cycle that can only sustain itself as long as new buyers keep entering the market.

This dynamic is particularly problematic because it means that the majority of participants will eventually lose money. Only a small percentage of early adopters and those with significant resources can make substantial profits, while the rest are left holding the bag when the bubble bursts.

Regulatory Risks

The regulatory landscape for cryptocurrencies is patchwork and constantly changing. Governments around the world are increasingly scrutinizing crypto due to its association with criminal activities, environmental impact, and potential to destabilize financial systems. China, for example, has banned cryptocurrencies altogether, and other countries are considering similar measures.

If regulators decide to crack down on cryptocurrencies, the value of your investment could drop to zero overnight. This regulatory risk adds another layer of uncertainty to an already volatile market, making it even more precarious for investors.

Market Manipulation

The crypto market is rife with manipulation. Pump and dump schemes, where groups of people artificially inflate the price of a coin and then sell it at the peak, are common. These schemes can be orchestrated through social media and messaging apps, making it easy for scammers to reach a large audience.

For instance, imagine being part of a Telegram group where thousands of people are hyped up to buy a particular coin, only to find out later that the leaders of the group have sold their holdings, leaving everyone else with significant losses. This kind of market manipulation is rampant in the crypto space and can lead to devastating financial losses.

Environmental Impact

Cryptocurrencies, especially those using proof-of-work algorithms like Bitcoin, have a significant environmental impact. The energy consumption required to mine these coins is staggering, often comparable to the energy usage of small countries. This has led to widespread criticism and concerns about the sustainability of these technologies.

In a world where environmental consciousness is increasingly important, investing in something that contributes so heavily to carbon emissions and energy waste is not only financially risky but also ethically questionable.

Decentralization Myth

One of the selling points of cryptocurrencies is their supposed decentralization. However, this decentralization is often more theoretical than practical. Many cryptocurrencies are controlled by a small group of large holders, and the infrastructure supporting them, such as exchanges and wallets, is often centralized.

For example, the collapse of FTX, a major cryptocurrency exchange, highlighted how centralized these systems can be. When FTX went bankrupt, it took billions of dollars in user funds with it, demonstrating that the “decentralized” nature of crypto is more of a myth than a reality.

Community and Influence

The crypto community is often driven by influencers and celebrities who promote various coins and projects. This can create a cult-like following where people invest based on hype rather than sound financial analysis. The rise-and-grind culture surrounding crypto, where people are encouraged to “stack sats” (buy small increments of Bitcoin) and watch their investments grow, is more about emotional appeal than rational decision-making.

This kind of environment can lead to mass hysteria, where people invest without fully understanding the risks or the underlying technology. It’s a scenario where the fear of missing out (FOMO) drives decisions rather than careful consideration and due diligence.

Conclusion

The crypto hype has led many to abandon sound investment principles in favor of speculative gambles. While the technology behind blockchain is intriguing and has potential uses beyond cryptocurrency, the current state of the crypto market is fraught with risks.

As an investor, it’s crucial to approach crypto with a clear head and a critical eye. Here are a few key takeaways to keep in mind:

- Understand the difference between investing and speculating. If you’re looking to make a quick profit based on market sentiment rather than inherent value, you’re speculating.

- Be aware of the volatility and unpredictability. Cryptocurrencies can be highly volatile, and their value can drop significantly without warning.

- Look for real-world utility. If a cryptocurrency is not widely accepted or practical for everyday use, it may not have the stability you’re looking for.

- Watch out for pyramid scheme dynamics and market manipulation. These can lead to significant financial losses and are common in the crypto space.

- Consider the regulatory and environmental risks. Changes in regulations or environmental concerns can impact the value of your investment.

- Don’t fall for the decentralization myth. Many aspects of the crypto ecosystem are more centralized than they appear.

- Be cautious of community influence and hype. Make decisions based on sound financial analysis rather than emotional appeals.

In the end, investing should be about making informed, rational decisions that align with your financial goals and risk tolerance. While the allure of crypto can be strong, it’s essential to approach it with caution and a healthy dose of skepticism.