When it comes to value investing, one of the most compelling strategies is to identify and leverage companies with strong economic moats, particularly those operating in niche markets. An economic moat, as the legendary investor Warren Buffett often describes, is a company’s ability to maintain its competitive advantages over time, protecting its market share and profits from encroaching competitors.

The Power of Dominant Market Share

Imagine a company that has carved out a unique position in a specialized market, where it is the undisputed leader. This dominance is not just about market share; it’s about the ability to set the rules of the game. For instance, consider a company like Costco, which has built an immense member base that allows it to negotiate prices with suppliers that are virtually unbeatable. This cost advantage is a moat that makes it extremely difficult for competitors to enter the market and survive.

“As price is set by the marginal producer, the efficient producer will capture the entire market,” Buffett once said. This principle is particularly true in niche markets where the leader can dictate terms.

Evaluating Specialized Expertise and Proprietary Technology

In niche markets, specialized expertise and proprietary technology can be formidable moats. Companies like Nvidia, which dominates the graphics processing unit (GPU) market, have built their moats through continuous innovation and technological leadership. Nvidia’s GPUs, especially in the AI and machine learning space, are industry leaders, and its proprietary technologies like the CUDA platform create a significant barrier for competitors.

How do you identify such companies? Look for those that have a history of innovation and a strong track record of staying ahead of the curve. Ask yourself: What makes this company’s technology or expertise unique? Is it something that can be easily replicated?

Assessing Market Expansion and Evolution

Niche markets are often misunderstood as being static or limited in growth potential. However, many niche markets have the potential to expand or evolve, providing a growth trajectory for the dominant company. For example, the market for electric vehicles was once a niche but has now become a significant segment of the automotive industry. Companies like Tesla, which had a strong moat in this niche, have benefited immensely from this expansion.

Consider the following: What are the trends in this niche market? Is there potential for growth or expansion into adjacent markets? How well-positioned is the company to capitalize on these opportunities?

