When it comes to identifying potential acquisition targets, value investors often find themselves in a unique position, blending the art of financial analysis with the science of market trends. This blend is crucial because it allows investors to spot undervalued gems that larger companies or private equity firms might be eager to acquire.

The Art of Industry Consolidation

Industry consolidation is a powerful trend that can signal which companies might be on the radar of potential acquirers. As Warren Buffett once said, “Price is what you pay. Value is what you get.” In the context of acquisitions, understanding the value that a company brings to the table is paramount.

Consider the healthcare industry, for example. Here, consolidation is a recurring theme, driven by the need for efficiency and the pursuit of economies of scale. Companies with strong market positions, innovative products, or significant customer bases are often prime targets. By analyzing industry trends and identifying sectors that are ripe for consolidation, investors can pinpoint companies that are likely to attract acquirers.

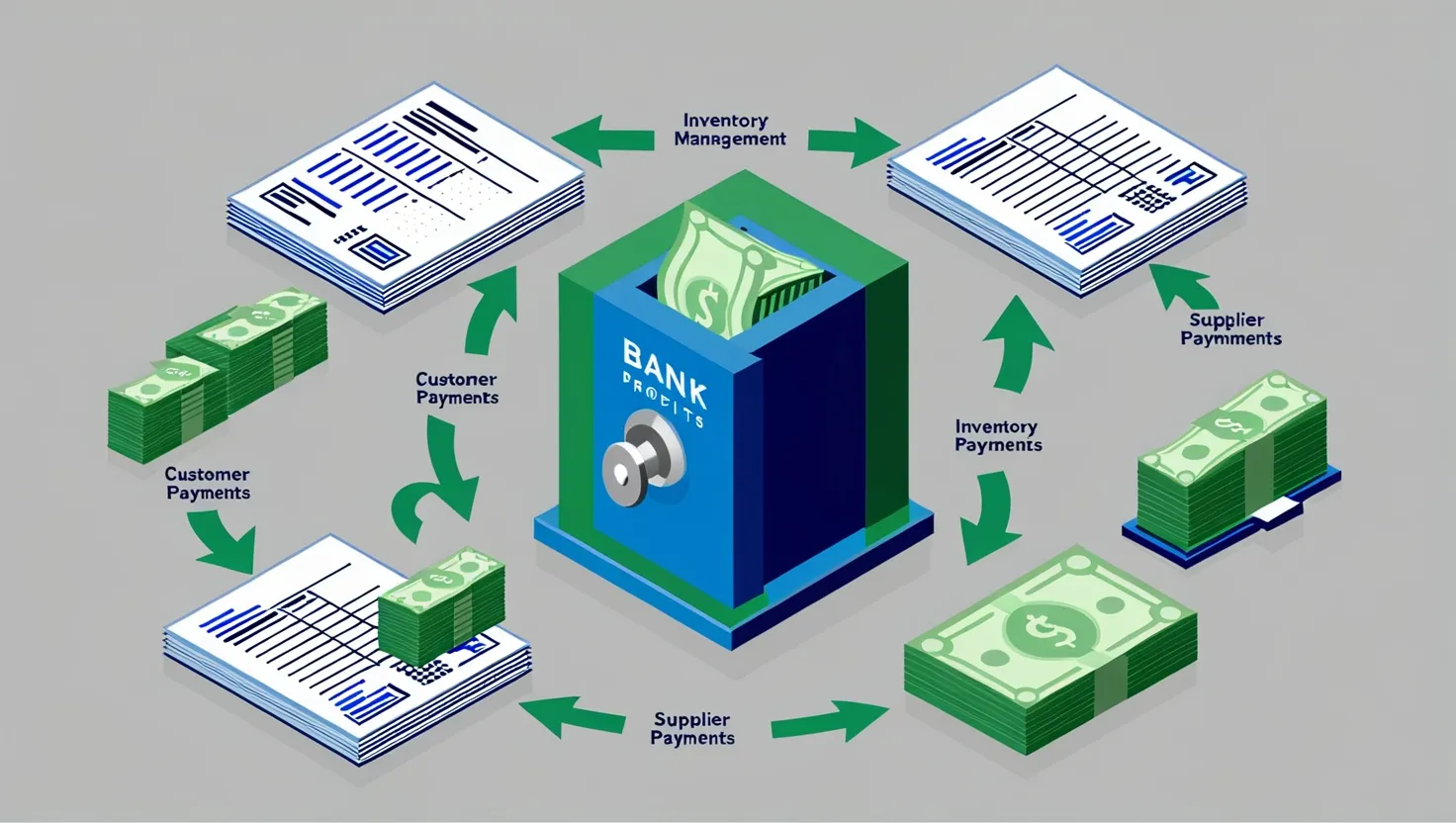

The Cash Flow Conundrum

Companies with strong cash flows and low debt levels are always attractive, but they become even more so when considered as potential acquisition targets. Cash flow is the lifeblood of any business, and companies that generate consistent, high-quality cash flows are inherently valuable. As Peter Lynch, the legendary investor, put it, “The real key to making money in stocks is not to get scared out of them.”

