8 Strategic Methods to Optimize Your 401(k) Contributions

The 401(k) retirement plan stands as one of the most powerful tools for building wealth for the future. Yet many employees miss opportunities to maximize its benefits. In 2025, with contribution limits rising to $23,500 for those under 50 and additional catch-up contributions available for older workers, now is the perfect time to review your strategy[1][2].

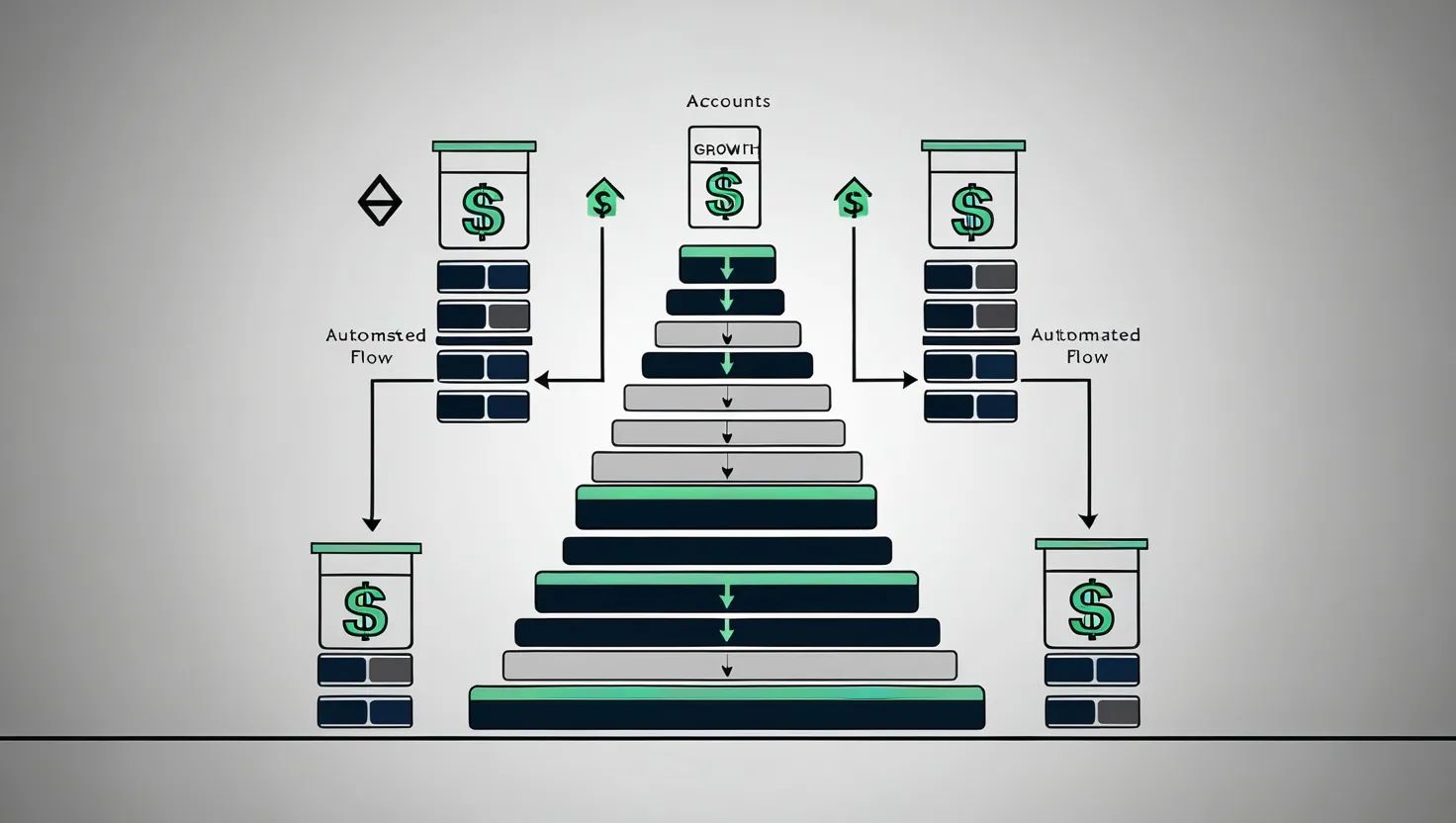

Most employees leave money on the table by mismanaging their 401(k) contributions. The strategies I’ll share ensure you capture every available dollar while optimizing tax efficiency and long-term growth.

First, let’s address the most essential strategy: capturing your full employer match. This match represents free money and an immediate return on your investment. Calculate your exact employer match formula and contribute at least the minimum required to capture the full match before prioritizing any other investments.

For example, if your employer offers a 50% match on contributions up to 6% of your salary, and you earn $60,000 annually, you need to contribute $3,600 per year (or about $138.46 bi-weekly) to receive the full $1,800 match. This represents an immediate 50% return on your investment – something no other investment can guarantee.

“The best investment you can make is in yourself.” – Warren Buffett

Have you calculated how much you might be leaving on the table by not maximizing your employer match?

The timing of your contributions also matters significantly. Some employees front-load their 401(k) contributions, reaching the annual limit early in the year. While this allows your money to grow tax-deferred for a longer period, it can be problematic if your employer matches per paycheck rather than annually.

If you reach your contribution limit before year-end, you’ll miss out on employer matches for the remaining pay periods. Instead, spread your contributions evenly throughout the year to ensure you receive every match opportunity. For 2025, with the contribution limit at $23,500, this means contributing about $904 per biweekly paycheck if you aim to maximize[1][3].

