Imagine a world where market cycles are not just abstract concepts, but living, breathing entities with their own unique biorhythms. This is the realm of financial chronobiology, where understanding the subtle, biological-like patterns that underpin market movements can give you a distinct edge in your investment decisions.

To start, let’s break down what we mean by “biorhythms” in the context of markets. Just as our bodies have circadian rhythms that dictate our sleep-wake cycles, metabolic rates, and other physiological processes, markets too can be seen as having their own rhythms. These rhythms are influenced by a myriad of factors, including economic indicators, geopolitical events, and even the collective psychology of investors.

Understanding Market Cycles as Biological Rhythms

When you think about it, different sectors of the market can be likened to different organs in the body, each with its own function and rhythm. For instance, tech stocks might be seen as the “brain” of the market, always buzzing with activity and innovation, while energy stocks could be the “heart,” providing the essential fuel that keeps everything running.

Notice how these sectors often have their own unique cycles. Tech stocks, for example, tend to be more volatile and reactive, much like the rapid firing of neurons in the brain. They “wake up” quickly to new trends and innovations, making them highly responsive to market stimuli. On the other hand, energy stocks are more stable, providing a steady beat that underpins the entire economy.

Syncing Your Investments with Market Rhythms

The key to successful investing in this chronobiological framework is to sync your decisions with the market’s natural rhythms. This means understanding when different sectors are likely to be active or dormant. For instance, if you notice that tech stocks tend to surge in the morning as new ideas and innovations are unveiled, you might want to time your investments accordingly.

Similarly, emerging markets can have a different “metabolic rate” compared to developed ones. Emerging markets often have a higher growth potential but also come with higher risks, much like how a younger organism might have a faster metabolism but also be more vulnerable to external factors. By understanding these differences, you can make more informed decisions about when to invest and when to hold back.

The Role of Circadian Rhythms in Global Exchanges

Global exchanges also have their own circadian rhythms. For example, the New York Stock Exchange (NYSE) tends to be most active during the morning hours, reflecting the natural wakefulness of the American market. Conversely, the Tokyo Stock Exchange is most active during the late evening and early morning hours in the U.S., reflecting the time difference and the natural rhythms of the Asian market.

By tuning into these rhythms, you can anticipate when certain markets are likely to be more active or dormant. This can help you make better timing decisions, such as when to buy or sell, and how to allocate your investments across different regions.

The Impact of Collective Psychology

The collective psychology of investors also plays a significant role in shaping market rhythms. Fear and greed, the two primary emotions driving market movements, can create waves of activity that follow predictable patterns. For instance, during times of economic uncertainty, investors might become more risk-averse, leading to a “sleepy” period in the market as everyone waits for clearer signals.

On the other hand, during periods of economic growth, the market can become highly active, with investors eager to capitalize on new opportunities. This “wakefulness” can drive up prices and create a sense of urgency among investors.

