Let’s start with a simple question: Why do most budgeting attempts collapse after a few weeks? For many, a budget is a set of restrictions written on paper, easily ignored with the next click or card swipe. But what if we treated our bank accounts as living boundaries instead of mere containers for money? That’s where account mapping comes in—and it’s more than just labeling a few envelopes or using a spreadsheet. It’s about using the structure of your banking setup to quietly shape your habits and make saving the path of least resistance.

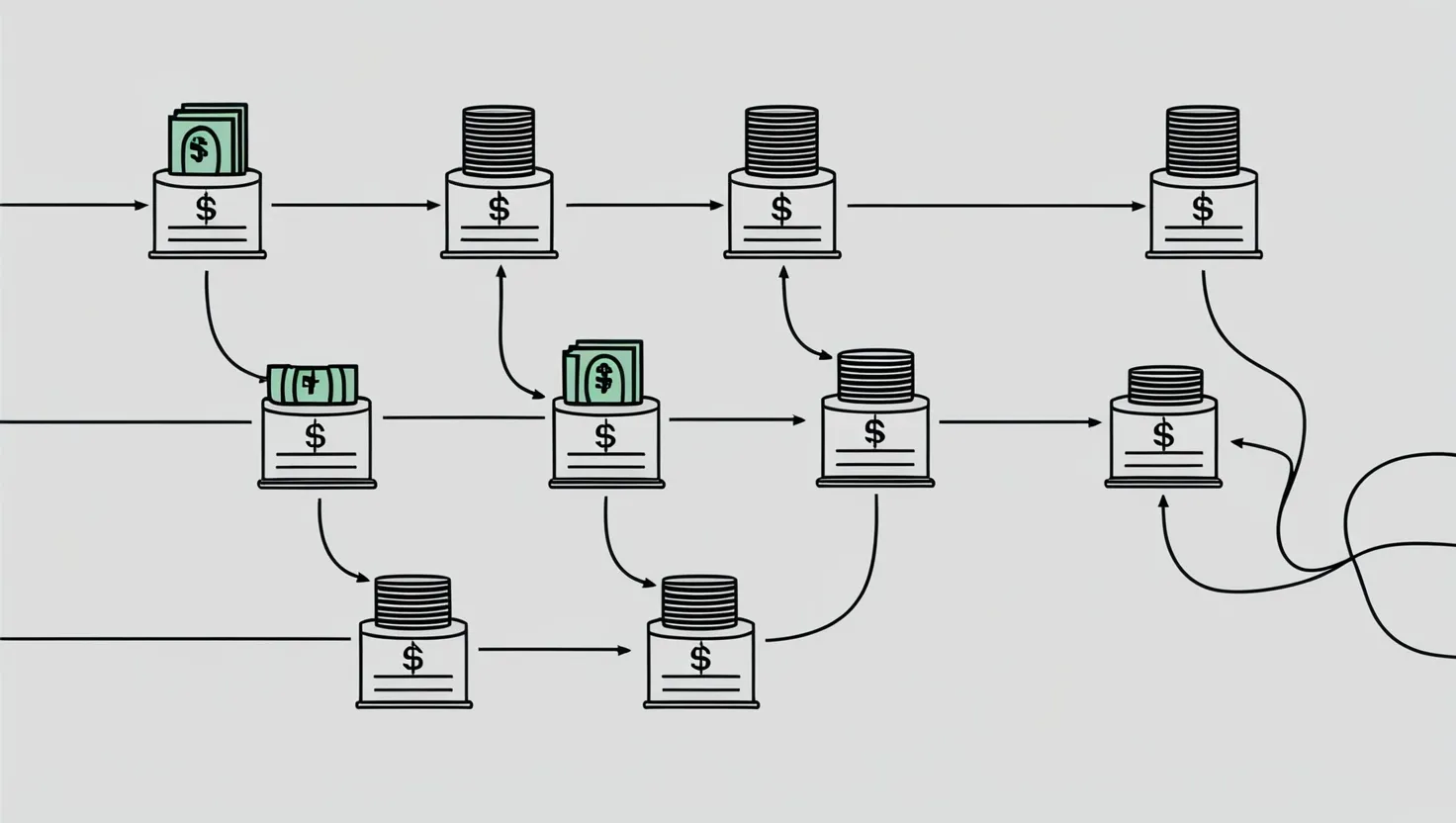

Account mapping goes a step beyond tracking. Picture this: your paycheck arrives and, instead of sitting in a single account, it immediately travels “downstream” into several smaller accounts, each waiting with its own purpose. Groceries, gas, utilities, fun money—they all get a slice, and each slice has a distinct boundary. This approach silently shifts your environment, influencing your spending without relying on battles of willpower or last-minute self-talk at the checkout.

Let’s talk about how this really works, starting with the idea of category-specific accounts. Imagine having a separate checking account for every big spending category: groceries, transport, utilities, and those famous “just because” purchases. You automate transfers for each on payday, so when the groceries account says zero, you know your food budget is done for the month. No spreadsheets necessary—your bank tells you when to stop. This system works not through constant reminders, but by making it physically inconvenient to overspend in the first place.

