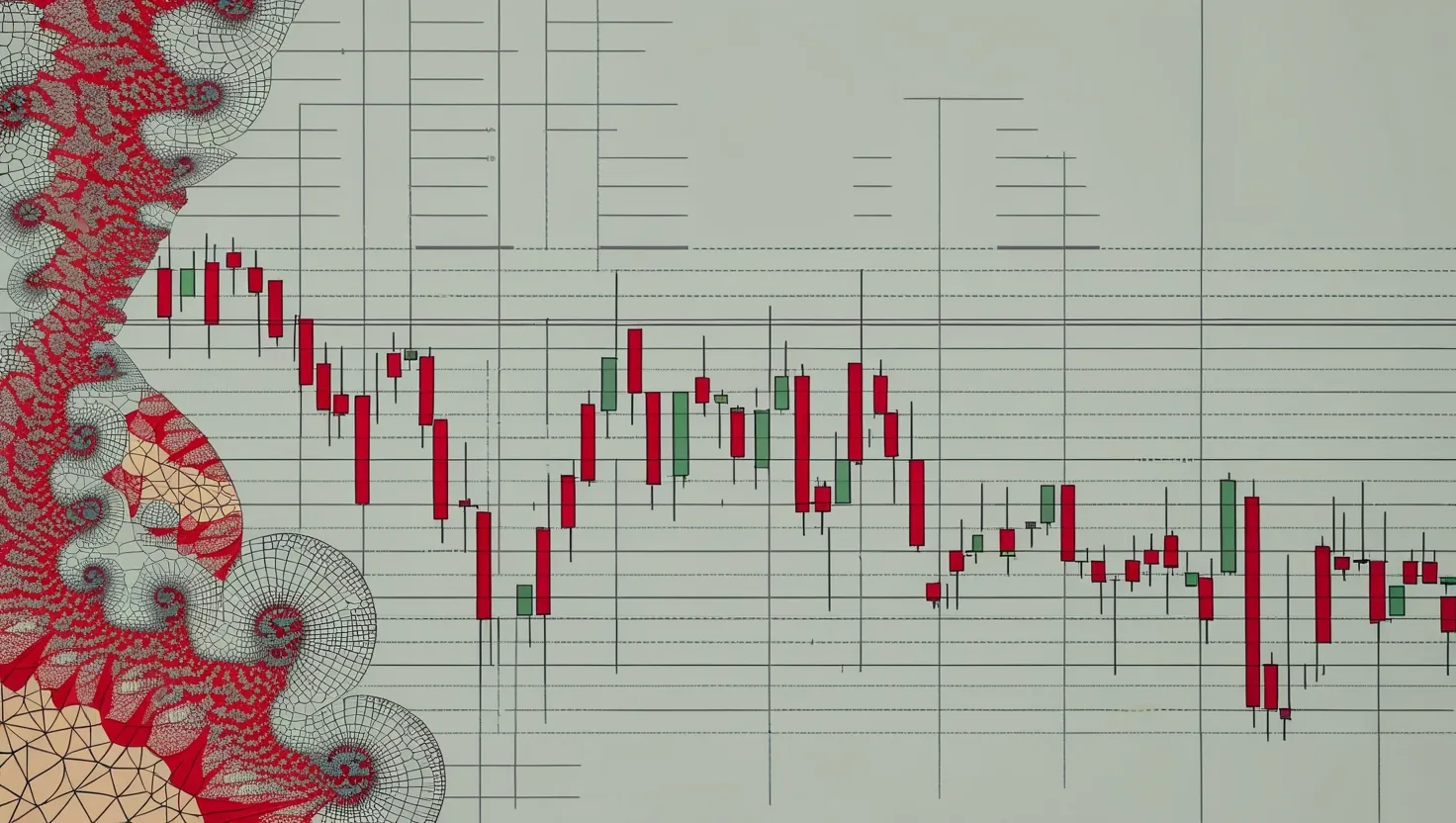

When we think about the stock market, we often imagine a chaotic, unpredictable entity that defies easy understanding. However, what if we told you that there are hidden patterns within this chaos, patterns that repeat at different scales, much like the intricate designs of a fractal? This concept, known as fractal valuation, offers a unique lens through which to view market microstructures, and it can be a powerful tool for investors looking to uncover trends before they become apparent to the masses.

The Fractal Nature of Markets

Fractals are geometric shapes that display self-similarity at different scales. In nature, you can see fractals in the branching of trees, the flow of rivers, and even the structure of snowflakes. Similarly, in financial markets, fractals can help explain the complex and often seemingly random movements of stock prices and trading volumes.

