Thriving in a Low-Interest Rate World: Strategies for 2024 and Beyond

The financial world is always changing, and right now, we’re in a pretty interesting spot. Interest rates are low, and that’s shaking things up for everyone from big investors to regular folks like you and me. So, let’s dive into what this means and how we can make the most of it.

First off, when interest rates drop, it’s like the economy just got a shot of espresso. The big dogs at the Federal Reserve are trying to get things moving, and cheaper borrowing is their way of doing it. Think about it - if you’ve been eyeing that new house or car, now might be the time to go for it. You’ll end up paying less interest over time, which means more money in your pocket.

But it’s not all sunshine and rainbows. If you took out a loan when rates were high, you might be feeling a bit stuck. Refinancing sounds good on paper, but those pesky fees can eat up any savings pretty quick. The good news? Rates are probably going to keep dropping, so keep your eyes peeled for the right moment.

Now, let’s talk stocks. When interest rates are low, it’s usually party time for the stock market. Companies can borrow money on the cheap, which means they can grow and make more money. This is especially sweet for smaller companies that rely on loans to expand. In fact, the Russell 2000 (that’s an index for smaller companies) is already showing some pep in its step.

But here’s the thing - the stock market is like that friend who always tries to predict the end of movies. It’s always looking ahead. So, a lot of the good vibes from lower interest rates might already be baked into stock prices. That said, some sectors like real estate and utilities might still see a boost as borrowing gets cheaper.

Bonds are another piece of the puzzle. When interest rates drop, older bonds with higher yields start looking pretty attractive. It’s like having a vintage wine collection - suddenly, those old bottles are worth a lot more. And with loads of cash sitting in money market funds looking for a better home, we might see a big shift into bonds and stocks.

This isn’t just a U.S. thing, either. Lower interest rates here can make waves across the globe. Countries with solid economies, especially in Southeast Asia, might see a flood of investment as people hunt for better returns. But it’s not a one-size-fits-all situation. Some places, like parts of Latin America, might not see as much benefit due to political uncertainty and other factors.

So, how do you play this game? First off, don’t put all your eggs in one basket. Diversifying your investments is key. The S&P 500 might seem like a safe bet, but it’s not the only game in town. Mix it up with some bonds, maybe some small-cap stocks, and other assets.

Speaking of mixing it up, you might want to rethink how much cash you’re holding onto. With interest rates dropping, that money market fund might not be working as hard for you as it used to. Consider moving some of that cash into bonds or other fixed-income options.

It’s also smart to have some hedges in your portfolio. Think of it like insurance for your investments. Things like gold or even bitcoin can help protect you if the economy takes an unexpected turn.

But here’s the most important thing - keep your eyes on the long game. It’s easy to get caught up in day-to-day market moves, but that’s a recipe for stress and poor decisions. The overall picture looks good for stocks and corporate credit, so don’t let short-term jitters throw you off course.

Now, let’s talk about your personal finances. If you’ve been thinking about taking out a loan for something big, now might be your moment. Whether it’s a mortgage, a car loan, or a home equity loan, lower interest rates can save you a bundle in the long run.

If you already have loans, keep an eye on refinancing opportunities. It might not make sense right away, but as rates continue to drop, you could find a sweet spot where the savings outweigh the fees.

