Ah, value investing and the magical art of patience—they go together like coffee and a rainy Sunday morning. Value investing, the legendary strategy championed by geniuses like Warren Buffett, is all about picking stocks that seem undervalued by the market and waiting patiently for their true worth to shine through like finding a hidden gem. It’s a long haul, folks, not a jump-and-run kind of deal. But trust me, when the rewards roll in, they’re usually pretty satisfying.

Picture this. You’ve got your eye on a stock that everyone’s ignoring or even scoffing at, but your gut tells you it’s got real potential. Maybe it’s an underrated tech company or a traditional manufacturer that’s yet to be noticed. The market is lukewarm, but you see it—this diamond in the rough patiently waiting. The challenge is holding onto this conviction without making rash decisions just because the market’s doing the jitterbug around you.

Looking back, the ones who held their nerve are the real champs. Value stocks have historically outpaced their growth counterparts by an impressive margin. Since 1928, value stocks have actually bettered growth stocks by around a 4.54% annual average. Imagine holding on tight through all the ups and downs, knowing history’s got your back.

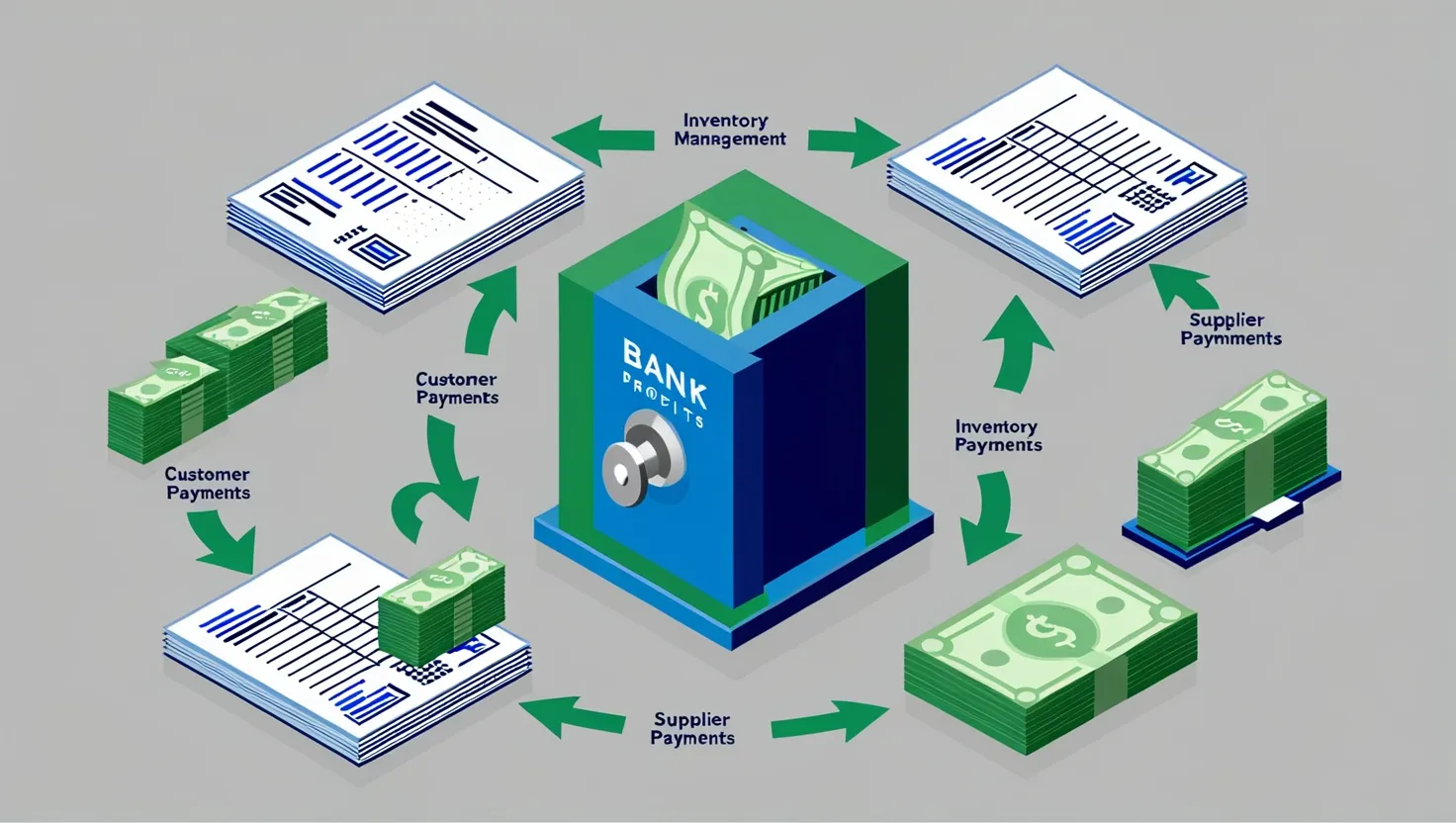

Research is everything here, like being a detective hot on the trail of a big story. Dive deep into the company’s numbers, understand what makes it tick and figure out why it’s undervalued. Once that puzzle is solved, the next step is to stay cool, composed, and patient until the market catches up to your foresight. It’s like planting a seed and waiting patiently for it to bloom into a grand oak tree—it doesn’t happen overnight, more like over several years.

A common trapdoor investors fall through is short-term thinking. The market’s heartbeat is beyond rapid; it’s more like the frantic tapping of a computer keyboard during finals week. Watching daily market fluctuations can be a nasty habit, one that leads to impulsive, regrettable moves. The trick is to zoom out and focus on the long game, seeing the whole picture rather than getting sidetracked by today’s noise.

Let’s peek into the wisdom of the greatest minds in investing. Warren Buffett, the man himself, swears by patience. His mantra reveals the truth: becoming wealthy slowly is more rewarding and sustainable than gambling away on quick gains. Howard Marks is another example—someone who preaches “patient opportunism.” He scans the horizon like a hawk, waiting for the right bargains to appear before he strikes. This waiting game is not for the faint-hearted, but it’s a reliable key to long-term success.

