In the intricate world of finance, understanding the quirks of human psychology can be your most powerful tool. This isn’t just about behavioral economics or traditional market psychology; it’s about delving into the complex network of cognitive biases that influence market behavior. By grasping how these biases interact and manifest in different market conditions, you can identify inefficiencies that others might overlook.

Let’s start with a fundamental concept: cognitive biases. These are mental shortcuts or rules of thumb that our brains use to make decisions quickly, but they often lead to systematic errors. For instance, the overconfidence bias makes us think we know more than we actually do, leading us to take on too much risk. Loss aversion, on the other hand, makes us fear losses more than we value gains, causing us to hold onto losing investments for too long.

Imagine you’re at a casino, and you’ve just lost a significant amount of money. The loss aversion bias might make you reluctant to cut your losses and walk away, even if it’s the rational thing to do. This bias can also affect investors who cling to underperforming stocks, hoping they will eventually rebound, rather than accepting the loss and moving on.

Another bias that plays a significant role in financial decisions is the anchoring bias. This is when we rely too heavily on the first piece of information we receive, even if it’s irrelevant or unreliable. For example, if you’re considering buying a stock and the first price you see is an inflated one, you might anchor on that price and think the stock is worth more than it actually is.

The herd mentality is another powerful bias. When everyone around us is doing something, we tend to follow suit, even if it doesn’t make logical sense. In the financial world, this can lead to market bubbles where prices skyrocket because everyone is buying, not because the underlying value of the asset has changed.

