7 Practical Ways to Build Wealth Through Strategic Cash Management

Cash management is often overlooked in wealth-building discussions, yet it’s critical for financial success. When I work with clients on their financial plans, I notice that while many focus on investments and retirement planning, they often neglect how their everyday cash can work harder for them.

In my experience, proper cash management sits at the foundation of financial success. It’s not just about having money available—it’s about making sure every dollar serves a purpose in your financial ecosystem.

“Too many people spend money they haven’t earned, to buy things they don’t want, to impress people they don’t like.” - Will Rogers

Let me share seven practical strategies that can transform how you handle cash and build wealth over time.

First, I recommend implementing a two-tier savings approach. This means separating your emergency fund into two parts: immediate-need cash (about 30% of your total emergency savings) kept in easily accessible accounts, and the remaining 70% placed in higher-yield options like money market accounts or short-term Treasury bills. This approach ensures you have immediate access to funds when needed while allowing most of your safety net to generate better returns.

Have you considered how much cash you’re keeping in low-interest accounts right now? Most people have more than they need for immediate expenses.

The two-tier approach works because it balances protection and growth. Your immediate cash portion covers unexpected short-term needs, while the larger portion fights against inflation by earning higher yields. US Treasuries are popular among wealthy individuals for this purpose because they offer security with better returns than typical savings accounts.

Next, create a personalized cash allocation formula based on your actual spending patterns. This involves tracking your cash flow systematically over time. I suggest using a simple spreadsheet that records:

Monthly Cash Management:

Income: $5,000

Fixed Expenses: $3,000

Discretionary: $800

Short-Term Savings: $700

Long-Term Investments: $500

This clarity helps you identify how much cash you actually need to keep liquid versus how much can be deployed more productively. By analyzing your spending cycles, you’ll likely find opportunities to reduce idle cash.

“The art is not in making money, but in keeping it.” - Proverb

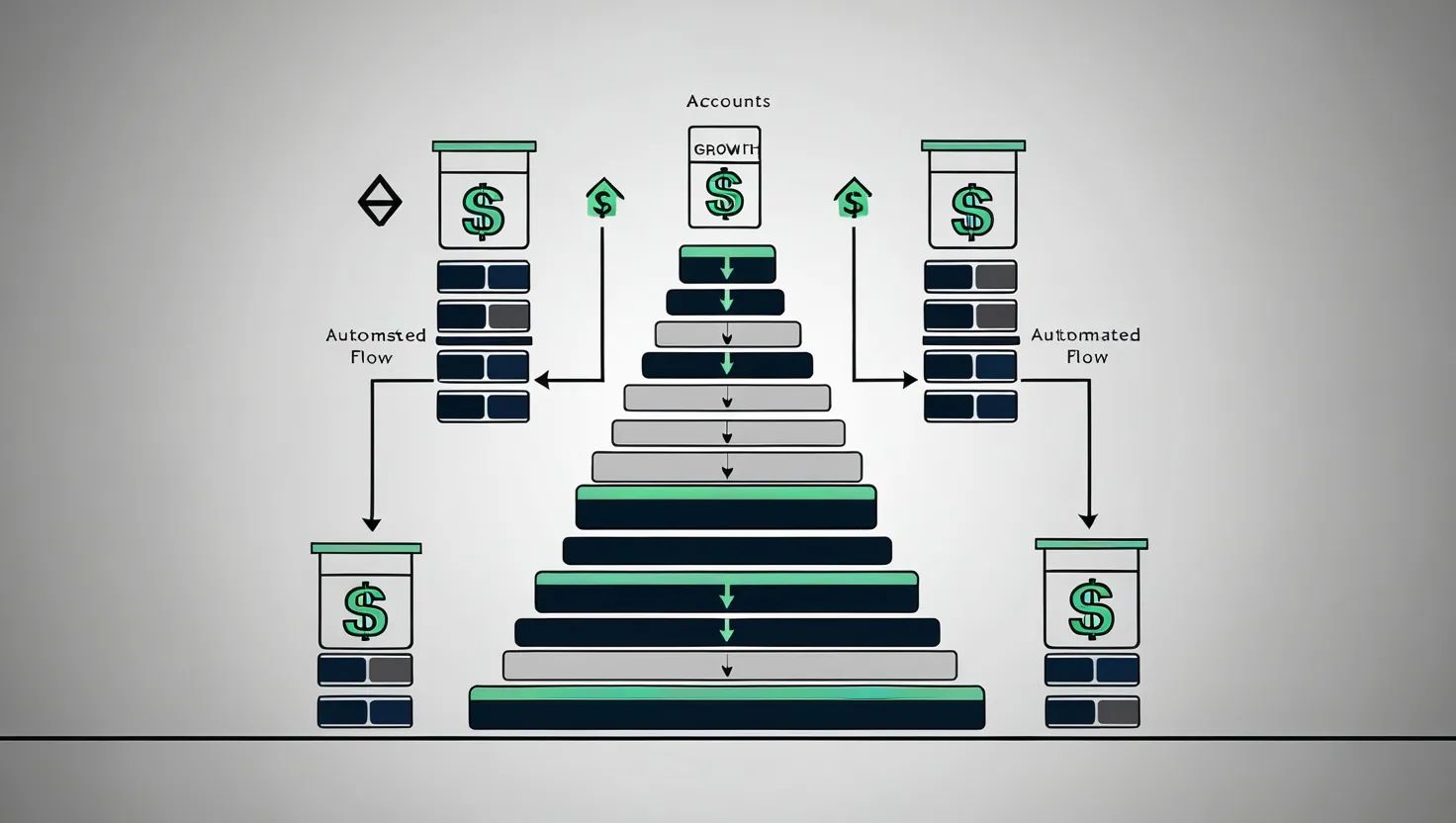

The third strategy I recommend is establishing automatic sweep thresholds for your checking accounts. This involves setting up automatic transfers that move excess balances to higher-yielding accounts when they exceed predetermined levels. For example, if your checking account balance goes above $3,000, the excess automatically “sweeps” into a money market fund where it can earn better returns.