So, how does one cultivate patience amid a sea of fast-paced markets and lightning-speed news? Start by sticking to your goals like glue. Remember why you embarked on this investing journey in the first place and let that be your North Star. Avoid the itch to constantly check your portfolio; consider setting specific times each month or quarter for a comprehensive review instead. Stock market volatility ain’t something scary once you embrace it as the norm. It’s like riding a roller coaster; expect it to twist and turn but rest assured it will eventually stop. And, importantly, don’t waste time trying to time the market—it’s like catching lightning in a bottle. Look for sturdy companies with their feet on solid ground, no matter the current storm.

Now, envision yourself sitting in your favorite chair, steaming cup of coffee in hand, after just investing in what you’re sure is a sleeping giant of a company. The market hiccups, and suddenly panic’s in the air, a symphony of people rushing to sell. But not you. Your research is solid, confidence like a warm blanket wrapped around you. By not giving in to the rush, that investment could flourish beautifully, like Coca-Cola’s story when market sentiments once dragged its stocks down. Those who kept their calm reaped remarkable rewards once it bounced back.

Here’s a profound truth: sometimes, the best move is to make no move at all. Investment master James Rogers famously said, “One of the best rules anybody can learn about investing is to do nothing, absolutely nothing, unless something needs to be done.” In this fast-paced world, doing nothing can actually be the most potent strategy. Patience, or better yet, well-time inaction, often emerges as a remarkable decision.

Patience also sets the stage for the magic of compounding. It’s where your investment’s returns start earning returns, snowballing into something substantial over time. The benefit of patience is that it allows compounding to do its job effectively, much like planting saplings and watching them transform into an ever-expanding forest.

In wrapping this up, think of patience not as a virtue but a necessity in value investing. It’s your faithful ally in reaching long-term objectives, steering clear of short-lived distractions and waiting for opportunities that are really worth your while. Being patient allows you to steer through the rocky waters of market volatility with confidence and serenity.

So, next time the market starts gyrating, and the urge to sell gets overwhelming, take a moment. Breathe. Remind yourself the value of patience and let it be your guide. As Warren Buffett so wisely put it, “The stock market is designed to transfer money from the ‘impatient’ to the ‘patient.’” If you embrace patience, you’re likely to find yourself standing on the rewarding side of this equation.