Money matters can be a source of stress and conflict for many families, but they don’t have to be. With a thoughtful approach and some practical steps, you can create a family money management system that works for everyone. Let’s explore how to build a financial framework that promotes transparency, accountability, and shared goals.

The foundation of any successful family financial plan is open communication. Start by gathering all the adults in your household for an honest conversation about your current financial situation and future aspirations. This initial meeting sets the tone for ongoing dialogue and collaboration.

During this discussion, lay all your financial cards on the table. Share information about income sources, debts, assets, and regular expenses. Be prepared for some potentially uncomfortable revelations - perhaps one partner has been hiding a credit card debt or another has a secret savings account. The goal isn’t to judge but to create a complete picture of your family’s financial landscape.

Once you have a clear understanding of where you stand, it’s time to dream big. What are your family’s short-term and long-term financial goals? Do you want to buy a home, save for your children’s education, or plan for early retirement? Write down these goals and prioritize them together.

“A goal without a plan is just a wish,” said Antoine de Saint-Exupéry. So, let’s turn those wishes into actionable plans.

The next step is to create a shared digital finance hub. This could be a spreadsheet, a budgeting app, or a combination of tools that work for your family. The key is to have a central location where all financial information is stored and easily accessible to all adult family members.

In this hub, track your income, expenses, and investments. Keep all financial documents, passwords, and account information in one secure location. This transparency helps prevent financial secrets and ensures that everyone is on the same page.

How often do you currently discuss money matters with your family? Weekly? Monthly? Only when there’s a crisis?

Regular money meetings are crucial for maintaining financial harmony. Set aside time each week to review your spending, discuss upcoming expenses, and track progress toward your goals. These meetings don’t have to be long or formal - even a 15-minute check-in over coffee can be effective.

During these meetings, celebrate your successes, no matter how small. Did you manage to stick to your grocery budget this week? That’s worth acknowledging! By focusing on positive progress, you’ll build momentum and motivation.

Automation is your friend when it comes to consistent financial habits. Set up automated bill payments and savings transfers to ensure you’re meeting your obligations and working towards your goals without having to think about it every month.

Consider the power of “paying yourself first” by automatically transferring a portion of your income to savings or investment accounts before you have a chance to spend it. This simple strategy can significantly boost your long-term financial health.