One effective approach ties contribution increases to salary raises. When you receive a raise, increase your 401(k) contribution rate by half the percentage of your raise. This allows you to boost retirement savings without reducing your take-home pay, helping you avoid lifestyle inflation while accelerating wealth building.

“Do not save what is left after spending, but spend what is left after saving.” – Warren Buffett

For those age 50 and older, catch-up contributions offer a powerful opportunity to accelerate retirement savings. In 2025, beyond the standard $23,500 limit, you can contribute an additional $7,500, bringing your total potential contribution to $31,000[2]. Even more impressive, those aged 60 to 63 can make catch-up contributions of $11,250, for a total potential contribution of $34,750[2]. These higher limits create significant opportunities to build wealth during your peak earning years.

How much more could you save if you increased your contribution rate by just 1% this year?

Another strategic decision involves choosing between traditional and Roth 401(k) contributions. Traditional contributions reduce your current taxable income but will be taxed when withdrawn in retirement. Roth contributions are made with after-tax dollars but grow tax-free and can be withdrawn tax-free in retirement.

Consider Roth contributions when:

- You’re in a lower tax bracket now than you expect to be in retirement

- You want tax diversification in retirement

- You’re early in your career with decades of tax-free growth ahead

Traditional contributions may be better when:

- You’re in a high tax bracket now and expect to be in a lower bracket in retirement

- You need the immediate tax deduction

- You’re closer to retirement with less time for tax-free growth

The SECURE 2.0 Act has introduced important changes for 2025. New retirement plans must include automatic enrollment with starting contribution rates between 3% and 10%[2]. Additionally, these plans must implement annual automatic increases of 1% until contributions reach at least 10% (but not exceeding 15%). If your plan includes these features, consider embracing rather than opting out of them, as they create a disciplined savings approach.

“The goal isn’t more money. The goal is living life on your terms.” – Chris Brogan

Investment selection within your 401(k) also demands attention. Many plans now offer index funds with extremely low expense ratios. Even a difference of 0.5% in annual fees can significantly impact your retirement balance over decades. Review your investment options annually and transfer balances to lower-cost options when available, while maintaining appropriate diversification for your age and risk tolerance.

What’s the average expense ratio of the funds in your 401(k) portfolio?

Some 401(k) plans offer in-service withdrawals or loans that can be used strategically for major financial goals like home purchases. While generally not recommended as first options, these features can provide flexibility in certain situations. However, use them only after capturing full employer matches and maintaining adequate emergency funds. Remember that 401(k) loans typically must be repaid within five years or immediately if you leave your job.

Beneficiary designations represent another often overlooked aspect of 401(k) management. Review these annually, especially after major life events like marriage, divorce, or the birth of children. Proper beneficiary designations ensure your hard-earned retirement savings transfer efficiently to your intended recipients without unnecessary complications or tax consequences.

“The best time to plant a tree was 20 years ago. The second best time is now.” – Chinese Proverb

As we move through 2025, the early part of the year has presented challenges for many 401(k) investors, with market fluctuations causing noticeable changes in account balances[2]. During such periods, it’s especially important to maintain a long-term perspective and avoid reactive decisions based on short-term market movements.

For high-income earners, another strategy involves maximizing not just employee contributions but also understanding the total contribution limit. In 2025, the combined employer and employee contribution limit is $70,000[3]. If you participate in a profit-sharing plan or receive substantial employer contributions, being aware of this limit helps in comprehensive retirement planning.

Have you reviewed your contribution rate since the 2025 limits were announced?

The automatic features of modern 401(k) plans provide a solid foundation, but taking an active role in managing your contributions can substantially improve outcomes. The difference between contributing the default 3% and pushing toward 10-15% of your salary compounds dramatically over decades of work.

For those with variable income, such as sales professionals receiving commissions or bonuses, creating a contribution strategy that adapts to income fluctuations can help maximize tax advantages and employer matches. Consider adjusting your contribution percentage before receiving bonuses or increasing contributions during high-income periods.

“Financial peace isn’t the acquisition of stuff. It’s learning to live on less than you make, so you can give money back and have money to invest.” – Dave Ramsey

Your 401(k) doesn’t exist in isolation but should be coordinated with your overall financial plan. If you have high-interest debt, establishing an emergency fund, or saving for short-term goals like a home purchase, these considerations affect how much to contribute beyond capturing employer matches. The optimal strategy balances multiple financial priorities while recognizing the unique tax advantages and employer matching benefits of 401(k) plans.

As retirement approaches, contribution strategies often shift from accumulation to distribution planning. In the years before retirement, maximizing contributions becomes even more critical. The catch-up provisions for those over 50 provide valuable opportunities to boost savings during peak earning years when many have reduced expenses as children leave home and mortgages are paid down.

Are you taking full advantage of catch-up contributions if you’re eligible?

The power of compound growth makes early and consistent 401(k) contributions particularly valuable. Even small increases in contribution rates can yield substantial differences in retirement balances. By implementing these eight strategic methods, you position yourself to optimize every aspect of your 401(k), from tax advantages to employer matches and long-term growth potential.

Your future financial security depends largely on decisions made today. By taking control of your 401(k) strategy, you create opportunities for a more secure and flexible retirement. The increased contribution limits for 2025 provide even more room to build wealth in this tax-advantaged vehicle. Don’t leave money on the table – optimize your 401(k) contributions today for a more secure tomorrow.