Smart Strategies to Build Wealth Using High-Yield Savings Account Laddering

In the world of personal finance, making your money work harder for you doesn’t always mean taking big risks. Sometimes, it’s about being clever with tools that are already at your disposal. High-yield savings account laddering is exactly that kind of approach - a practical strategy that helps you maximize interest earnings while keeping your money accessible.

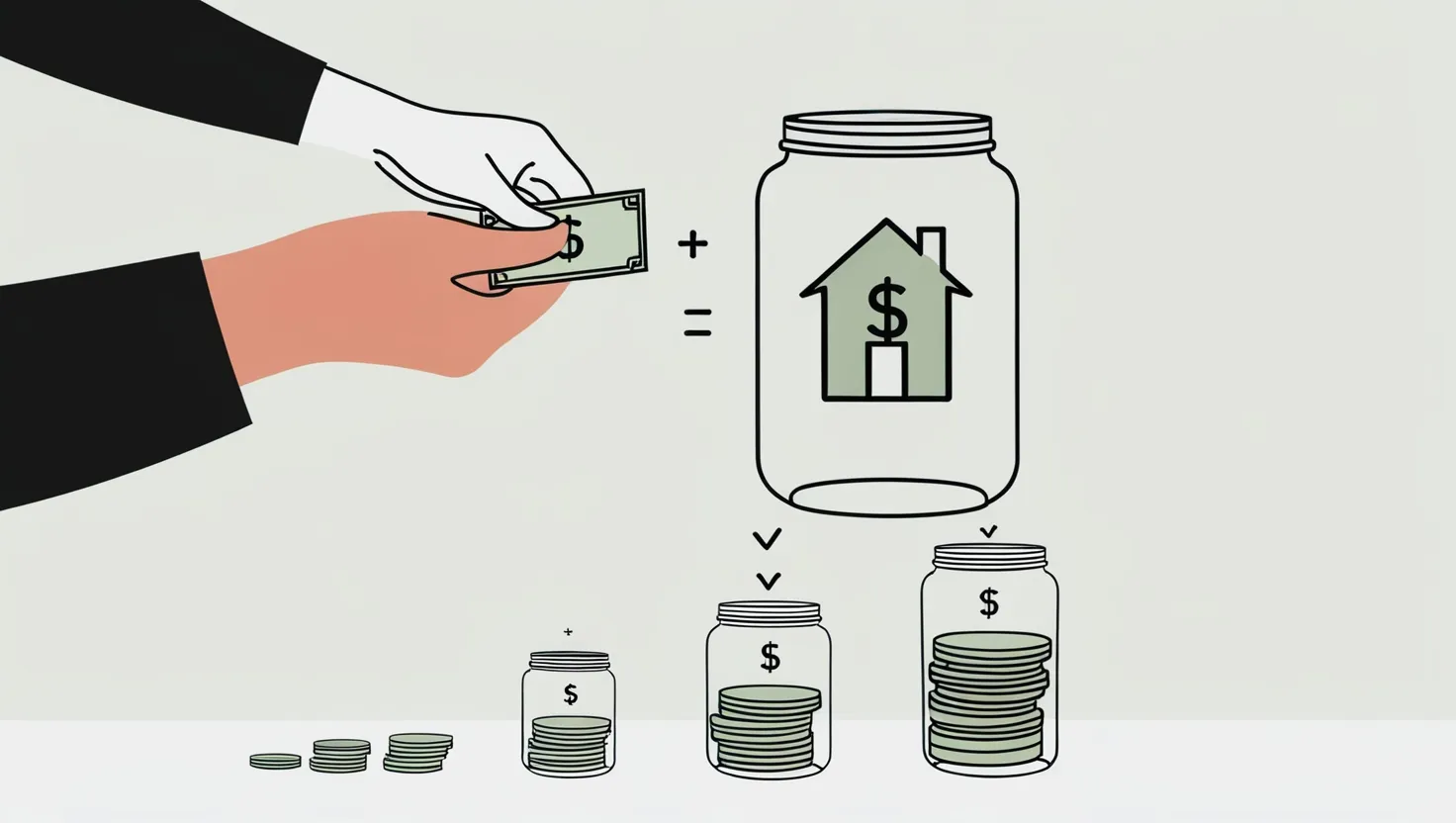

Think of high-yield savings account laddering as a financial chess game where you’re always a few moves ahead. Instead of parking all your money in one account, you spread it across multiple accounts with different promotional periods and interest rates. This creates a continuous cycle of high returns that a single account simply cannot match.

“The art of getting rich consists not in industry, much less in saving, but in a better order, in timeliness, in being at the right spot.” - Ralph Waldo Emerson

Have you ever wondered why banks offer promotional rates that seem too good to be true? They’re betting on our forgetfulness or complacency - that we’ll leave our money sitting there after the promotional period ends when rates drop. With a well-structured laddering approach, you can turn this banking strategy on its head and keep your money constantly flowing toward the highest returns.

