As an investor, venturing into international markets can be both exhilarating and daunting. The landscape is vast, with a myriad of cultural, economic, and regulatory differences that can either hinder or enhance your investment journey. Here, we delve into five critical value investing lessons gleaned from international markets, offering a fresh perspective on how to navigate and capitalize on the unique opportunities these markets present.

The Power of Cultural and Economic Divergence

When investing globally, it’s essential to recognize that cultural and economic nuances can significantly impact the valuation and performance of companies. For instance, in some Asian markets, family-owned businesses are prevalent, and their governance structures can be quite different from those in Western countries. Understanding these dynamics is crucial because they can influence everything from corporate decision-making to investor relations.

In Japan, for example, the concept of “keiretsu” – a network of companies with interlocking business relationships and shareholdings – can create complex webs of influence that affect a company’s financial health and growth prospects. Recognizing these cultural peculiarities can help you identify undervalued gems that might be overlooked by investors who are less familiar with local customs.

The Importance of Local Accounting Standards

Local accounting standards and corporate governance practices are another critical aspect to consider when evaluating foreign companies. What might seem like a straightforward financial statement in one country could hide significant discrepancies in another. For instance, the use of different accounting standards, such as IFRS versus GAAP, can lead to varying interpretations of a company’s financial health.

In some emerging markets, the lack of stringent regulatory oversight can make financial reporting less transparent. Here, a keen eye for detail and a thorough understanding of local accounting practices are indispensable. It’s not just about numbers; it’s about understanding the context in which those numbers are presented.

