In the pursuit of financial freedom, the concept of turning personal skillsets into passive income streams is a tantalizing prospect. It’s a journey that transforms your unique talents and skills into the very ingredients that brew a steady flow of income, even while you sleep. This isn’t just about monetizing hobbies or side hustles; it’s an art of self-monetization that leverages your everyday expertise to create a goldmine of passive income.

The Power of Real Estate

One of the most traditional yet effective ways to generate passive income is through real estate. If you have a knack for property management or an eye for potential in real estate, buying and renting out properties can be a lucrative venture. Not only do you earn rental income, but you also benefit from the appreciation of the property’s value over time. Real estate investing allows you to leverage other people’s money through mortgages, enabling you to invest in more properties than you could otherwise afford. Whether it’s a single-family home, a multifamily property, or a commercial building, real estate offers a diverse range of opportunities to suit different skill sets and financial capacities.

The Magic of Online Courses

If you’re knowledgeable and passionate about a particular subject, creating an online course can be a powerful way to monetize your expertise. Imagine teaching thousands of students around the world without having to be physically present. Online courses can be sold repeatedly, generating passive income for as long as the course remains relevant. The process involves deciding on a topic, structuring the content, and marketing the course. With the right tools and a bit of creativity, you can turn your knowledge into a digital product that earns money continuously.

The World of Peer-to-Peer Lending

Peer-to-peer lending is another innovative way to generate passive income while supporting other entrepreneurs and small businesses. By lending money through specialized platforms, you receive regular interest payments and diversify your investment portfolio. These platforms are user-friendly, making it easy to set up an account and start investing. You’re not just earning passive income; you’re also contributing to the growth of your community.

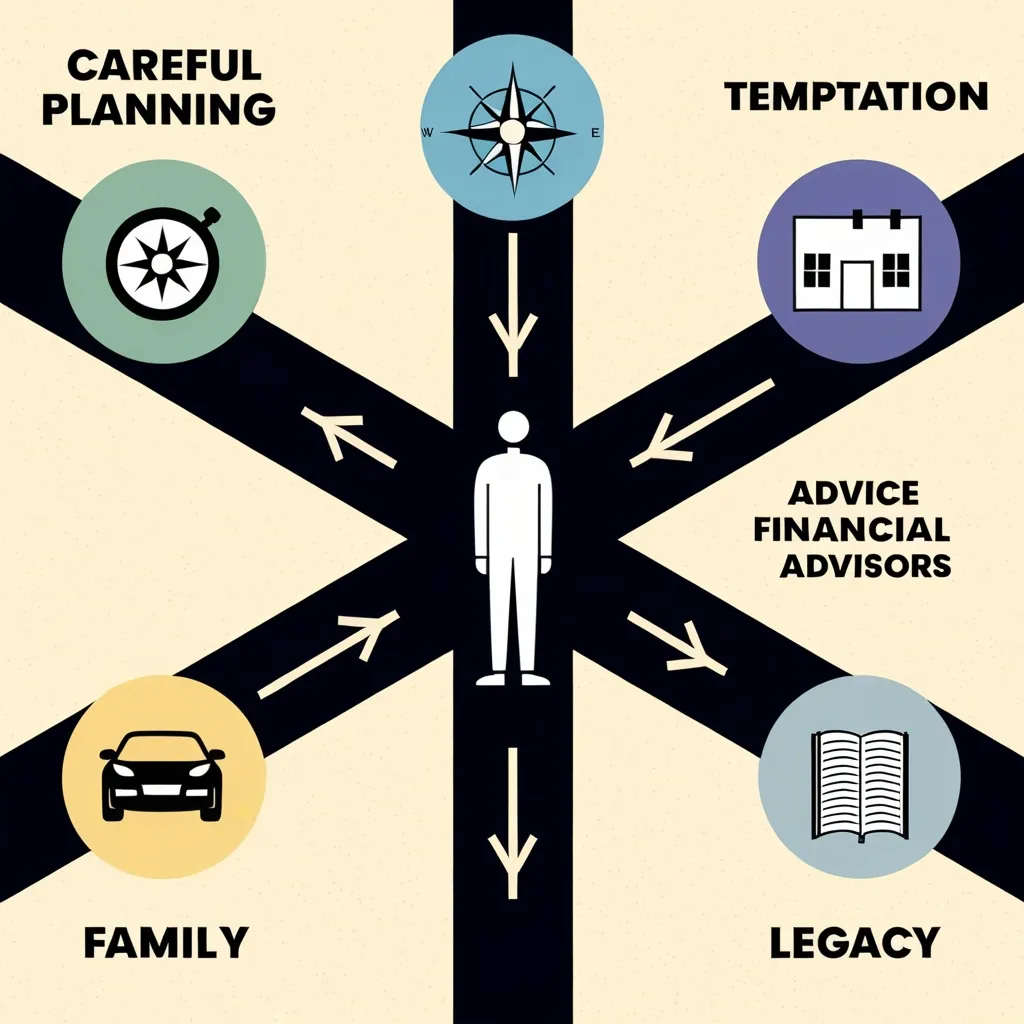

The Dividend Route

Investing in dividend-paying stocks is a strategy that offers a consistent stream of passive income. Instead of speculating on stock prices, you focus on companies that distribute a portion of their profits to shareholders. This approach is relatively safe and stable, making it ideal for those seeking predictable income. However, it’s crucial to do your own research and consult a financial advisor to ensure you’re making informed decisions.