Let’s explore six powerful strategies to build wealth through high-yield savings account laddering that can transform your approach to cash management.

Strategy 1: Research and Secure Promotional Rates

The foundation of effective savings account laddering begins with thorough research. Banks frequently offer promotional rates to attract new customers, typically featuring rates 1-2% higher than their standard offerings for periods of 12-18 months.

I recommend creating a dedicated spreadsheet that tracks financial institutions offering the best promotional rates. Include national online banks, which often feature the most competitive rates, but don’t overlook regional banks and credit unions that might offer special deals to attract local deposits.

When comparing rates, look beyond the headline number. Pay attention to minimum balance requirements, monthly fees, and any stipulations about direct deposits or debit card usage. These factors can significantly impact your actual returns.

“Do not save what is left after spending, but spend what is left after saving.” - Warren Buffett

What’s your current strategy for keeping track of bank promotions? Do you have a system in place, or are you leaving money on the table?

Strategy 2: Create a Systematic Deposit Schedule

Timing is everything with savings account laddering. Instead of opening multiple accounts simultaneously, stagger your account openings every 2-3 months. This creates a rotation where you’ll always have an account coming off its promotional period just as you’re opening a new high-yield account.

For example, you might start with $1,000 in Bank A in January, then add $1,000 to Bank B in March, and another $1,000 to Bank C in May. By July, the promotional period for Bank A might be ending, at which point you can move those funds to a new high-yield option at Bank D.

This systematic approach ensures that your money is continuously moving toward the highest possible returns without leaving you with periods of lower earnings.

The key is consistency. Set calendar reminders for when promotional periods end and when it’s time to research new options. This prevents funds from sitting in accounts that have reverted to standard (lower) interest rates.

Strategy 3: Monitor Rate Changes Weekly

The financial landscape changes quickly, and interest rates can fluctuate based on broader economic conditions. Successful laddering requires staying informed about these changes.

I dedicate 15 minutes each weekend to check current rates across my existing accounts and scan for new promotions. This regular habit has helped me catch rate changes early and make adjustments before they impact my returns.

“Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn’t, pays it.” - Albert Einstein

Several financial websites and apps track and compare high-yield savings accounts, making this process easier. Consider setting up alerts for rate changes or new promotions that meet your criteria.

How often do you check your savings account rates? Could a more regular review help you capture higher returns?

Strategy 4: Set Up Strategic Automatic Transfers

Automation is a powerful tool in savings account laddering. By setting up automatic transfers that coincide with promotional rate expirations, you can ensure your money moves efficiently without requiring constant attention.

When opening a new account, immediately schedule a transfer for the date when the promotional period ends. This creates a self-managing system where your funds naturally flow to the next highest-yield option.

Many banks allow you to schedule transfers months in advance. Take advantage of this feature to create a transfer calendar that aligns with your laddering strategy. Just be sure to review these scheduled transfers periodically as your strategy evolves.

Strategic automation doesn’t just save time—it removes the emotional element from financial decisions. When transfers happen automatically, you’re less likely to second-guess your strategy or leave money in underperforming accounts due to procrastination.

Strategy 5: Negotiate Rate Matches

Here’s a strategy that many savers overlook: using competitive offers as leverage. Banks value customer retention, and many will match or even exceed promotional rates offered by competitors rather than lose your business.

I’ve successfully negotiated higher rates by simply calling my existing bank, mentioning a competitor’s promotional rate, and asking if they can match it. This approach works particularly well if you have a substantial balance or a long-standing relationship with the institution.

“The best investment you can make is in yourself.” - Warren Buffett

When negotiating, be specific about the competing offer and polite but direct about your intent to move your funds if they can’t provide a competitive rate. Having your research readily available during these conversations strengthens your position.

Have you ever tried negotiating with your bank? What’s stopping you from picking up the phone today?

Strategy 6: Build Relationships with Credit Unions and Community Banks

While national online banks often advertise the highest rates, credit unions and community banks frequently offer competitive rates to members without the same level of national marketing.

These smaller institutions often value relationship banking and may provide preferential rates to customers who use multiple services. By establishing accounts at several local institutions, you create additional opportunities for your laddering strategy.

Credit unions, in particular, are worth exploring as they’re member-owned and typically pass their profits back to members through higher savings rates and lower loan rates. Many have relaxed their membership requirements in recent years, making them more accessible than ever.

The personal relationships you develop with these institutions can lead to insider information about upcoming rate specials or other financial opportunities that align with your goals.

Making Your Ladder Work

The beauty of savings account laddering lies in its flexibility. You can scale this approach based on your available capital, starting with just a few thousand dollars spread across three or four accounts and expanding as your savings grow.