Now, here’s an angle I rarely see discussed: tiered funding triggers. What if your “fun” account only gets a boost if you come in under budget on groceries, or gets docked if you’re late paying the electric bill? It’s like your accounts are talking to each other, rewarding good behavior and gently punishing lapses. This isn’t about being punitive; it’s about aligning your environment with your intentions. When I tried this, I noticed how quickly I started rooting for myself—spending less at the store because I knew it meant more for experiences I valued. The behavioral feedback loop here is immediate and surprisingly motivating.

Let’s pause and reflect. Benjamin Franklin once wrote, “Beware of little expenses. A small leak will sink a great ship.” With account mapping, the leaks can’t escape your notice—they’re automatically shut off at the valve.

There’s a particularly clever twist called geographic account locking. Suppose your “dining out” account only works within a certain radius of your home. No more tempting yourself with takeout after work or while running errands across town. When real-life scenarios create the friction—“Sorry, this card doesn’t work here”—you’re nudged back toward your priorities without a lecture or a guilt trip.

How often have you regretted an impulse purchase made late at night? I know I have. Time-based access rules take advantage of our own patterns. I set my “shopping” account to be offline from 8 PM until early morning. During those hours, no online retailer can tempt me, and the simple friction is enough to halt most late-night spending sprees. By the time access returns, the urge is usually gone. Have you ever wondered how much of your spending is driven by the time of day, rather than real need?

Oscar Wilde once quipped, “I can resist everything except temptation.” With account mapping, you don’t need to resist at all—the temptation is simply out of reach, no internal struggle required.

Impulse control deserves its own strategy. I built what I call a “48-Hour Hold” account. Whenever I’m hit with the urge to buy something unplanned, I move the amount into this holding pen. After two days, if I still want it, I transfer it to my spending account. The surprising part? The majority of these transfers never make it out. Time dissolves the impulse.

The psychological magic here is subtle. Instead of feeling deprived, I’m trusting myself just enough to say, “If it’s still important later, it’s yours.” Most times, urgency fades, and I save money without feeling like I’ve lost something.

Let’s consider what happens at scale. People adopting these techniques cut their discretionary spending by over 20 percent within a few months. Imagine what that means over a year—thousands of dollars that might otherwise have vanished in forgettable purchases, now available for real goals: paying down debts, funding adventures, or padding your emergency fund.

Compound that monthly savings at even a modest investment rate, and you’re looking at a sum that transforms your financial trajectory. It’s not just about skipping the latte; it’s about using the mechanics of your bank accounts to make better outcomes nearly automatic.

But there are deeper, less obvious benefits. Splitting your money by intention means you’re constantly aware of your priorities. It becomes hard to ignore how much you truly value eating out, or whether your discretionary account always drains before the month’s end. These signals create space for reflection: Am I funding what matters, or just letting old habits rule the day?

Walt Whitman once said, “Simplicity is the glory of expression.” Account mapping is simplicity in action—a structure that quietly expresses and enforces your real goals, without the noise of constant monitoring.

Some might argue that opening several accounts is overkill or too complicated. But the point is not complexity for its own sake. Modern banking platforms make it easy to set up, automate, and monitor multiple accounts, usually at no extra cost. Once running, the system requires less attention than a detailed budget. The boundaries are built in.

What about the risk of missing out on rewards or interest from keeping money split up? In my experience, the behavioral savings far outweigh minor lost perks. Plus, many banks let you segment funds within one main account or link sub-accounts under a single login, so efficiency need not be sacrificed for structure.

Let me ask: If you could automate away 90% of your willpower struggles, would you try it for three months? Anyone can experiment with one or two category accounts to start—no need to overhaul everything at once. The immediate clarity and control often leads to a desire to expand the system over time.

There’s an unexpected bonus in how this approach changes conversations with partners or family. Instead of vague arguments over “spending too much,” the account boundaries make discussions concrete. Are we funding our weekend plans, or do we need to be creative with groceries this week? The accounts quietly direct attention to shared goals.

“Do not save what is left after spending, but spend what is left after saving,” said Warren Buffett. Account mapping makes this sentiment real, shifting savings from an afterthought to the default. When money meant for essentials is protected, and the rest flows into savings or investments immediately, you stop wondering where it all went by month’s end.

The real genius of account mapping is how little it demands from you once it’s set up. There’s no ongoing battle, just a silent helper in the background, removing temptation and highlighting your priorities. Over time, you’ll find yourself making better decisions not because you’re suddenly more disciplined, but because the system does the heavy lifting for you.

Finance doesn’t have to be about deprivation or endless vigilance. It can be, quietly and powerfully, about wiring your life to favor your ambitions. I encourage you to try account mapping—not just as a budgeting hack, but as a new way to align your daily choices with your deepest goals. When your accounts become your allies, saving money is no longer a struggle. It becomes, almost effortlessly, a way of life. Would you be willing to let your bank accounts do the hard work, so you don’t have to? That’s the question—and the opportunity—account mapping offers.