Imagine you wake up one morning, your car won’t start, and you need to pay for a major repair. Do you reach for your credit card, borrow from friends, or calmly use your emergency fund? That fund is not just a financial tool—it’s peace of mind. If you’re thinking this is something only rich or “smart” people do, I promise, it’s not. Building a robust emergency fund is essentially a set of straightforward habits anyone can learn and practice, no matter how little money you have or how “bad” you think you are with finances.

Why does having an emergency fund matter so much? It means any unexpected disaster won’t push you into debt or panic. It lets you respond with confidence instead of scrambling. The strategies to get there aren’t magical—they’re deliberate, practical, and build on each other. Let’s break them down so you know exactly what to do.

To start, I recommend calculating your monthly expenses. Only count essentials: rent, groceries, electricity, basic medical insurance—ignore shopping sprees, restaurants, and movies. It’s easy to overcomplicate this step, but the clearer your number, the better. Multiply that by three if you feel pretty secure in your job and six if your income’s more unpredictable or you just want extra protection. That number is your target—write it large on a sticky note. Now, doesn’t the goal already feel less overwhelming?

“The secret of getting ahead is getting started.” – Mark Twain

Once you have your magic number, it’s time to give your cash a home. My advice: start a separate high-interest savings account. Call it “Emergency Fund”—literally, name it that—so when you check online, you and your money both know not to touch it. Why separate? If it’s mixed with your regular spending account, it’ll disappear faster than you think. Make it a little inconvenient: online accounts without debit cards make withdrawals less tempting, but your money is still close when you truly need it.