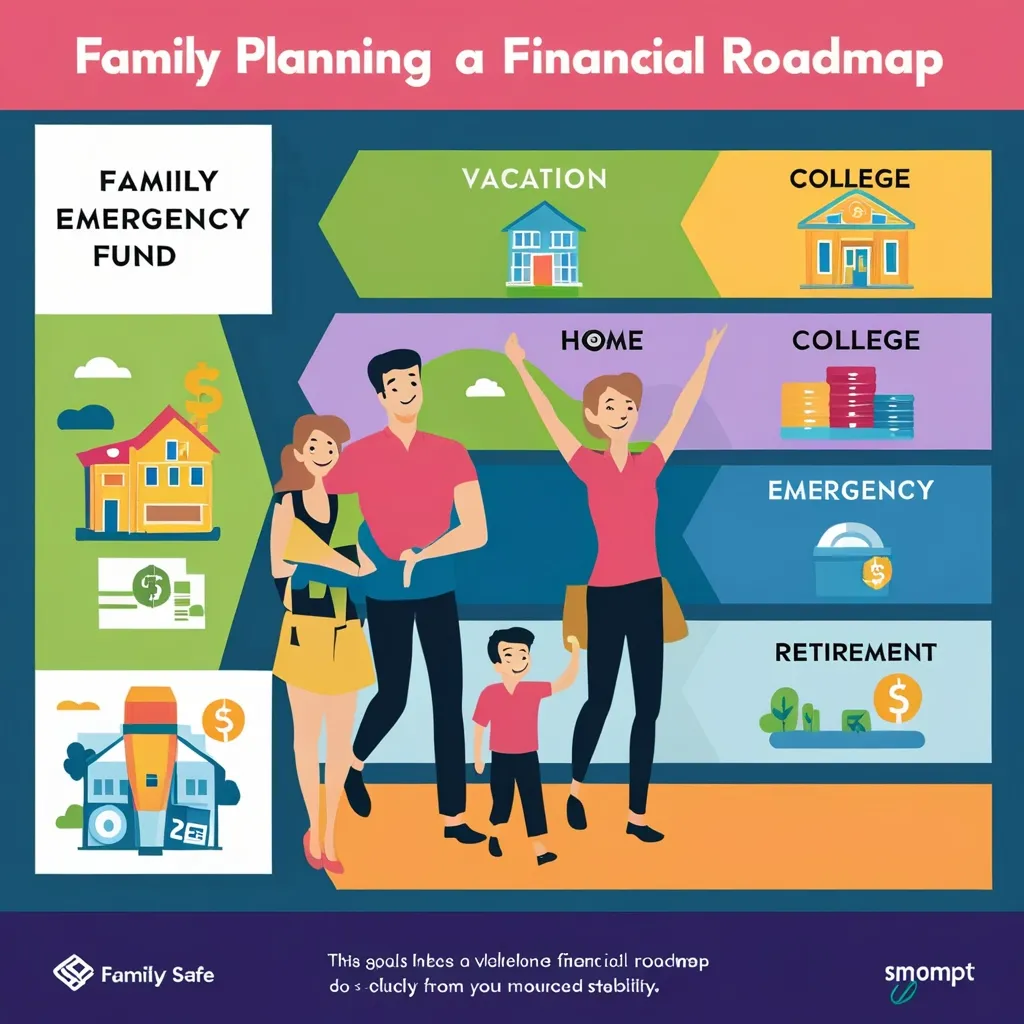

Understanding these biases is crucial because they can significantly impact financial decisions. By recognizing how our brains work when making money choices, we can develop strategies to mitigate these biases. For instance, taking a step back to evaluate decisions logically, seeking diverse opinions, and setting clear financial goals can help you make more rational choices.

Neuroeconomics, a field that combines neuroscience, psychology, and economics, provides valuable insights into how our brains affect financial choices. It uses tools like fMRI and EEG to see how different parts of the brain, such as the prefrontal cortex and amygdala, work together when we make financial decisions. This helps us understand how our thinking and feelings influence our use of money.

For example, the prefrontal cortex is involved in rational decision-making, while the amygdala handles emotions. When these two parts of the brain are in conflict, it can lead to irrational financial decisions. Knowing this, you can take steps to ensure your rational thinking prevails over emotional impulses.

In practical terms, this means being aware of your own biases and actively working to counter them. If you find yourself overly confident in your investment choices, take the time to seek out opposing views and consider alternative scenarios. If you’re holding onto a losing investment due to loss aversion, remind yourself that cutting your losses now might be the best decision in the long run.

Exploiting these cognitive biases for market advantage involves a nuanced understanding of how they interact in different market conditions. It’s like playing a game of 3D chess, where you anticipate how biases will shape price movements. For instance, during a market downturn, loss aversion might cause many investors to sell their stocks at low prices, creating an opportunity for you to buy at a discount.

In a bull market, the herd mentality can drive prices up, but knowing this can help you avoid getting caught up in the frenzy and making irrational purchases. By anticipating these bias-driven market swings, you can position yourself to take advantage of the inefficiencies they create.

This approach turns behavioral finance into a precision tool. It’s not just about understanding that biases exist; it’s about using that knowledge to make informed, strategic decisions. In this neuroeconomic landscape, your edge comes from your ability to navigate the complex web of human irrationality and turn cognitive blind spots into golden opportunities for arbitrage and value creation.

To illustrate this, consider the concept of arbitrage. Arbitrage involves exploiting price differences between two or more markets to make a profit. In a world where cognitive biases influence market behavior, identifying these biases can help you spot mispricings that others might miss. For example, if a stock is undervalued due to the anchoring bias, you can buy it at the lower price and sell it at its true value, making a profit.

Moreover, understanding cognitive biases can help you avoid common pitfalls. For instance, the confirmation bias makes people seek out information that supports their existing beliefs. In finance, this can lead to poor investment decisions because you’re only considering information that confirms your preconceived notions. By actively seeking out diverse perspectives and challenging your own beliefs, you can make more informed decisions.

The role of personality traits in financial decision-making is another important aspect to consider. Research has shown that personality characteristics, such as extraversion, can moderate the impact of cognitive biases on investment decisions. For example, extraverted individuals might be more prone to the overconfidence bias, leading them to take on more risk than they should.

Understanding these interactions can help you tailor your investment strategy to your personality. If you know you’re prone to overconfidence, you can set up checks and balances to ensure you’re not taking unnecessary risks. This personalized approach can make your financial decisions more effective and sustainable.

In conclusion, navigating the financial markets with an understanding of cognitive biases is like having a secret weapon. It allows you to see beyond the surface level of market movements and anticipate how human psychology will influence prices. By developing this deep understanding, you can position yourself ahead of predictable, bias-driven market swings and turn what others see as irrationality into opportunities for arbitrage and value creation.

This isn’t just a theoretical concept; it’s a practical strategy that can be applied in real-world financial decisions. Whether you’re an individual investor or a professional trader, recognizing and exploiting cognitive biases can give you the edge you need to succeed in the complex and often irrational world of finance.

So, the next time you’re making a financial decision, take a moment to reflect on your own biases. Are you being overly confident? Are you avoiding losses at all costs? By acknowledging these biases and taking steps to mitigate them, you can make wiser, more effective financial choices that set you apart from the crowd.

In the end, it’s not about outsmarting the market; it’s about understanding the human element that drives it. By mastering this understanding, you can turn the quirks of human psychology into your greatest financial asset.