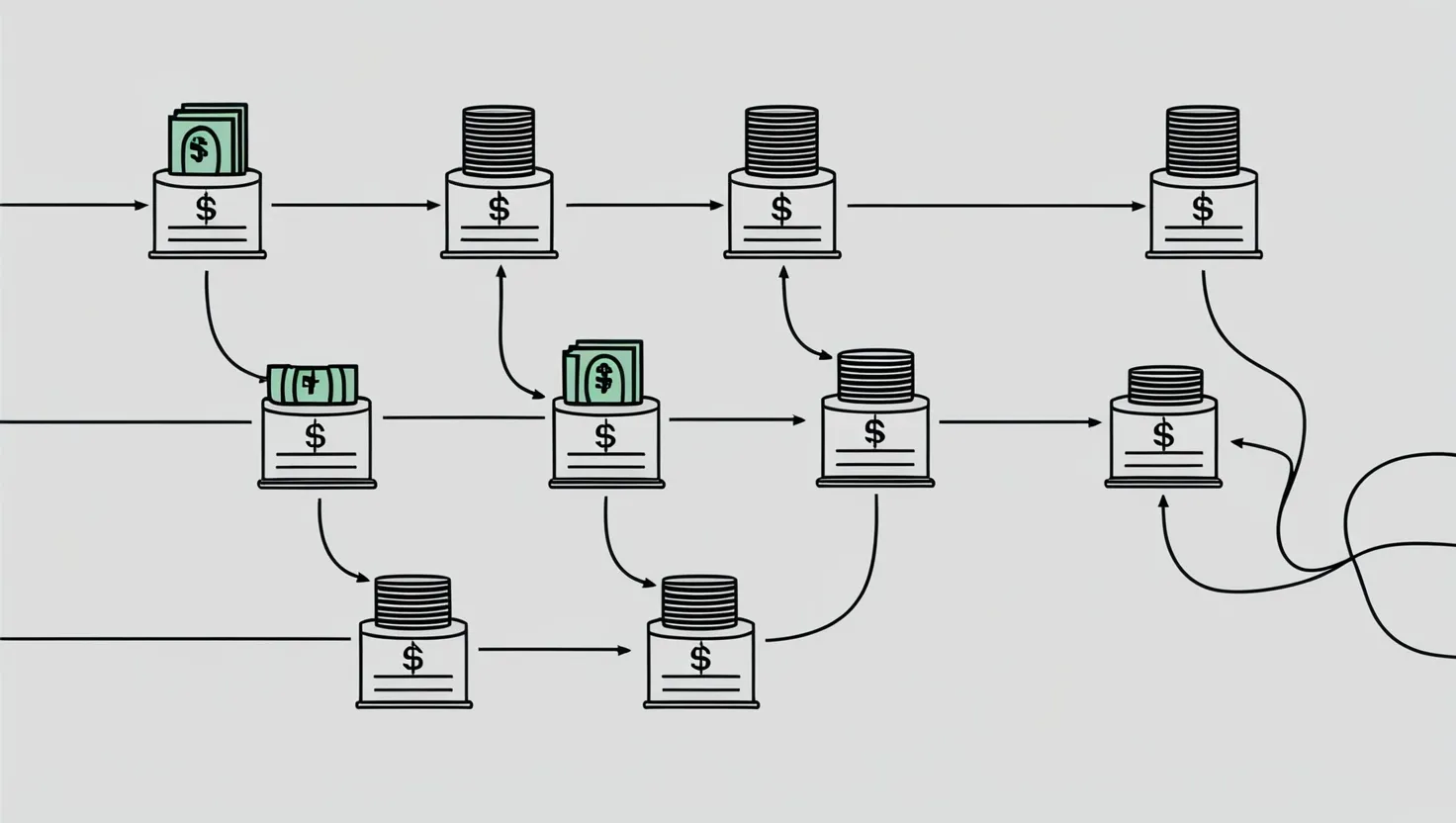

When it comes to debt repayment, the traditional advice often revolves around two popular methods: the debt snowball and the debt avalanche. However, for those looking to accelerate their debt payoff journey, there are several unconventional strategies that can make a significant difference.