Adapting to Emerging Markets

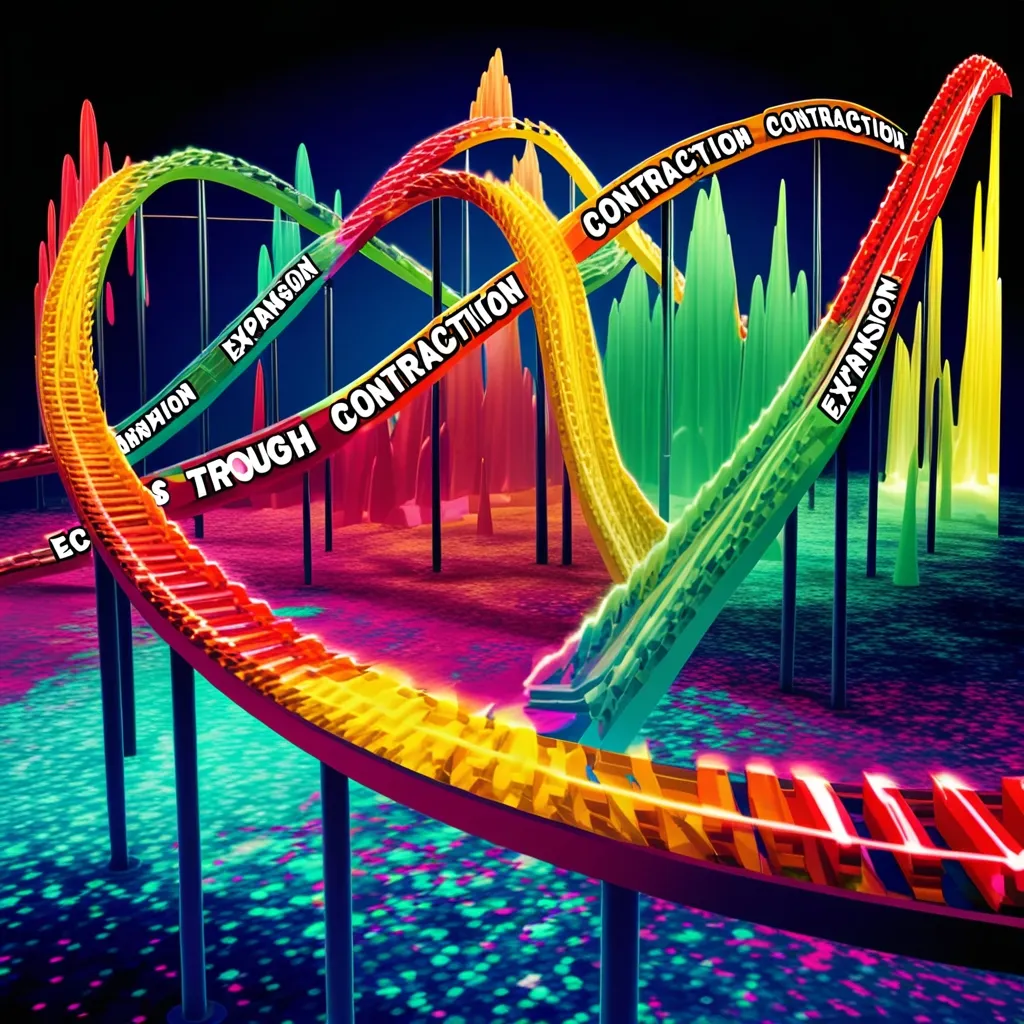

Emerging markets present a unique set of challenges and opportunities. Political instability, currency fluctuations, and limited analyst coverage can make these markets more volatile. However, these same factors can also create significant value opportunities for the astute investor.

When assessing companies in emerging markets, it’s vital to consider the broader macroeconomic environment. For example, a company in Brazil might be undervalued due to the country’s economic instability, but if you believe in the company’s intrinsic value and its ability to weather the storm, it could be a lucrative investment.

Moreover, the lack of institutional investment in these markets means there is often less analyst coverage, which can result in mispricing. This is where thorough research and a contrarian approach can pay off. By focusing on companies with strong fundamentals that are trading at a discount due to market inefficiencies, you can capitalize on the potential for significant returns.

Identifying Global Industry Leaders

Identifying global industry leaders trading at a discount to their intrinsic value is a cornerstone of successful value investing. This involves looking beyond the borders of your home market to find companies that are leaders in their respective industries but may be undervalued due to various market inefficiencies.

Consider companies like Nestle or Unilever, which are global giants but may be trading at lower multiples in certain markets. These companies have robust business models, strong brand recognition, and a proven track record of generating consistent earnings. By investing in these companies at the right price, you can benefit from their global reach and stability.