Practical Applications of Financial Chronobiology

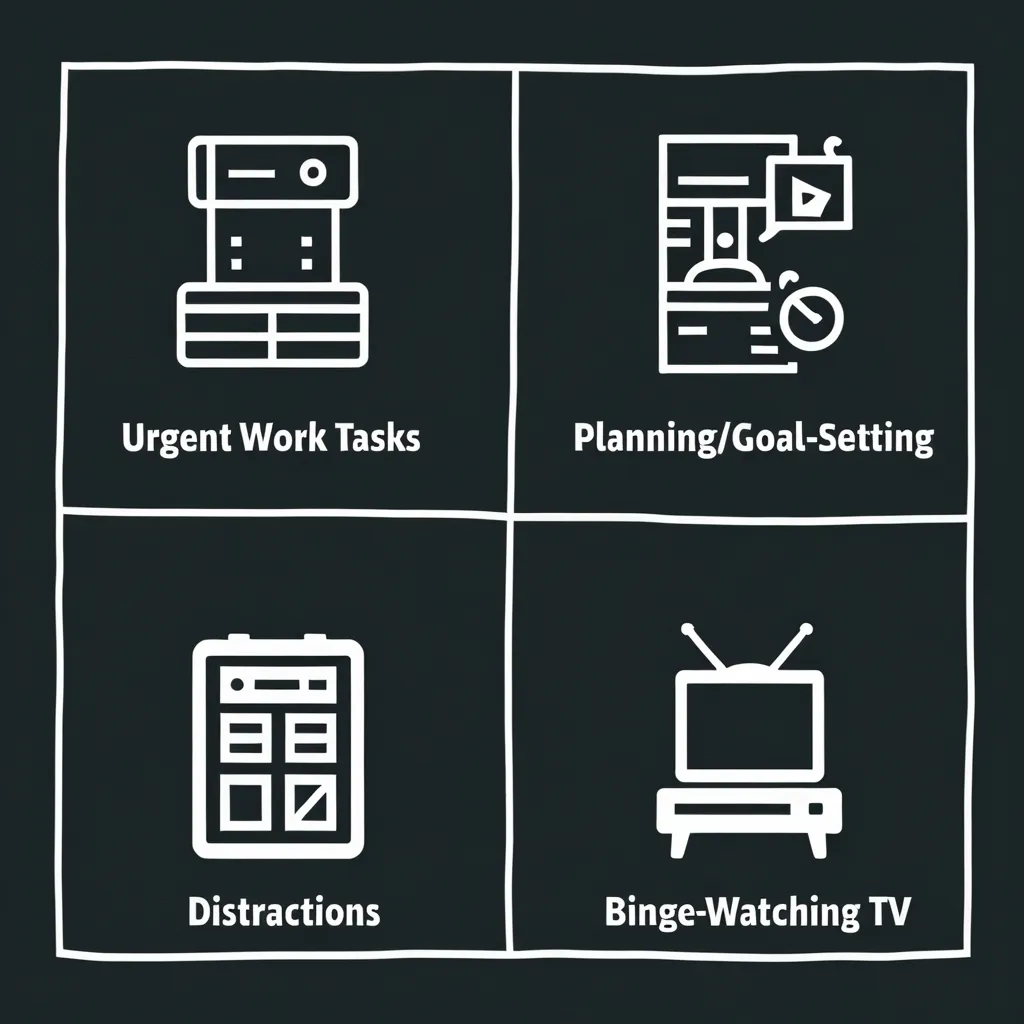

So, how can you apply these concepts in your everyday investing? Here are a few practical tips:

- Monitor Sector Cycles: Keep an eye on the cycles of different sectors. For example, if you notice that tech stocks tend to perform well in the first quarter of the year due to new product launches and earnings reports, you might want to allocate more of your portfolio to tech during this period.

- Time Your Trades: Understand the circadian rhythms of global exchanges. If you’re trading on the NYSE, be prepared for higher activity during the morning hours. If you’re trading on the Tokyo Stock Exchange, be ready for late evening and early morning activity.

- Watch for Psychological Patterns: Pay attention to the collective psychology of investors. During times of fear, the market might be more dormant, while during times of greed, it might be highly active. Adjust your investment strategy accordingly.

- Diversify Based on Metabolic Rates: Diversify your portfolio by investing in sectors with different “metabolic rates.” For example, balance high-growth emerging markets with more stable developed markets to manage risk and maximize returns.

The Edge of Feeling the Market’s Pulse

The ability to feel the pulse of the market, to understand its inherent biological-like cycles, is what sets successful investors apart. It’s not just about being early or patient; it’s about being in sync with the market’s natural rhythms.

In this world of financial chronobiology, your edge comes from your ability to anticipate and adapt to these rhythms. By doing so, you can extract value from the market in a way that feels almost intuitive, as if you’re moving in harmony with the market itself.

This approach to investing is not about predicting the future or following traditional economic calendars; it’s about understanding the underlying biological-like patterns that drive market behavior. And once you grasp these patterns, you’ll find that your investment decisions become more informed, more intuitive, and ultimately, more successful.