Credit card debt can be a beast, but there’s no need to stress. With some smart moves, you can conquer it and reclaim your financial freedom. Here’s your ultimate guide to tackling credit card debt the easy way.

Knowing exactly what you owe is the first step. Make a list of all your credit cards along with their balances and interest rates. Having everything laid out helps you prioritize your payments and figure out the best approach for your situation. It’s like seeing the whole mountain before planning your climb.

Creating a budget is like drawing a treasure map to financial freedom. Track your income and expenses for a month to find where you might be overspending. Cutting back on non-essentials like eating out or unused subscriptions can free up cash to pay off your debt. A solid budget keeps you from racking up more debt while you’re trying to pay off what you already owe.

Paying more than the minimum monthly payment is crucial. The minimum payment mostly covers interest, leaving your principal balance almost untouched. So, throw as much money as you can at those balances. Each extra dollar you pay reduces the principal, lowering the interest you’ll owe over time.

Choosing the right payment strategy can make all the difference. There are two popular methods:

Debt Snowball Method This involves paying off your card with the smallest balance first. Once it’s paid, move to the next smallest. This approach wins because each success motivates you to keep going.

Debt Avalanche Method This method targets the card with the highest interest rate first. Though it might not offer the instant gratification of the snowball method, it saves you more money on interest in the long run. It’s the money-savvy choice if you love seeing interest charges shrink.

Automating your payments helps you dodge late fees and penalties. Set automatic payments from your bank account to your credit card accounts so you never miss a due date. It also keeps you on track with your debt repayment plan without the hassle of manual payments.

Consolidating your debt can simplify things, especially if you have multiple cards with high balances. Transferring them to a single card with a lower interest rate or using a debt consolidation loan can save you money. Watch out for balance transfer fees and make sure the new interest rate is actually lower than what you’re currently paying.

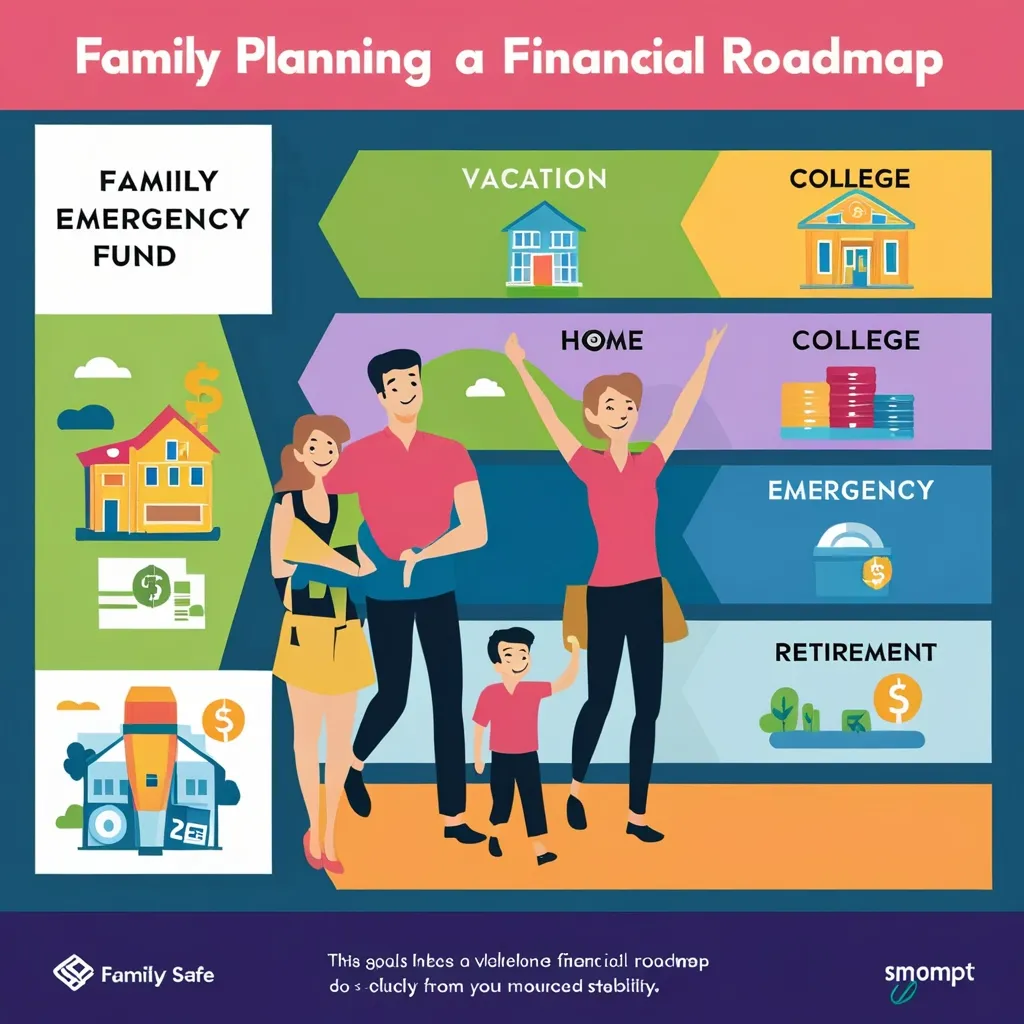

Life throws curveballs, and having an emergency fund can cushion those unexpected expenses. Aim to save six months’ worth of expenses. This safety net stops you from relying on credit cards for emergencies.

Being mindful of your spending is crucial. Stick to a shopping list, avoid impulse buys, and maybe leave your credit card at home when you go out. Cut back on luxuries like dining out or those daily pricey coffees. Review your bills to see if you can reduce services like cable or streaming.

Got a financial windfall? Use it wisely. Raises, bonuses, or any extra money should go towards your debt. This can really speed up the repayment process, getting you closer to a debt-free life. Resist the urge to splurge and commit to paying down your balances.

Monitoring your credit regularly lets you track how far you’ve come. It also helps you catch any errors in your report that could hurt your credit score.

Don’t be afraid to seek help if you’re struggling. You might borrow from family or friends, but make sure there’s a clear agreement to avoid straining relationships. Some credit card companies offer repayment plans or lower interest rates for customers facing financial difficulties.

Staying motivated is key. It might take time, but celebrating small wins can keep you going. Adjust your strategy if your financial situation changes. Just remember, every step you take brings you closer to financial freedom.

Following these strategies won’t just help you manage your credit card debt, but it will also pave the way to a debt-free future. It’s a journey that requires effort and discipline, but the peace of mind you’ll find at the end is priceless. Start today, and you’re on your way to conquering that mountain of debt.