It’s no secret that supply chain disruptions have become a recurring headache for businesses and investors alike. From geopolitical tensions to natural disasters, the interruptions are as unpredictable as they are disruptive. But where some see chaos, value investors see opportunity. The key lies in identifying businesses that leverage supply chain resilience as a competitive advantage. Let me take you through three strategies I’ve seen work wonders, including some lesser-talked-about angles that often fly under the radar.

First, let’s talk about inventory management. At first glance, it may sound overly mechanical or even boring, but dig deeper, and you’ll see why it’s a goldmine for value investors. Companies with robust inventory management systems don’t just weather the storm; they capitalize on it. The idea isn’t simply about stocking up but maintaining a balance between agility and preparedness. For instance, firms that adopt hybrid inventory models—holding core components while employing just-in-time strategies for non-essential goods—are better equipped to respond to disruptions. Why? Because they can pivot when supply lines are strained without tying up unnecessary capital in unused stock. Have you ever wondered why some companies bounce back faster from crises than others? Chances are, their inventory systems are doing the heavy lifting.

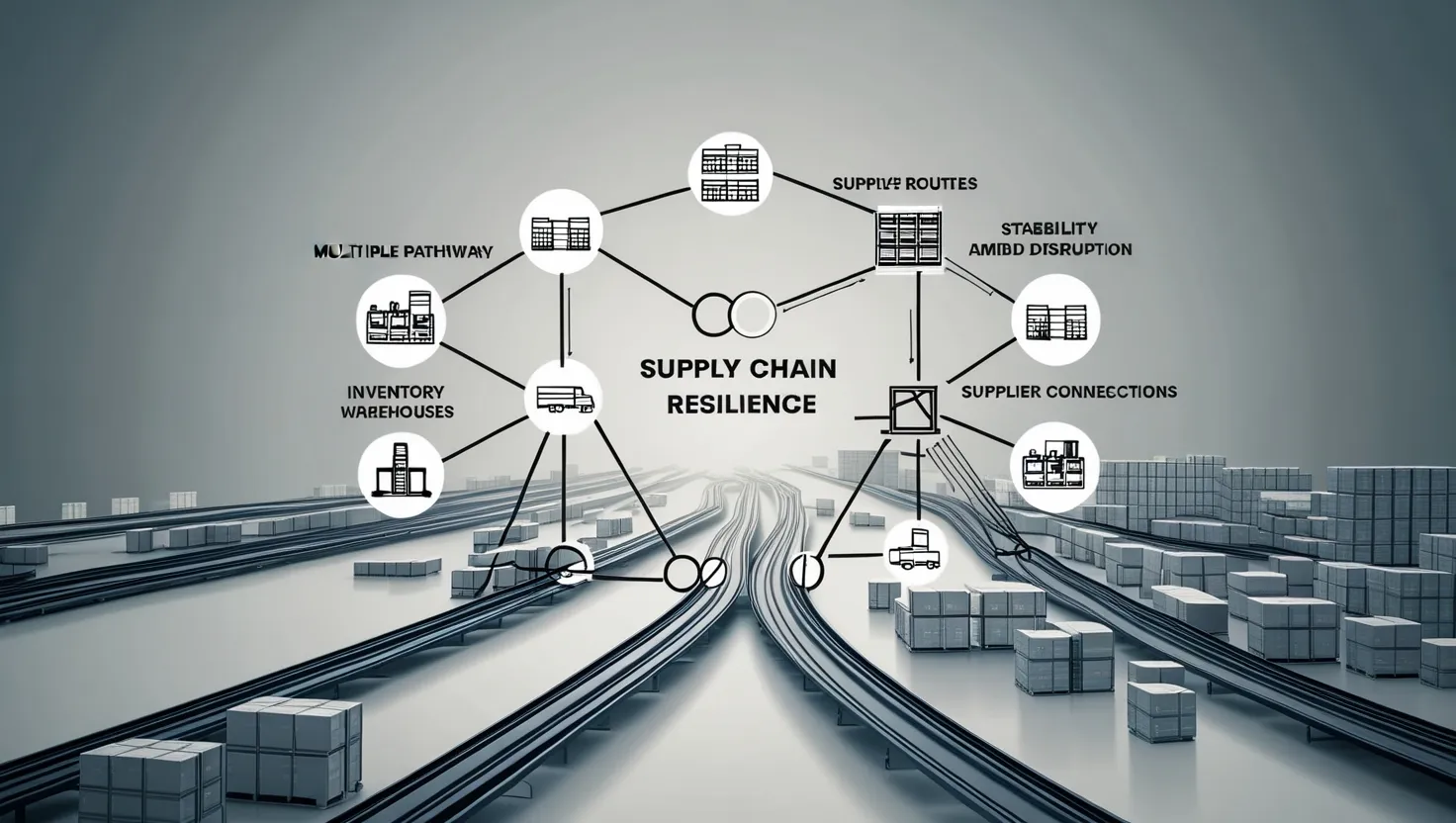

Take a moment to think about this: Do the companies you’re eyeing rely on a single-source supplier for critical inputs? If so, tread carefully. Diversification isn’t just a buzzword; it’s a lifeline. Companies that diversify their supplier base reduce dependency on any one region or vendor, insulating themselves from localized shocks. But let me add a layer here that often gets overlooked. Diversification isn’t just about having multiple suppliers—it’s about owning the relationships with those suppliers. Businesses that treat their suppliers as strategic partners, rather than commodities, often enjoy preferential treatment during shortages. It’s worth asking: How much effort does a company put into nurturing these partnerships? Analyzing this might reveal more about long-term resilience than surface diversity metrics ever could.

Now, let’s shift to vertical integration. Sure, it’s an age-old strategy, but it’s one that becomes especially relevant during times of supply chain turmoil. Companies that own key parts of their production chain have greater control over quality, costs, and timelines. But here’s an unconventional twist: rather than full vertical integration, some firms adopt a semi-integrated model. They invest in critical nodes within their supply chain—raw materials or logistics—while outsourcing less critical operations. The result? They maintain a strategic grip without the heavy capital burden of integrating everything. How often do we, as investors, consider partial integration as a sign of strategic foresight rather than seeing it as a halfway measure?

“Turn obstacles into opportunities, and problems into profits.” – Anonymous. This mindset perfectly encapsulates the genius of companies that use disruptions as a springboard for differentiation.