As your ladder matures, the compounding effect becomes increasingly powerful. Your interest earnings begin generating their own interest, creating an accelerating cycle of growth that traditional single-account saving simply cannot match.

“Money is only a tool. It will take you wherever you wish, but it will not replace you as the driver.” - Ayn Rand

Regular review is essential to maintain an effective ladder. At least quarterly, evaluate your entire strategy to ensure it’s still aligned with current market conditions and your financial goals. Are there new promotional offers worth pursuing? Have any banks changed their terms or conditions? This ongoing assessment keeps your approach optimized.

What would prevent you from implementing this strategy this week? Is it time constraints, uncertainty about the process, or something else entirely?

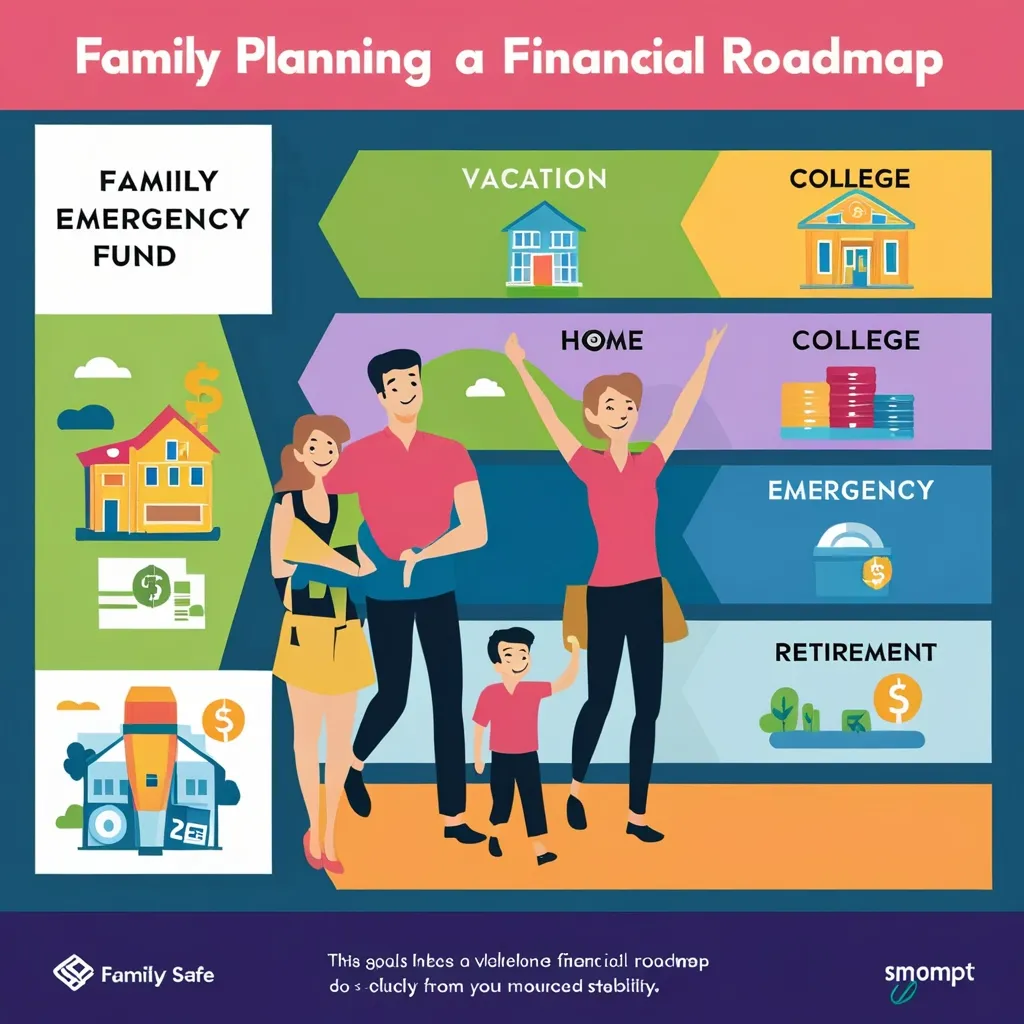

Remember that high-yield savings account laddering is just one component of a comprehensive financial strategy. While you’re maximizing returns on your liquid savings, don’t neglect other important elements like retirement accounts, investments, and debt management.

By applying these six strategies consistently, you can transform ordinary savings into an active wealth-building tool. The increased returns might seem modest in the short term, but over years and decades, the difference can be substantial—all achieved without taking on additional risk.

The most successful savers aren’t those who make dramatic financial moves, but those who systematically optimize every aspect of their financial lives. High-yield savings account laddering represents exactly this kind of optimization—a method to extract maximum value from assets you already have, creating wealth through careful planning rather than increased risk.