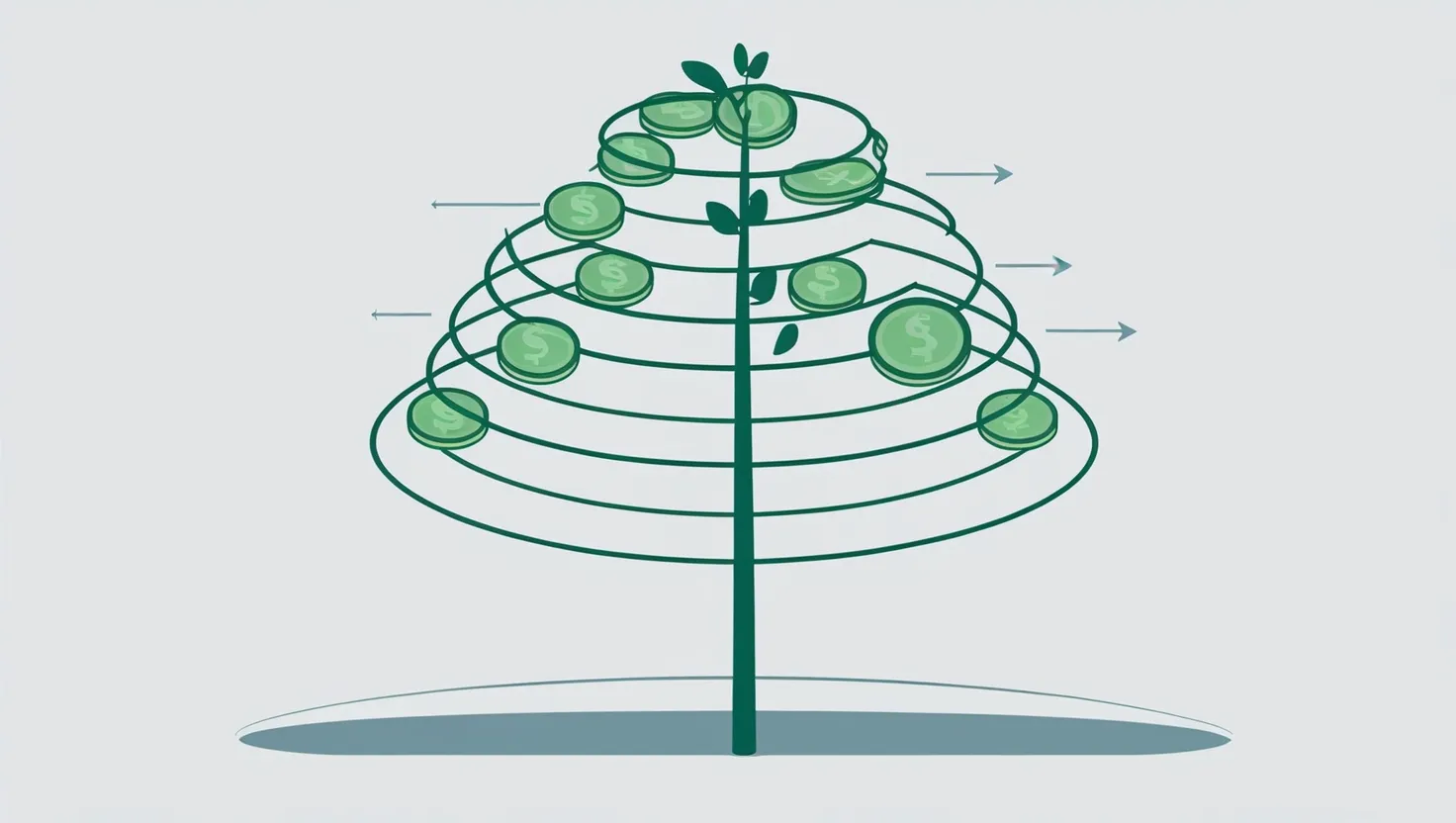

Ever wonder why even smart savers get stuck? Most people forget the power of automation. If your paycheck comes on the 1st, set up an automatic transfer for the 2nd. Treat your emergency fund like rent or a phone bill—not an afterthought. Even if it’s just $25 at first, the regularity matters. If you can spare $200 a month, you’ll hit a $9,000 fund in less than four years. Tiny steps matter more than heroic big ones you can’t repeat. What’s stopping you from setting this up today?

“Success is the sum of small efforts, repeated day in and day out.” – Robert Collier

Can you speed this up? Absolutely. Every so often, you get windfalls— a bonus at work, tax refund, birthday cash from grandma. Instead of treating this money as bonus spending power, split it. Put half right into your emergency fund, guilt-free. Let’s say you get a $1,000 surprise check; $500 goes straight to your safety net, no questions. This little rule alone can shave months—even years—off your saving goal. How many times have you spent surprise money just because it felt “extra”? Imagine if half went somewhere that actually reduced your stress instead.

But what if you’re really tight right now? How do you start with nothing? Here’s my unconventional take—sell something you don’t need. Old gadgets, unused clothes, furniture collecting dust—turn them into cash and use that for your emergency fund seed money. It’s a double win: you declutter and get closer to your financial safety net.

Have you ever taken money out of your emergency fund for something that wasn’t truly urgent? It’s easier than we like to admit. That’s why I urge you to write down—yes, on paper—what counts as a genuine emergency. Job loss, car breakdowns, sudden medical bills—those qualify. A last-minute vacation or a fancy dinner do not. This clear definition isn’t just for you—it’s for your future self, when temptation creeps in. When you do spend from the fund, make another rule: pay yourself back within six months, by increasing your automatic transfers a little, so you rebuild fast.

Ask yourself: If disaster struck today, how many months could you survive without borrowing or selling something important? If your emergency fund is fully stocked, the answer is probably “several.” If it’s empty, this is your wake-up call.

“By failing to prepare, you are preparing to fail.” – Benjamin Franklin

Let’s not sugarcoat the process. Sometimes you’ll struggle—an unexpected bill pops up, or your income drops. If that happens, pause the fund-building temporarily for survival mode, but start again as soon as money stabilizes. The trick is consistency, not perfection. If you fall behind, don’t quit—just adjust your plan. Financial experts who talk in complicated jargon often forget that habits, not big knowledge, build real safety.

Setting up these steps may sound boring, but actually, it gives you real freedom. With your emergencies covered, you can use your regular budget or future raises for things that make life better, like travel or investing, without guilt or fear.

How long will this take? Usually, about 12 to 24 months. That may sound long, but time passes fast. I’m not promising you a shortcut—just a framework that works. Think about what could happen if you face a financial shock with zero backup. Wouldn’t you rather have the solution ready and waiting than regret not starting?

“To succeed, jump as quickly at opportunities as you do at conclusions.” – Benjamin Franklin

Now, let’s talk about some things people rarely mention. Did you know the best emergency funds aren’t always cash? Sometimes keeping one month of expenses in cash and the rest in a high-interest online savings account balances access and growth. Some people park larger chunks in money market accounts—not investing for growth, just for safety and slight interest—while keeping enough quick cash to get by when ATMs are down or banks glitch.

If you get paid irregularly—freelancers or commission-based folks—try a strategy where you save a higher percentage every time you earn, since you can’t always predict when the next paycheck lands. This can be automated too, based on each deposit.

I also urge you to revisit your fund twice a year. Life changes—new family members, new job, moving cities, or changing health insurance—mean you might need more (or less). Review your needs and adjust the goal. More isn’t always better. If your family doubles, you adjust. If your expenses drop, you don’t need to over-save.

“How wonderful it is that nobody need wait a single moment before starting to improve the world.” – Anne Frank

One last odd but powerful trick: make saving less painful by pairing it with reward systems. After every quarter you stick to your savings plan, allow yourself a minimal treat—like buying your favorite snack or a small book. Train your mind to link discipline with positive results, not just denial.

Remember, this is not about getting rich fast. It’s about building a foundation you can stand on no matter what life throws your way. The smartest people often aren’t the ones with the highest incomes, but those with the strongest defenses. Our lives are filled with unpredictability. Your emergency fund turns chaos into something manageable.

So, ask yourself one last time: When you think of your financial future, do you want constant stress or calm? The choice is not luck—it’s habit. Can you take the first small step today and watch it grow?

“Do not wait to strike till the iron is hot; but make it hot by striking.” – William Butler Yeats

Building your robust emergency fund is less about numbers and more about action. Get started, keep going, and watch how quickly your stress melts. Your future self will thank you more than you can imagine.