The Gig Economy: A Deep Dive into Its Financial Impacts

The gig economy has revolutionized the way we work, offering flexibility and freedom that traditional 9-to-5 jobs can’t match. But let’s be real - it’s not all sunshine and rainbows. There’s a whole bunch of financial challenges lurking beneath the surface that can really throw a wrench in your personal finances.

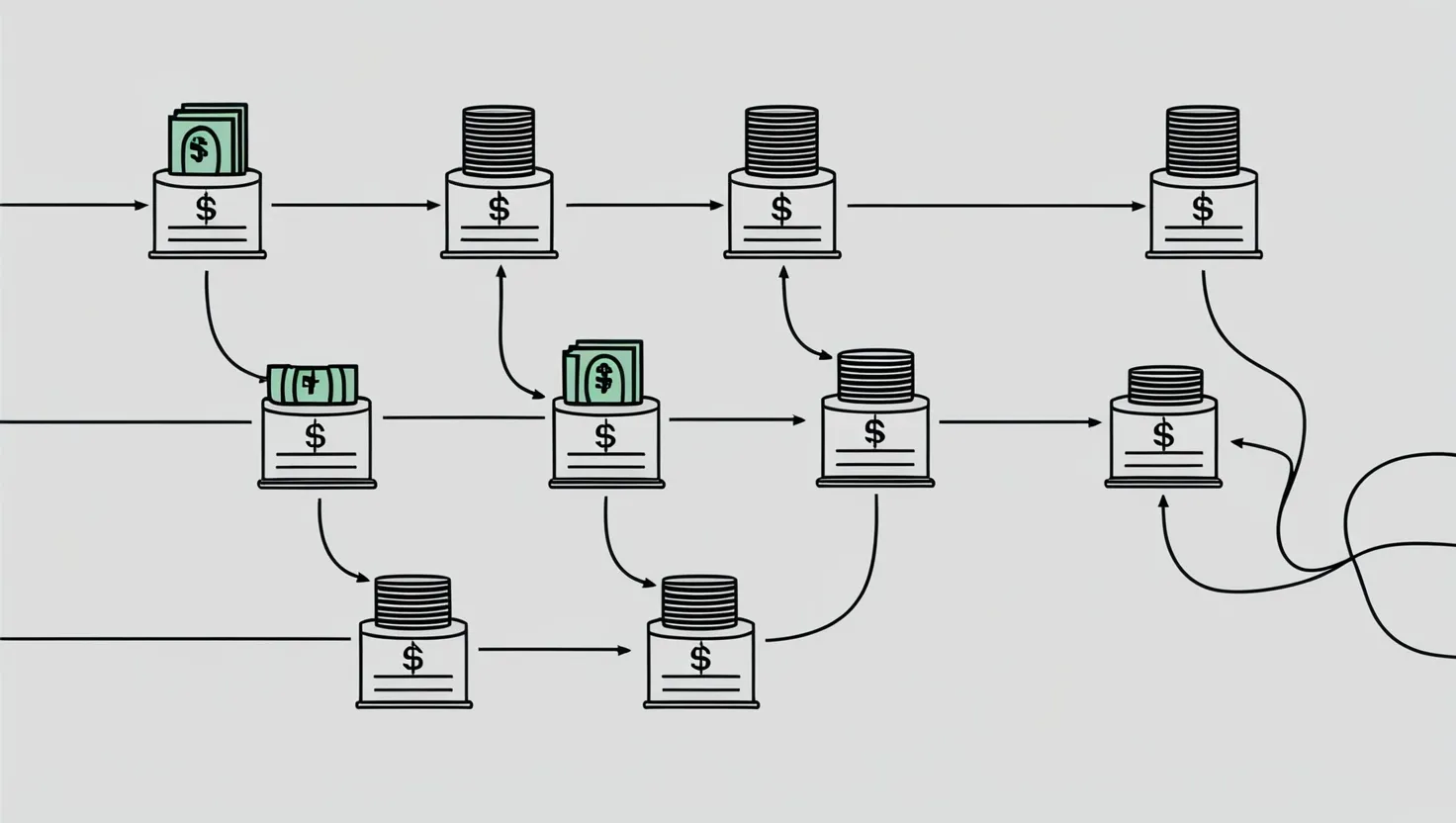

First off, let’s talk about the flexibility trap. Sure, it’s awesome to be able to work when and where you want. But man, that unpredictable income can be a real pain in the butt. One month you’re rolling in dough, the next you’re scraping by. It’s like trying to ride a financial rollercoaster blindfolded.