When evaluating a company’s financial health, look beyond the surface. A company with robust cash flows can weather economic storms and invest in growth initiatives, making it an appealing target for acquirers looking to bolster their own financial stability. Low debt levels further enhance this appeal, as they indicate a company’s ability to manage its finances prudently.

Synergy and Strategic Fit

Synergy is a buzzword in the M&A world, but it’s more than just a concept; it’s a tangible benefit that can significantly enhance the value of an acquisition. When a company has assets or capabilities that align perfectly with those of a potential acquirer, the stage is set for a mutually beneficial deal.

Think about it this way: if a company has a strong distribution network and a potential acquirer has a complementary product line, the combination can create a powerhouse. This strategic fit is what drives many acquisitions, as it allows the acquirer to leverage the target company’s strengths to enhance its own operations.

The Value of Patents and Technologies

In today’s technology-driven world, companies with valuable patents, technologies, or significant market share are highly sought after. These assets can provide a competitive edge that is hard to replicate, making them extremely valuable to acquirers.

Consider the tech industry, where companies like Google and Microsoft are constantly on the lookout for innovative technologies that can enhance their offerings. A small company with a groundbreaking patent or technology can suddenly find itself in the crosshairs of these giants.

Balancing Upside with Fundamentals

While the potential upside of an acquisition can be tantalizing, it’s crucial to remember the fundamentals of value investing. As Benjamin Graham, the father of value investing, advised, “Price is what you pay. Value is what you get.” This mantra holds true even when considering potential acquisition targets.

Investors should focus on the intrinsic value of the company rather than speculating on takeover premiums. This means evaluating the company’s financial health, market position, and growth potential independently of any potential acquisition. By doing so, investors ensure that they are making a sound investment decision, regardless of whether the company is acquired or not.

Case Studies in Success

There are numerous case studies of successful investments in companies that were later acquired, highlighting the importance of focusing on intrinsic value. Take the example of a company like Celgene, which was acquired by Bristol Myers Squibb in 2019. Investors who focused on Celgene’s strong cash flows, innovative pipeline, and market position were rewarded handsomely, whether through the acquisition or the company’s standalone performance.

Another example is the acquisition of LinkedIn by Microsoft. Here, LinkedIn’s strong user base, innovative products, and strategic fit with Microsoft’s offerings made it an attractive target. Investors who recognized these strengths were well-rewarded, both before and after the acquisition.

The Role of Market Research

Market research is a critical component of identifying potential acquisition targets. By studying industry trends, understanding market dynamics, and identifying sectors with high growth potential, investors can pinpoint companies that are likely to attract acquirers.

Technology has made this process easier, with tools like data analytics and AI-powered screening enabling investors to sift through vast amounts of data quickly. These tools can identify companies with solid financial health, competitive strengths, and growth potential, making the search for acquisition targets more efficient.

Questions to Ask

As you embark on this journey of identifying potential acquisition targets, here are some questions to keep in mind:

- What are the industry trends that could drive consolidation in this sector?

- Does the company have strong cash flows and a manageable debt level?

- How does the company’s strategic position align with that of potential acquirers?

- Are there valuable patents, technologies, or market share that make this company attractive?

By asking these questions and focusing on the intrinsic value of the company, you can make more informed investment decisions and potentially capitalize on the upside of an acquisition.

Conclusion

Identifying potential acquisition targets is a nuanced process that requires a blend of financial acumen, market insight, and strategic thinking. By analyzing industry consolidation trends, evaluating companies with strong cash flows and low debt levels, assessing synergy potential, and identifying valuable assets, investors can spot undervalued businesses that may appeal to larger companies or private equity firms.

Remember, as Charlie Munger, Warren Buffett’s partner, once said, “All I want to do is get richer by owning good companies.” By focusing on the intrinsic value of these companies and understanding the trends that drive acquisitions, you can make smarter investment decisions and potentially reap significant rewards.