The Power of Frugality: The “Debt Dash”

Imagine living extremely frugally for short, intense periods. This approach, which we can call the “debt dash,” involves cutting back on almost all discretionary spending for a few months at a time. It’s not about adopting a permanent austerity lifestyle but rather about periodic bursts of extreme frugality to turbocharge your debt repayment.

For instance, you might decide to cook all your meals at home, cancel subscription services, and avoid any non-essential purchases for three months. The money saved during these periods can then be channeled directly into your debt. This method requires discipline but can yield impressive results.

As the famous financial advisor, Dave Ramsey, once said, “Winning at money is 80 percent behavior and 20 percent knowledge.” The debt dash is all about behavior – it’s a temporary adjustment that can have a lasting impact on your financial health.

Harnessing Cash Windfalls

We’ve all experienced those unexpected windfalls – a tax refund, an inheritance, or a surprise bonus at work. Instead of treating these as opportunities to splurge, consider allocating them strategically towards your debt.

Using cash windfalls to pay down debt can be incredibly effective. For example, if you receive a $5,000 tax refund, putting it towards your highest-interest debt could save you hundreds of dollars in interest over the life of the loan. It’s a one-time boost that can significantly accelerate your debt repayment.

The Art of Balance Transfers

Balance transfer credit cards can be a powerful tool in your debt repayment arsenal, but they require careful management. These cards offer a 0% interest rate for a promotional period, usually ranging from 6 to 18 months. By transferring your high-interest debt to one of these cards, you can save a substantial amount on interest charges.

However, it’s crucial to understand the terms and conditions. Make sure you know the balance transfer fee, the length of the promotional period, and the interest rate that will apply after the promotion ends. Used wisely, balance transfer cards can be a game-changer.

The Snowflake Method: Small Savings Add Up

The snowflake method is a lesser-known but highly effective strategy for debt repayment. It involves applying small, seemingly insignificant savings to your debt payments. For example, if you save $5 by skipping a coffee or $10 by canceling a subscription, these amounts might not seem like much on their own, but they can add up over time.

Imagine saving just $10 a week – that’s $520 a year. Applied to your debt, this can make a significant difference, especially when combined with other repayment strategies. The snowflake method is about recognizing that every little bit counts and leveraging those small savings to accelerate your debt payoff.

Selling Unused Items and Skills

Many of us have unused items lying around the house or skills that we don’t utilize. Selling these items or offering your skills as services can generate extra funds that can be directed towards your debt.

For instance, if you have a talent for writing or graphic design, consider freelancing on the side. If you have unused electronics or furniture, sell them online. These extra funds can provide a much-needed boost to your debt repayment efforts.

As Robert Kiyosaki, author of “Rich Dad Poor Dad,” once said, “The rich do not work for money. The money works for them.” By leveraging your unused items and skills, you’re making your money work harder for you.

The Psychological Aspect

Debt repayment is as much a psychological battle as it is a financial one. The strategies mentioned above not only help you pay off your debt faster but also provide a sense of accomplishment and motivation.

For example, the debt dash and snowflake method can give you quick wins and a feeling of progress, which is crucial for staying motivated. The balance transfer and cash windfall strategies can offer a sense of relief and a significant reduction in interest payments, making the journey less daunting.

Interactive Reflection

- How would you feel about living extremely frugally for a few months to accelerate your debt repayment?

- Have you ever received an unexpected windfall? How did you use it?

- What are some small savings you could make each week to apply to your debt?

Conclusion

Accelerating debt repayment is not just about following traditional advice; it’s about finding innovative and practical strategies that work for you. By implementing a debt dash, using cash windfalls strategically, exploring balance transfer opportunities, leveraging the snowflake method, and selling unused items or skills, you can significantly speed up your journey to financial freedom.

As Suze Orman once said, “You must tell your money what to do or it will tell you.” By taking control of your finances and using these unconventional strategies, you’re telling your money exactly what to do – work towards your financial freedom.