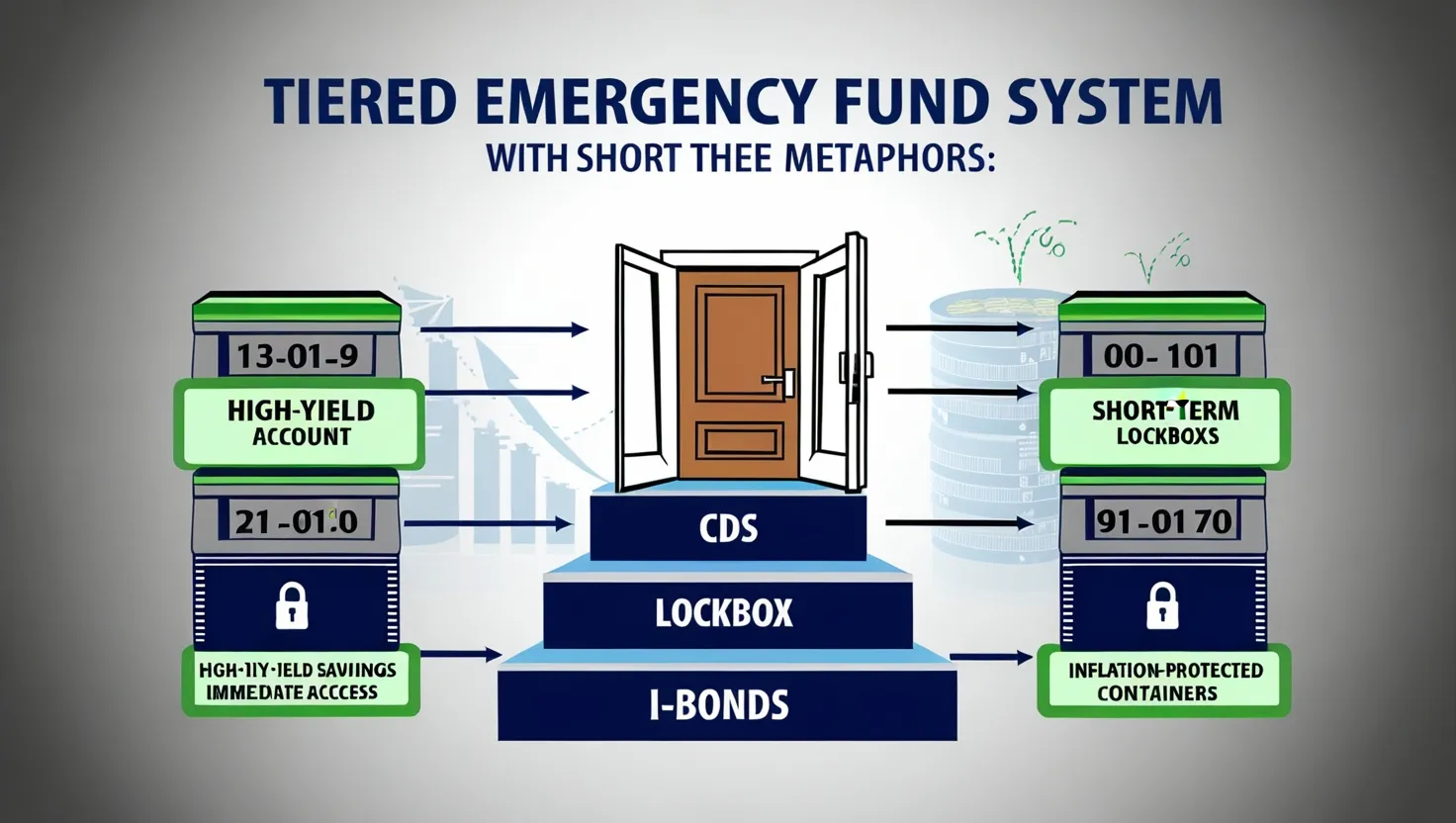

Even with low interest rates, having an emergency fund is still crucial. Aim to have enough to cover 3-6 months of living expenses. It’s like a financial safety net - you hope you never need it, but you’ll be glad it’s there if you do.

And here’s a tip that often gets overlooked - invest in yourself. Whether it’s furthering your education, learning new skills, or personal development, improving yourself is always a solid investment. As the job market evolves, having a diverse skill set can make you more resilient and adaptable.

Navigating this low-interest rate world isn’t always easy, but it’s full of opportunities if you know where to look. It’s about finding the right balance between playing it safe and taking calculated risks. Keep yourself informed, be willing to adjust your strategy as things change, and always keep that long-term perspective in mind.

Remember, whether you’re a seasoned investor or just trying to manage your personal finances, this economic landscape presents both challenges and opportunities. By being proactive and strategic, you can not only survive but thrive in this new financial environment.

So, take a deep breath, assess your financial situation, and start making moves. Maybe it’s time to revisit your investment portfolio, or perhaps you’re finally ready to make that big purchase you’ve been putting off. Whatever it is, the current low-interest rate environment might just be the push you need to take that next step.

And hey, don’t forget to enjoy the journey. Financial planning isn’t just about numbers on a spreadsheet - it’s about creating the life you want. Whether that’s saving for a dream vacation, planning for retirement, or just having the peace of mind that comes with financial stability, every decision you make is a step towards your goals.

As we move further into 2024 and beyond, the financial landscape will continue to evolve. But armed with knowledge, a solid strategy, and a willingness to adapt, you’re well-equipped to navigate whatever comes your way. So here’s to thriving in this low-interest rate world - may your investments grow, your loans shrink, and your financial future shine bright.