When it comes to investing, two of the most popular and often debated options are real estate and stocks. As someone who has dabbled in both, I’ve found that the choice between these two isn’t as straightforward as it seems. Here’s a deeper dive into the world of real estate and stocks, highlighting some surprising truths and lesser-known facts that can help you make a more informed decision.

The Historical Perspective

Historically, stocks have outperformed real estate in terms of returns. The S&P 500, for example, has averaged around a 10% annual return over the long term, including dividends. In contrast, real estate returns have been more modest, averaging between 4-8% annually. However, there have been periods where real estate has shone brighter, such as the Great Moderation from 1990 to 2006, when housing returns exceeded those of the stock market.

Volatility and Risk

One of the most significant differences between real estate and stocks is volatility. Stock prices can fluctuate wildly in a short period, making them more volatile. Real estate, on the other hand, tends to be less volatile, with prices moving more gradually. This stability can be comforting, especially for those who are risk-averse or prefer a longer-term investment horizon.

Tangible vs. Intangible

Real estate offers a tangible asset that you can see and touch, which can be very appealing. Owning a property gives you a sense of control and security that you just can’t get with stocks. Stocks, by contrast, are intangible and represent a small piece of a company. While this intangibility can make stocks more liquid and easier to trade, it also means you have no physical asset to fall back on.

Passive Income and Leverage

Real estate is renowned for its ability to generate passive income through rental properties. This can be a game-changer for investors looking to earn money without actively working for it. Additionally, real estate allows for leverage, where you can purchase a property with a significant amount of borrowed money, amplifying your potential returns. For instance, if you buy a $200,000 property with a 20% down payment and the property appreciates by 3%, you effectively earn 15% on your initial investment.

Liquidity and Transaction Costs

Stocks are highly liquid, meaning you can buy and sell them quickly and easily through your brokerage account. Real estate, however, is much less liquid. Selling a property can take months, and the process involves significant transaction costs, such as closing fees that can range from 6% to 10% of the sale price. This makes real estate a less flexible investment option compared to stocks.

Tax Benefits and Risks

Both real estate and stocks come with their own set of tax implications. Real estate investments can offer substantial tax benefits, including deductions for mortgage interest, property taxes, and depreciation. However, selling real estate or stocks can result in capital gains taxes. It’s worth noting that if you hold onto your stocks or real estate for more than a year, you may qualify for lower long-term capital gains tax rates.

Diversification and Time Commitment

Diversification is key in any investment strategy, and both real estate and stocks can play a role. However, diversifying a real estate portfolio is much more challenging and costly compared to diversifying a stock portfolio. Real estate investments often require significant upfront capital and ongoing management, including maintenance and tenant management. Stocks, on the other hand, can be easily diversified through index funds or ETFs, requiring minimal time and effort.

