Setting financial goals is like plotting out a road trip. You wouldn’t set off without knowing where you’re headed, right? The same goes for money matters. Having clear financial goals gives you a game plan for managing your cash, helps you make smarter financial moves, and guides you towards significant milestones in life. Let’s dive into why nailing down your financial goals is a game-changer and how to actually go about setting and smashing them.

First off, having financial goals means you’ve got a direction and a purpose. It helps you figure out what’s worth spending on, what to save for, and what can wait. Without these goals, you might end up spending willy-nilly, potentially digging yourself into debt and financial headaches. Goals give you a reason to budget, making sure you’re not just living within your means but also saving up for the future.

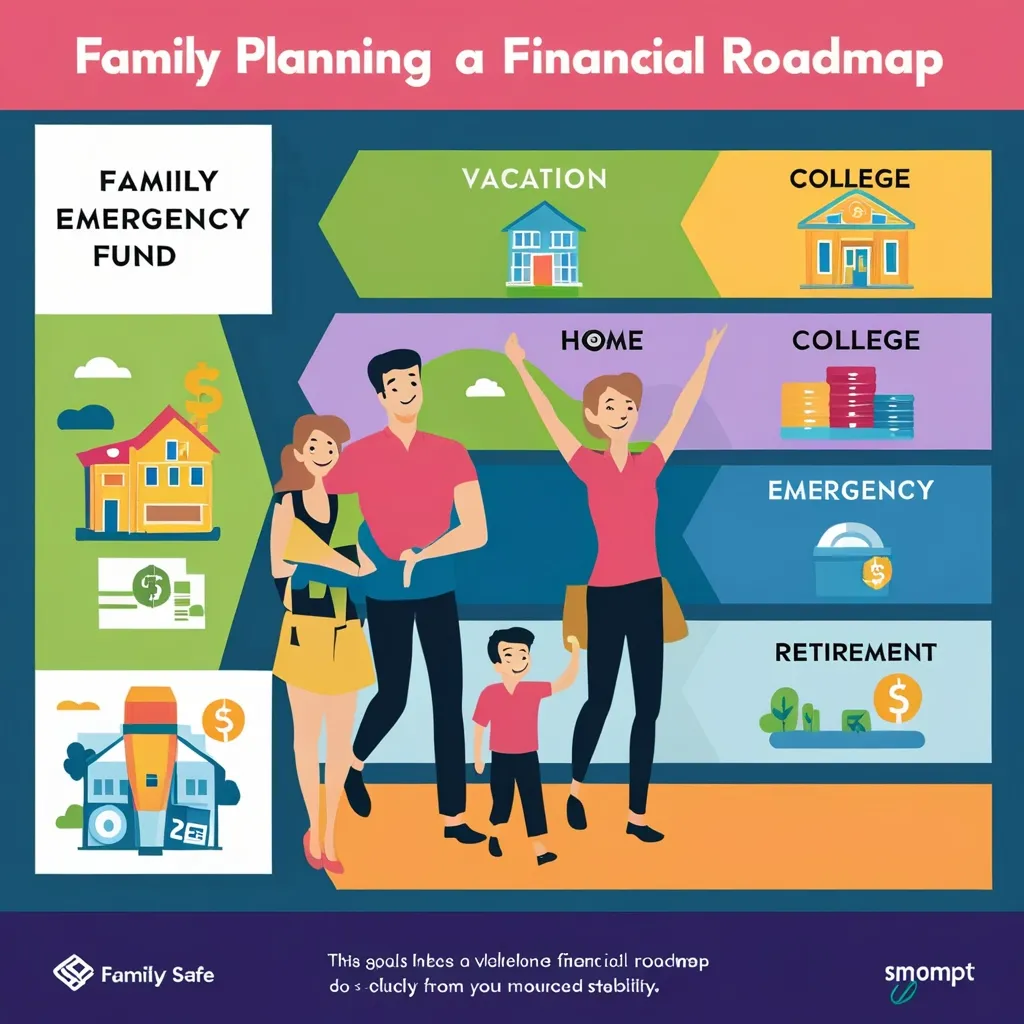

Financial goals come in all sizes: short-term, mid-term, and long-term. Short-term goals are things you can tick off within a year or so. Think of saving for a vacation or clearing a pesky credit card debt. Mid-term goals take a bit longer – a few years, maybe. These might include saving for a home deposit or getting rid of a car loan. Then there are long-term goals, which are real big-picture stuff like retirement savings or funding a kid’s college education.

Setting your financial goals starts with a good hard look at where you stand financially. Check out your income, expenses, debts, assets, and existing savings. This helps you see the full picture. Then, get specific about what you want to achieve. General wishes like “I want to save for a house” are too vague. Be precise: “I will save $30,000 for a house down payment over the next five years” is more like it.

Now, break down your big goals into bite-sized pieces. For instance, if you aim to save $30,000 in five years, that’s $500 a month. Breaking it down makes the goal seem less daunting and totally doable.

Budgeting is crucial to making any of this happen. A good budget helps you allocate your money smartly, control your expenses, and keep tabs on how you’re doing. It’s your roadmap, ensuring you’re not overspending and that you’re consistently putting aside money for your goals. Revisit and tweak your budget regularly to match any changes in your income or expenses.

One of the first short-term targets you should set is building an emergency fund. This fund is your financial safety net, aiming to cover three to six months of living expenses in case something unexpected comes up, like losing your job. Having this buffer can save you from a lot of stress and financial trouble.

Next up, tackling debt, especially high-interest debt like credit card balances, is key. Debt can really drag you down, so making a plan to pay it off fast is vital. You might want to look into consolidating your debts at a lower interest rate or making extra payments when you can.

When it comes to long-term goals, saving for retirement is often at the top of the list. Consistent effort over many years is the name of the game here. Aim to save about 10-15% of your income in retirement accounts such as a 401(k) or an IRA. Try and estimate what you’ll need for retirement by looking at your desired annual expenses and figuring out what you might get from Social Security and any other retirement plans.

Staying disciplined and motivated over the long haul can be tricky. Regularly track your progress and give yourself a pat on the back at each milestone. Seeing how far you’ve come can be a huge motivation booster. If you’re struggling, think about getting advice from a financial advisor.

Remember, financial goals aren’t set in stone. Life happens: new jobs, marriage, kids, and so forth. Be ready to recalibrate your goals and strategies as your circumstances evolve.

Insurance should also be part of your financial planning. Policies like health, life, and disability insurance protect you from unforeseen financial setbacks. Make sure you’re adequately covered to keep your financial plan on track.

Achieving financial freedom isn’t an overnight thing. It’s a journey requiring patience, discipline, and a set of clear goals. By being specific, measurable, and realistic with your goals, you create a solid path to financial success. Stay focused, celebrate your wins, and keep an open mind to new strategies and advice. With determination and a good plan, you can tackle financial challenges head-on and reach your aspirations.

In conclusion, setting financial goals is the bedrock of any solid financial plan. It helps you carve out your financial vision, set actionable steps, and adapt as life changes. By prioritizing both your short-term and long-term goals and making informed decisions, you’re laying down the path to financial success. Start by taking stock of where you are, set clear goals, and set a budget that mirrors your ambitions. Stay the course, track your progress, and be ready to adjust when necessary. With a clear plan and constant effort, financial stability and security aren’t just dreams but achievable realities.