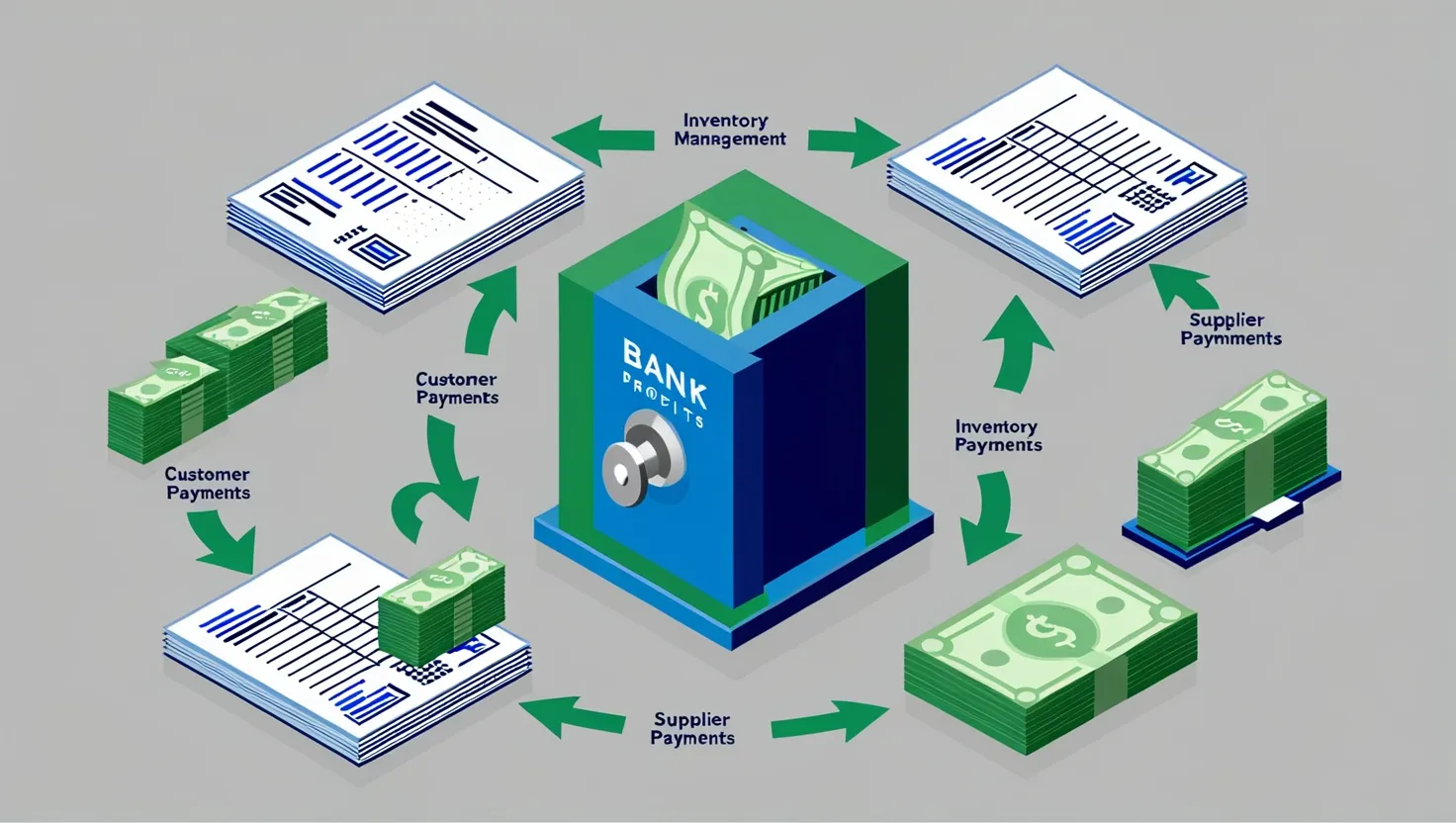

Financial Impact of Strong Competitive Positioning

A strong competitive position in a niche market can have a profound financial impact. Companies with wide moats often enjoy higher profit margins and greater pricing power. This is because they can either undercut competitors on price or maintain higher prices due to their unique advantages.

“Price is what you pay. Value is what you get,” Buffett has said. In niche markets, the value that a company with a strong moat provides is often reflected in its financial performance.

Applying Traditional Value Metrics

When evaluating companies in niche markets, traditional value metrics such as the price-to-earnings ratio (P/E ratio) and return on equity (ROE) are still relevant but need to be applied with a nuanced understanding of the company’s moat. For instance, a company with a strong moat may justify a higher P/E ratio due to its sustainable competitive advantages.

How do you apply these metrics in a niche market? Look for companies that consistently outperform their peers in terms of profitability and growth. Ask yourself: Does the company’s valuation reflect its long-term competitive advantages?

Managing Risk in Specialized Industries

Investing in niche markets comes with its own set of risks. These markets can be volatile, and changes in technology or consumer preferences can quickly erode a company’s moat. Therefore, it’s crucial to assess the durability of the moat and the company’s ability to adapt to changes.

“Risk comes from not knowing what you’re doing,” Buffett has warned. In niche markets, this risk can be mitigated by thorough research and a deep understanding of the company’s competitive advantages.

Case Studies of Successful Value Investments

One of the most compelling case studies is that of Nvidia. By leveraging its technological leadership and strong network effects, Nvidia has built a formidable moat in the GPU market. This moat has allowed Nvidia to expand into new areas such as AI and data centers, providing significant growth opportunities.

Another example is Costco, which has used its cost advantage to dominate the warehouse club market. Costco’s ability to offer low prices while maintaining high margins has made it nearly impossible for competitors to challenge its position.

The Potential for Outsized Returns

When economic moats align with undervalued opportunities, the potential for outsized returns is significant. Value investors who can identify these opportunities early can reap substantial rewards.

“Be fearful when others are greedy and be greedy when others are fearful,” Buffett advises. In niche markets, this principle can be particularly powerful as investors often overlook these hidden gems.

In conclusion, leveraging economic moats in niche markets is a powerful strategy for value investors. By identifying companies with dominant market share, evaluating the durability of their specialized expertise or proprietary technology, assessing the potential for market expansion, and applying traditional value metrics with a nuanced understanding, investors can uncover opportunities for significant returns.

As you embark on this journey, remember that the key to success lies in thorough research and a deep understanding of the company’s competitive advantages. Ask yourself the right questions, and you might just uncover the next hidden gem in a niche market.