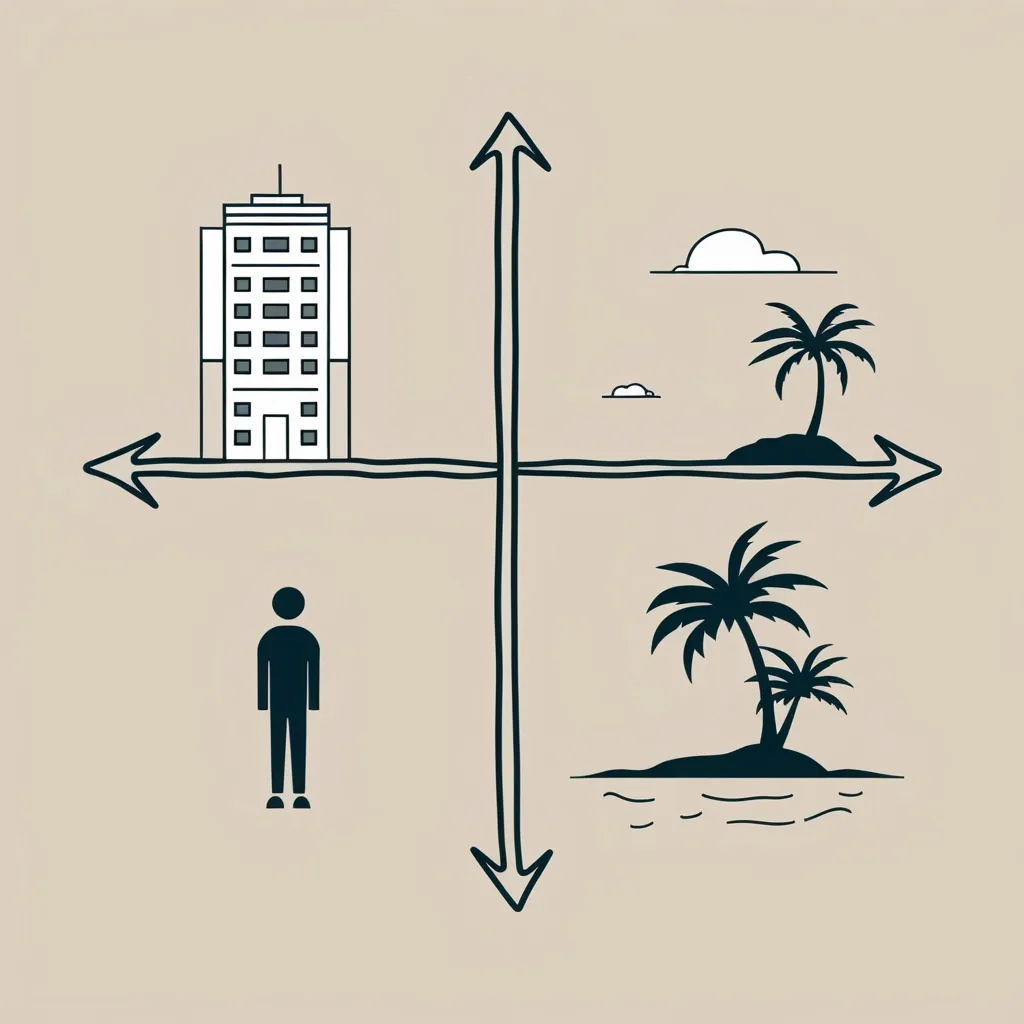

Personal Experience and Goals

Ultimately, the choice between real estate and stocks depends on your personal financial situation, risk tolerance, and investment goals. If you’re looking for passive income and are willing to put in the time and effort to manage properties, real estate might be the way to go. However, if you prefer a more liquid, low-maintenance investment with the potential for higher returns, stocks could be your better bet.

A Balanced Approach

Many investors find that a balanced approach works best. By investing in both real estate and stocks, you can diversify your portfolio and mitigate risks. For example, you could invest in a rental property to generate passive income while also holding a diversified stock portfolio to capture the higher potential returns of the stock market. This balanced approach can help you achieve your financial goals while minimizing the risks associated with either investment type alone.

The Role of REITs

For those who want to invest in real estate without the hassle of managing properties, Real Estate Investment Trusts (REITs) are a viable option. REITs allow you to invest in real estate through the stock market, providing the benefits of real estate investing without the need for direct property management. Historically, REITs have performed well, sometimes even outperforming the broader stock market.

Market Conditions and Timing

The performance of both real estate and stocks can be heavily influenced by market conditions and timing. For instance, the housing market boom from 1990 to 2006 saw real estate outperform stocks, but the subsequent housing crash in 2007-2008 highlighted the risks involved in real estate investing. Similarly, stock market performance can vary significantly depending on economic conditions, geopolitical events, and other factors.

Emotional Investment

Investing in real estate often involves an emotional component that you don’t typically find with stocks. Owning a home or rental property can be a source of pride and a sense of accomplishment. This emotional investment can sometimes cloud judgment, leading to decisions based on personal feelings rather than financial logic. It’s important to keep your emotions in check and make investment decisions based on sound financial principles.

Conclusion

In the end, whether real estate or stocks is the better investment for you depends on a multitude of factors, including your financial goals, risk tolerance, and personal preferences. Both options have their pros and cons, and understanding these can help you make a more informed decision.

For me, the key has been finding a balance that works. By diversifying my portfolio with both real estate and stocks, I’ve been able to mitigate risks and maximize returns. Whether you’re a seasoned investor or just starting out, taking the time to understand the nuances of each investment type can make all the difference in achieving your financial goals.

So, the next time you’re pondering whether to invest in real estate or stocks, remember that it’s not necessarily an either-or situation. Both can be valuable components of a well-rounded investment strategy, each offering unique benefits and challenges. By understanding these differences and aligning them with your personal financial goals, you can set yourself up for long-term financial success.