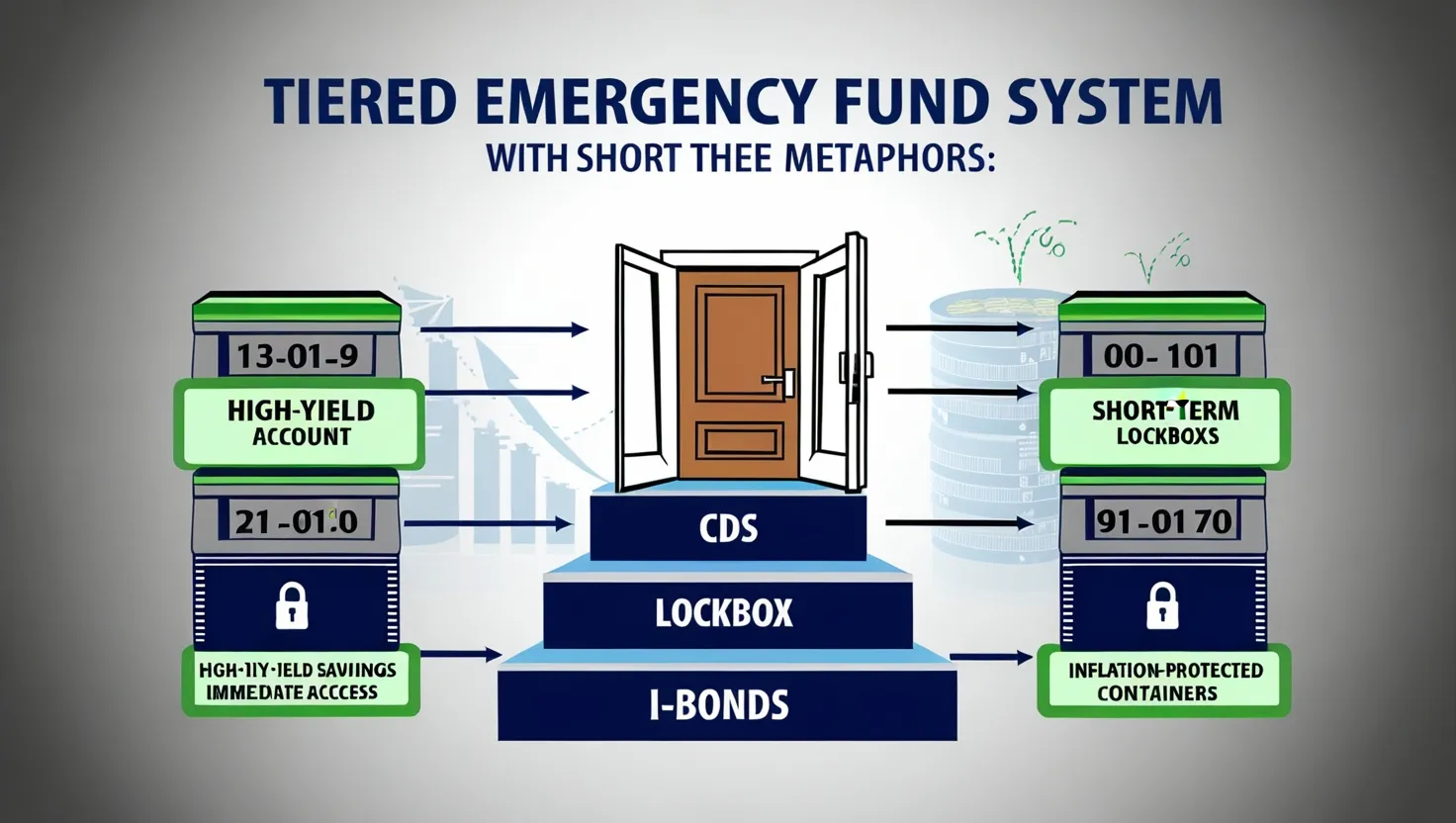

While a joint account can be useful for shared expenses, maintaining separate accounts for different purposes can help you stay organized and avoid overspending. Consider setting up accounts for bills, savings, investments, and discretionary spending.

This approach allows for both individual financial autonomy and shared responsibility. Each family member can have their own “fun money” account to spend as they please, while also contributing to shared financial goals.

Large purchases can be a source of conflict in many families. To avoid this, implement a clear approval process for expenses above an agreed threshold. This could mean that both partners need to agree on any purchase over $500, for example.

This system ensures that significant financial decisions are made collaboratively, reducing the likelihood of resentment or financial surprises.

“An investment in knowledge pays the best interest,” said Benjamin Franklin. Apply this wisdom by creating dedicated investment accounts for specific goals.

Set up separate accounts for retirement, education, and even family vacations. This targeted approach makes it easier to track progress towards each goal and adjust your strategy as needed.

Have you considered how your investment strategy aligns with your family values? Ethical investing is becoming increasingly popular, allowing families to grow their wealth while supporting causes they believe in.

Remember, your family money management system isn’t set in stone. Review and adjust it quarterly to ensure it continues meeting your family’s needs and financial objectives. As your income, expenses, and goals change over time, your financial strategy should evolve too.

Creating a family money management system is about more than just numbers on a spreadsheet. It’s about fostering financial literacy, teaching valuable life skills to your children, and working together towards shared dreams.

By implementing these practical steps, you’re not just managing money - you’re building a foundation for your family’s financial future. You’re creating a legacy of financial wisdom that can be passed down through generations.

What’s the first step you’ll take today to improve your family’s financial management? Remember, every journey begins with a single step. Your future self - and your family - will thank you for starting now.