Affiliate Marketing: Promoting What You Love

Affiliate marketing allows you to promote products or services from other companies and earn commissions on sales generated through your unique link or referral code. This method is particularly appealing because it requires no startup costs or specific skills. You can support your favorite businesses while earning passive income, creating a win-win situation. For instance, if you have a blog or social media following, you can use affiliate marketing to monetize your influence.

Dropshipping: The Inventory-Free Business

Dropshipping is an innovative way to sell products online without the hassle of inventory management. You partner with a supplier who ships products directly to your customers, eliminating the need for storage and upfront inventory costs. This model is perfect for those who want to be their own bosses without significant initial investments. By focusing on marketing and sales, you can build a successful dropshipping business that generates passive income.

Creating Digital Products

If you have a talent for design, writing, or any other creative skill, you can create digital products that sell repeatedly. For example, designing Notion templates that solve specific problems or streamline workflows can be a lucrative venture. Similarly, writing and self-publishing an e-book on platforms like Amazon Kindle Direct Publishing can reach a wide audience and generate passive income.

The Power of Print on Demand

Print on demand is a relatively new but highly effective method of generating passive income. You design and sell products such as t-shirts, mugs, or wall art without having to hold any inventory. Platforms like Printify and Etsy handle the printing and shipping, allowing you to focus solely on designing and marketing your products. This model is almost entirely passive, as once your designs are uploaded, the platform takes care of the rest.

Diversifying Your Income Streams

Having multiple streams of income is a key strategy for building wealth. Research suggests that millionaires often have around seven different income streams. This diversification is crucial because it protects you from financial instability and allows you to grow your wealth more consistently. Whether it’s earned income from your day job, business income, interest income, dividend income, rental income, capital gains, or royalties, each stream contributes to a robust financial foundation.

The Importance of Financial Discipline

Building passive income streams requires financial discipline. Highly paid professionals, in particular, are in a prime position to accelerate their financial growth by investing their earned income into various passive income machines. It’s about balancing your expenses and being strategic about where you invest your money. By moving your earned income into passive income streams, you create a cycle of continuous financial growth.

Leveraging Your Social Media Skills

If you have a knack for social media, you can turn this skill into a passive income stream. Creating content that attracts a large following can be monetized through affiliate marketing, sponsored posts, or even selling digital products. For instance, if you’re good at creating engaging videos or posts, you can build a community around your content and earn passive income through ads, sponsorships, or merchandise sales.

Turning Your Creativity into Gold

Financial alchemy is all about transforming your creativity and skills into continuous financial growth. Whether you’re crafting compelling narratives, designing intricate digital artworks, or simply being a social media wizard, your unique talents can become the ingredients for a passive income goldmine. It’s about identifying what you’re good at and finding innovative ways to monetize it.

In this journey of financial alchemy, the key is to be creative and persistent. It’s not just about making money; it’s about living the life you want, free from the constraints of a traditional 9-to-5 job. By leveraging your skills and turning them into passive income streams, you’re not only earning money while you sleep but also building a hedge against the uncertainties of the future.

Real-Life Examples and Success Stories

Consider the story of someone who turned their passion for teaching into an online course. With an initial investment of time and effort, they created a course that now sells thousands of copies worldwide, generating a steady stream of passive income. Or think about the designer who creates print-on-demand products and sells them on Etsy, earning passive income without ever having to handle inventory.

These stories are not exceptions; they are examples of what can be achieved when you transform your skills into passive income streams. Whether you’re an expert in a particular field or simply have a unique talent, the possibilities are endless.

The Future of Passive Income

As we move forward, the landscape of passive income is evolving. With the rise of AI and automation, new opportunities are emerging that were previously unimaginable. For instance, using AI to automate online businesses or create digital products can significantly reduce the effort required to maintain passive income streams.

In conclusion, turning your personal skillsets into passive income streams is a journey that requires creativity, discipline, and a bit of financial savvy. By leveraging your unique talents and skills, you can create a world where your creativity not only expresses itself but also compounds into continuous financial growth. Welcome to the realm of financial alchemy, where your ingenuity fuels your freedom.