This automation removes the psychological barrier of having to make constant decisions about your money. The system works silently in the background, optimizing your cash position without requiring your attention.

Do you know what your checking account balance was last month? Was it higher than necessary for your actual spending needs?

Fourth, practice strategic bill timing by aligning payment dates with income cycles. This maximizes what financial professionals call “float periods” while avoiding late fees. For example, if you receive income on the 1st and 15th of each month, schedule bills to be paid shortly after these dates rather than having them scattered randomly.

This approach maintains optimal cash flow throughout the month and prevents unnecessarily large cash buffers sitting idle in checking accounts. It requires an initial effort to contact service providers and adjust due dates, but the long-term benefits to your cash management are substantial.

Fifth, set up targeted saving subaccounts for specific goals with different timelines. Rather than one general savings account, create separate accounts for different purposes: vacation fund, home repair fund, holiday gift fund, etc. Each can have its own appropriate yield strategy based on when you’ll need the money.

“Do not save what is left after spending, but spend what is left after saving.” - Warren Buffett

This targeted approach prevents the common problem of dipping into savings for unintended purposes. It also allows you to match the liquidity needs of each goal with the right financial product. For short-term goals (less than a year), high-yield savings accounts work well. For medium-term goals (1-3 years), consider certificates of deposit or Treasury bills.

What specific future expenses are you currently saving for? Are they all mixed together or separated by purpose and timeline?

The sixth strategy involves using laddered CD strategies for predictable expenses that will occur 6-24 months in the future. CD laddering means buying certificates of deposit with staggered maturity dates. For example, if you know you’ll need $12,000 for a home renovation next year, instead of keeping it all in savings, you might buy six $2,000 CDs that mature monthly starting when you’ll need the money.

This approach allows you to capture higher yields without sacrificing access when you need it. As each CD matures, the funds become available for your planned expense. This works particularly well for known future costs like property taxes, insurance premiums, or planned purchases.

Finally, I strongly recommend implementing quarterly cash audits to identify and eliminate idle funds. Many people have money sitting in accounts earning minimal interest that could be working much harder. Set calendar reminders every three months to review all your accounts and ask: “Is this cash serving its optimal purpose?”

During these audits, look for forgotten accounts, excess emergency funds, or cash sitting in investment accounts awaiting deployment. These regular reviews often reveal thousands of dollars that can be better positioned to support your financial goals.

“Money is only a tool. It will take you wherever you wish, but it will not replace you as the driver.” - Ayn Rand

When implementing these strategies, remember that the goal isn’t to eliminate liquidity but to optimize it. Every dollar should have a purpose—whether that’s providing immediate spending capability, short-term safety, or long-term growth.

Have you taken time recently to evaluate your overall cash management strategy? Most people are surprised by how much improvement is possible with just a few adjustments.

At the heart of effective cash management lies the principle of maximizing the potential of every dollar at your disposal. This goes beyond basic budgeting and debt management; it’s about strategically moving your funds to cover both expected and unforeseen expenses while avoiding the drawbacks of idle cash.

For example, high-yield cash reserve accounts that invest in Treasury ETFs offer significantly better returns than traditional savings accounts while maintaining excellent liquidity. These vehicles provide a strong defense against inflation and support your overall financial health.

Another approach worth considering is asset/liability matching, where you align specific investments with known future expenses. This creates a predictable cash flow that reduces stress and prevents the need to sell investments at potentially unfavorable times.

Bond ladders can be particularly effective for retirement distribution planning. By staggering bond maturities to match your anticipated withdrawal needs, you create a reliable income stream while minimizing interest rate risk. This strategy provides peace of mind knowing that your near-term expenses are covered regardless of market fluctuations.

“It’s not how much money you make, but how much money you keep, how hard it works for you, and how many generations you keep it for.” - Robert Kiyosaki

Remember that effective cash management isn’t static—it evolves with your life circumstances. As your income, expenses, and goals change, your strategy should adapt accordingly. The quarterly audits I mentioned earlier provide perfect opportunities to make these adjustments.

Have you considered how your cash management needs will change in the next five years? Planning for these transitions now can prevent financial stress later.

In conclusion, strategic cash management forms the foundation of wealth building. By implementing these seven practical strategies—two-tier savings, personalized cash allocation formulas, automatic sweep thresholds, strategic bill timing, targeted saving subaccounts, CD laddering, and quarterly cash audits—you can significantly improve your financial performance.

These approaches ensure your money works as hard as you do while maintaining the liquidity you need for life’s opportunities and challenges. The result is greater financial security, reduced stress, and accelerated progress toward your long-term wealth goals.

The most important step? Starting today. Choose just one of these strategies to implement this week. Once it becomes habitual, add another. This gradual approach leads to sustainable change and, ultimately, to the financial freedom you deserve.