Another critical factor to evaluate is pricing power. This isn’t just about whether a company can raise prices—it’s about how seamlessly they can do so without losing market share. Businesses that deliver unique value or operate in essential sectors are often able to pass on cost increases to customers. The trick is to look beyond short-term margin fluctuations. If a company can maintain customer loyalty despite higher prices, it’s likely building long-term value. Ever wondered why some luxury brands thrive even when input costs soar? It’s because their customers value the product above the price tag. Can the same be said for the companies you’re considering?

But resilience isn’t just about the “what” and “how”—it’s about the “who.” The management team’s foresight and track record in navigating previous disruptions are invaluable indicators. Look for leadership that doesn’t just react but proactively builds redundancy into their systems. For example, during the semiconductor shortage, some technology companies were quick to explore alternative chip designs and secondary suppliers. Others sat on their hands, hoping the storm would pass. Guess which group emerged stronger?

Here’s a question to reflect on: When was the last time you reviewed a company’s crisis management history before investing? If it’s been a while, you might be undervaluing the human element within supply chain resilience.

Let’s not ignore the elephant in the room—short-term margin pressures. It’s tempting to steer clear of companies experiencing temporary setbacks during disruptions. But some of the best value plays emerge in these moments. What matters is why margins are under pressure and how the company is responding. Are they investing in long-term solutions like regional supply hubs or advanced analytics for demand forecasting? Or are they cutting corners to preserve quarterly earnings?

“Don’t find fault. Find a remedy.” – Henry Ford. I love this quote because it speaks to the essence of resilient businesses. They don’t dwell on the problem; they fix it—innovatively and decisively.

Let me share an example that should drive this point home. During a recent global logistics crunch, a mid-sized retail chain implemented predictive analytics to optimize transportation routes and inventory levels. While their profitability took an initial hit, they gained a competitive edge by keeping shelves stocked when competitors couldn’t. Today, they not only recovered their margins but expanded their market share. The question isn’t whether disruptions will occur but whether companies are positioning themselves to emerge stronger when they do.

Of course, not every company will handle disruption with grace. It’s on us, as investors, to separate the wheat from the chaff. Beyond financial ratios and short-term KPIs, look for intangible indicators: customer loyalty, supplier goodwill, and innovation in crisis. These are the factors that don’t immediately show up in earnings but often determine long-term success.

So, where does all of this leave us? Value investing in the context of supply chain disruptions requires a blend of traditional analysis and forward-thinking evaluation. It’s not just about finding undervalued stocks but about identifying companies building resilience as a lasting advantage. As disruptions continue to become the new normal, the ability to spot these gems will distinguish successful investors from the rest.

How do you plan to integrate these strategies into your investment framework? After all, it’s one thing to understand resilience on paper—it’s another to use it as a lens for uncovering opportunities.