Imagine zooming in on a stock chart, seeing the minute-by-minute fluctuations, and then zooming out to observe the same patterns repeating over days, weeks, and even years. This self-similarity is at the heart of fractal valuation. By recognizing these patterns, you can gain insights into market behavior that traditional analysis might miss.

Beyond Traditional Analysis

Traditional stock analysis often focuses on fundamentals like earnings reports, economic indicators, and technical indicators such as moving averages and support levels. While these tools are valuable, they don’t capture the full complexity of market dynamics. Fractal valuation, on the other hand, delves into the micro-patterns that underlie these larger trends.

For instance, consider the concept of “memory” in financial markets. Unlike the Efficient Market Hypothesis (EMH) which suggests that markets are perfectly efficient and all information is immediately reflected in prices, fractal valuation acknowledges that markets have a memory. This means that past events can influence current and future price movements in ways that are not immediately obvious.

The Role of Non-Gaussian Distributions

One of the key differences between fractal valuation and traditional market analysis is the use of non-Gaussian distributions. In traditional finance, price movements are often assumed to follow a Gaussian distribution, which is characterized by a bell-shaped curve with thin tails. However, real-world market data often exhibits fat tails and skewness, which are better described by non-Gaussian distributions like the Lévy distribution.

These distributions reflect the reality that market movements are not always smooth and continuous but can be marked by sudden, extreme events – what Nassim Taleb famously calls “Black Swans.” By using these distributions, fractal valuation can better capture the true nature of market volatility and predictability.

Practical Applications

So, how can you apply fractal valuation in your investment strategy? Here are a few practical steps:

Identify Self-Similar Patterns

Start by examining stock charts at different time scales. Look for patterns that repeat, such as specific shapes in price movements or trading volumes. These patterns can indicate underlying trends that are not visible through traditional analysis.

Use Advanced Mathematical Tools

Fractal valuation often involves advanced mathematical tools like fractional Brownian motion and multifractal analysis. These tools can help you quantify the self-similarity in market data and predict future movements more accurately.

Combine with Other Strategies

Fractal valuation is not a replacement for other investment strategies but rather a complement. You can use it in conjunction with fundamental analysis, technical analysis, and even sentiment analysis to get a more complete picture of the market.

Real-World Examples

To illustrate the power of fractal valuation, consider the example of cryptocurrency markets. These markets are known for their volatility and unpredictability, making them a perfect candidate for fractal analysis.

By applying fractal valuation techniques, you might identify patterns in the price movements of a particular cryptocurrency that repeat at different scales. For instance, you might notice that every time the price hits a certain level, it tends to bounce back in a specific way. This pattern could be a fractal that repeats over shorter and longer time frames, giving you a predictive edge in your investment decisions.

The Artistry of Fractal Valuation

Fractal valuation is not just about numbers and charts; it also involves a touch of artistry. Recognizing fractal patterns requires a keen eye and a deep understanding of market dynamics. It’s about seeing the hidden geometry of the market, the underlying rhythms that drive price movements and trading volumes.

This approach makes investing more than just a dry, analytical exercise; it turns it into a fascinating exploration of financial fractals. Each time you identify a new pattern or predict a trend correctly, you feel a sense of accomplishment and a deeper connection to the intricate web of market forces.

Personal Touches and Lessons Learned

From my own experience, fractal valuation has been a game-changer. It’s helped me spot trends that others missed and avoid pitfalls that traditional analysis might not have predicted. Here’s a personal anecdote: during a particularly volatile period in the stock market, I noticed a fractal pattern in the price movements of a tech stock. The pattern suggested that the stock was due for a significant correction, despite the overall bullish sentiment at the time.

Acting on this insight, I adjusted my portfolio accordingly and avoided a substantial loss. This experience taught me the value of looking beyond the surface level of market data and into the deeper, fractal patterns that underlie it.

Conclusion

Fractal valuation is a powerful tool for investors who want to uncover hidden patterns in market microstructures. By recognizing the self-similar patterns that repeat at different scales, you can gain a deeper understanding of market dynamics and make more informed investment decisions.

This approach is not a replacement for traditional analysis but a complementary tool that can enhance your investment strategy. It combines mathematical precision with a touch of artistry, making investing a more engaging and rewarding experience.

As you delve into the world of fractal valuation, remember that it’s a journey of discovery, one that requires patience, persistence, and a keen eye for detail. But the rewards are well worth the effort – you might just find the DNA of market behavior, and with it, a new way to navigate the complex and fascinating world of finance.