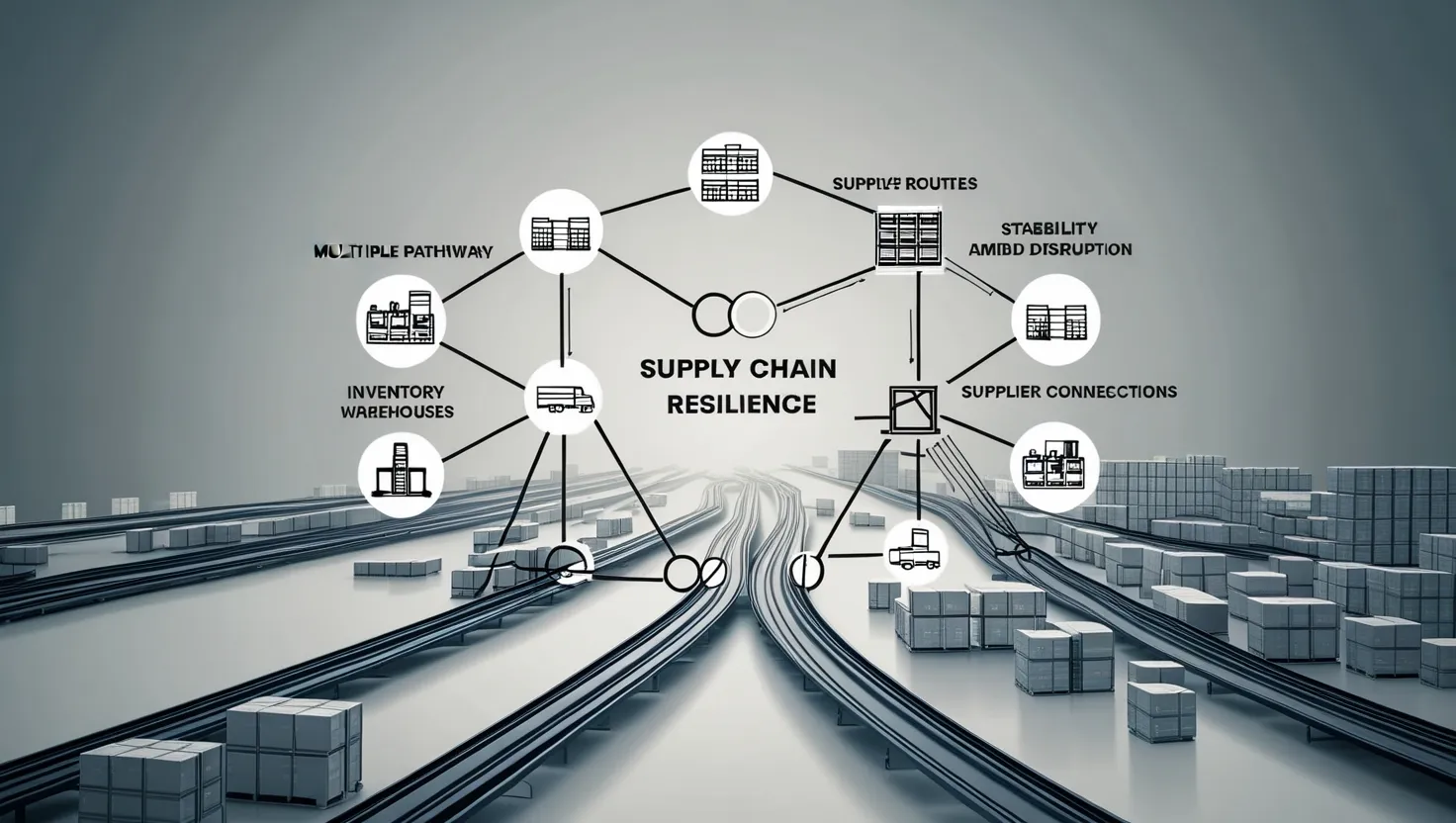

Hedging Against Domestic Market Risks

One of the most compelling reasons to invest in international value stocks is to hedge against domestic market risks. Markets are inherently cyclical, and what works well in one market may not work in another. By diversifying your portfolio across different geographies, you can mitigate risks associated with any single market.

For instance, if the US market is experiencing a downturn, your investments in European or Asian markets might continue to perform well, providing a buffer against losses. This diversification is particularly important in today’s interconnected world, where economic shocks can quickly spread across borders.

Case Studies of Successful Investments

There are numerous case studies of successful international value investments that highlight both the potential rewards and the challenges of this approach. One notable example is the investment in Japanese automaker Toyota during the early 2000s. Despite being a global leader, Toyota’s stock was undervalued due to Japan’s economic stagnation and the yen’s weakness.

Investors who recognized Toyota’s intrinsic value and its potential for long-term growth were rewarded handsomely as the company continued to expand its global footprint and improve its financial performance. This example underscores the importance of looking beyond short-term market fluctuations and focusing on a company’s fundamental strengths.

Practical Tips for Incorporating Global Value Stocks

Incorporating global value stocks into your portfolio requires a disciplined and informed approach. Here are a few practical tips to keep in mind:

First, conduct thorough research on the companies you are considering. This involves not just analyzing financial statements but also understanding the local market dynamics, regulatory environment, and cultural nuances.

Second, be patient. Value investing is a long-term game, and it often takes time for the market to recognize the intrinsic value of a company. Avoid the temptation to make quick profits and instead focus on the long-term potential of your investments.

Third, diversify your portfolio. Spread your investments across different geographies and sectors to mitigate risks. This will help you ride out market volatility and ensure more consistent returns over the long term.

Finally, stay informed but avoid being swayed by short-term market sentiment. Keep a keen eye on global economic trends, political developments, and regulatory changes that could impact your investments.

In conclusion, investing in global value equities is a complex yet rewarding endeavor. By understanding the unique cultural and economic differences of international markets, adapting your strategies to emerging markets, identifying global industry leaders, and hedging against domestic market risks, you can create a diversified and resilient investment portfolio.

The journey into international value investing is not without its challenges, but for those willing to delve deeper and think differently, the rewards can be substantial. As you navigate this intricate landscape, remember that it’s not just about the numbers; it’s about understanding the context, the culture, and the potential for long-term growth. With the right approach and a keen eye for value, you can unlock a world of investment opportunities that lie beyond your domestic market.