And don’t even get me started on the benefits void. No health insurance, no paid time off, no retirement contributions - nada. It’s like jumping out of a plane without a parachute. You’re on your own, buddy, and it can be pretty scary.

Financial insecurity is the name of the game in the gig economy. A lot of gig workers are working their tails off just to make ends meet. It’s like being on a hamster wheel that never stops. And saving for the future? Yeah, good luck with that. It’s tough to think about retirement when you’re worried about paying this month’s rent.

Getting credit can be a real headache too. Banks look at gig workers like they’ve got three heads. “What do you mean your income isn’t steady?” they ask. It’s enough to make you want to pull your hair out.

And let’s not forget about taxes. Being self-employed means you’re on the hook for both the employee and employer portions. It’s like getting hit with a double whammy. Plus, all those work-related expenses add up fast. Before you know it, your income has shrunk faster than a wool sweater in hot water.

The stress of it all can really mess with your head too. It’s hard to relax when you’re constantly worried about where your next paycheck is coming from. It’s like living with a dark cloud hanging over your head all the time.

But hey, it’s not all doom and gloom. A lot of gig workers are still pretty optimistic about their financial futures. Maybe it’s the freedom, maybe it’s the potential for multiple income streams. Whatever it is, it’s keeping people going.

And there are some solutions popping up to help gig workers out. On-demand pay is a pretty cool idea. It’s like getting a payday advance, but without the ridiculous interest rates. Some companies are even starting to offer financial tools and benefits to their gig workers. It’s about time, if you ask me.

If you’re thinking about jumping into the gig economy, or if you’re already in it, there are some things you can do to make life easier. Budgeting is key. You’ve got to be flexible, just like your income. Set aside money for taxes, benefits, and emergencies. Trust me, your future self will thank you.

An emergency fund is a must-have. Aim for at least three to six months of living expenses. It’s like having a financial safety net. You hope you never need it, but you’ll be glad it’s there if you do.

Don’t skimp on health insurance. Yeah, it’s expensive, but so is a trip to the ER without coverage. And start thinking about retirement now. There are options out there for self-employed folks, like SEP-IRAs and solo 401(k)s. Future you will be grateful you didn’t put it off.

And if you can, take advantage of those on-demand pay solutions. They can be a real lifesaver when you need cash in a pinch.

Look, the gig economy isn’t perfect. It’s got its ups and downs, just like any other way of working. But if you go in with your eyes open and prepare for the challenges, you can make it work for you.

It’s all about finding that balance between flexibility and stability. It’s not easy, but it’s doable. And who knows? Maybe as the gig economy grows, we’ll see more solutions pop up to help gig workers manage their finances better.

At the end of the day, the gig economy is here to stay. It’s changing the way we think about work and income. And while it’s got its challenges, it also offers opportunities that weren’t available before. It’s up to each of us to figure out how to make it work for our own financial situations.

So if you’re in the gig economy, or thinking about joining it, remember this: it’s not just about the freedom and flexibility. It’s about being smart with your money, planning for the future, and taking care of yourself. Because in the gig economy, you’re not just the employee - you’re the boss, the accountant, and the HR department all rolled into one.

It’s a lot to handle, but with the right mindset and some careful planning, you can make the gig economy work for you. Just remember to take care of your finances, and your finances will take care of you. After all, in the gig economy, you’re the captain of your own ship. So steer it wisely, and you’ll navigate these financial waters just fine.