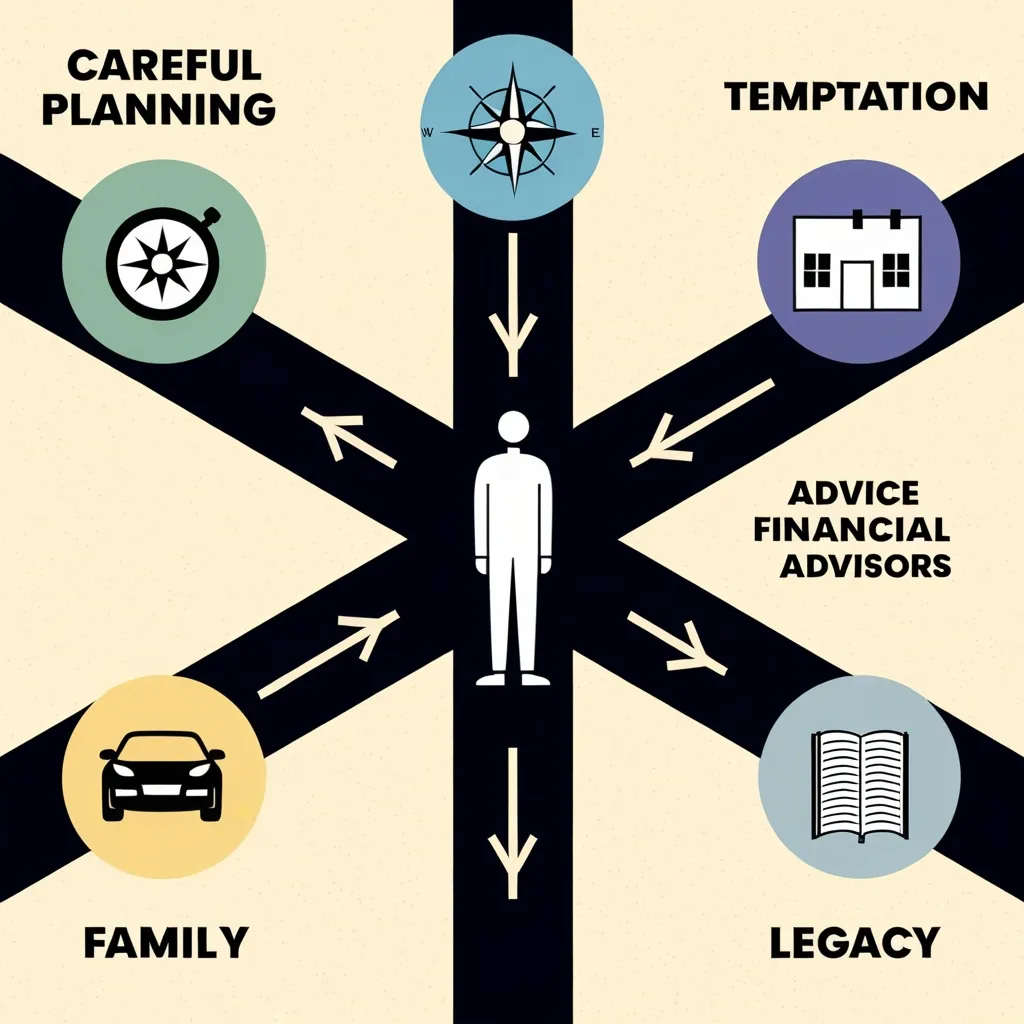

An unexpected inheritance can be a double-edged sword. On one hand, it brings the thrill of newfound wealth; on the other, it comes with a bundle of responsibilities and emotions that can quickly become overwhelming. The key to making the most of this windfall is to approach it calmly and wisely. This guide lays out how to handle an inheritance in a way that secures your financial future and honors the legacy you’ve been left with.

First things first, when you’re hit with an unexpected inheritance, pause and give yourself some time to breathe. The temptation to make snap decisions—whether it’s quitting your job or buying that luxury car you’ve always dreamed of—can be strong, but acting on impulse can lead to regrets down the line. Take about six to nine months to process the situation. Think things through and let the initial rush of emotions settle.

Before diving into your inheritance, ensure your current financial situation is stable. A good starting point is a budget that reflects where you are financially and where you want to go. This will guide you in deciding how to integrate your inheritance into your broader financial goals. Consider paying off any high-interest debts first—they can be a drag on your finances. It’s also a great time to top up your emergency fund and review your life insurance coverage.

Next, find some trusted advisors to help you navigate this new terrain. You’ll need a certified financial planner, a certified public accountant, and an estate attorney at the very least. These pros will help you understand the financial, tax, and legal implications of your inheritance. Make sure they come highly recommended and are clear about how they charge for their services.

Once you have your team, it’s time to craft a comprehensive financial plan. This plan should detail your short-term and long-term goals, like saving for retirement, funding your kids’ education, or perhaps some charitable giving. Your advisors will help you assess how the inheritance impacts your current investments and suggest changes that align with your new financial status.

Don’t forget about tax implications. This newfound wealth can have significant tax consequences, so work with your advisors to minimize your tax burden. This might involve timing when you receive certain parts of the inheritance, using tax-advantaged investments, or taking advantage of applicable deductions. Both federal and state tax laws should be considered.

If your inheritance includes stocks or investments that aren’t diversified, you might want to manage these risks. Concentrated stock positions can be risky and volatile. Your advisors can help you develop a strategy to balance this, maybe by selling off some of the concentrates or using hedging strategies to mitigate risks.

Now that you’ve got more wealth, estate planning becomes crucial. You’ll want to make sure that your heirs benefit from your wealth without a hefty tax bill attached. Consider setting up trusts, charitable vehicles, and updating your will. This helps preserve your legacy and ensure your wishes are honored.

Privacy is key when dealing with an inheritance. Family dynamics can shift quickly with money involved, so it’s better to keep the details of your windfall under wraps, sharing only with those who need to know. Also, think about what your benefactor would have wanted. Let their values and wishes guide your decisions to honor their legacy appropriately.

Impulse decisions can be tempting, but they often lead to regret. Take your time, and consult with your advisory team before making any big purchases or investments. Remember that your inheritance isn’t just a pile of money; it can provide long-term financial security. Consider not only the lump sum but how it can serve as a stream of income over the years.

A smart move could be to invest in education for future generations. Setting up educational trusts or 529 college savings plans not only provides tax advantages but also ensures that the educational legacy remains strong in your family. These can be tailored to suit your wishes, ensuring that your descendants benefit according to your plans.

Reevaluating your lifestyle might also be on the cards with this new wealth. Maybe you always wanted to travel more or have a second home. That’s fine, but be cautious. Any lifestyle changes should align with your long-term financial goals to ensure you don’t overextend yourself.

Sticking with your job, at least for a while, can be beneficial too. This not only stretches the life of your inheritance but also continues to build your Social Security benefits. If your new investments don’t perform as expected, having that steady income can be a lifesaver.

In the end, managing an unexpected inheritance is about careful planning and smart decisions. By taking your time, leaning on expert advice, and focusing on long-term goals, you can make sure that this windfall brings lasting financial security. It’s not just about having more money—it’s about the opportunities it brings to secure your future and that of your loved ones.