Real estate has long been a cornerstone of wealth building, but for many, the barrier to entry seems insurmountable. Enter Real Estate Investment Trusts (REITs) - a vehicle that democratizes property investment, allowing everyday investors to participate in the real estate market without the headaches of property management. When combined with the time-tested strategy of dollar-cost averaging, REITs become a powerful tool for building wealth systematically.

Let’s explore how you can harness the power of REITs using dollar-cost averaging to potentially grow your wealth over time.

First, what exactly are REITs? They’re companies that own, operate, or finance income-producing real estate across a range of property sectors. By law, REITs must distribute at least 90% of their taxable income to shareholders annually in the form of dividends. This makes them particularly attractive for income-seeking investors.

Now, let’s talk about dollar-cost averaging. This investment technique involves regularly investing a fixed amount of money into a particular investment or portfolio, regardless of its share price. The beauty of this approach is that it removes the emotional aspect of trying to time the market. You buy more shares when prices are low and fewer when prices are high, potentially lowering your average cost per share over time.

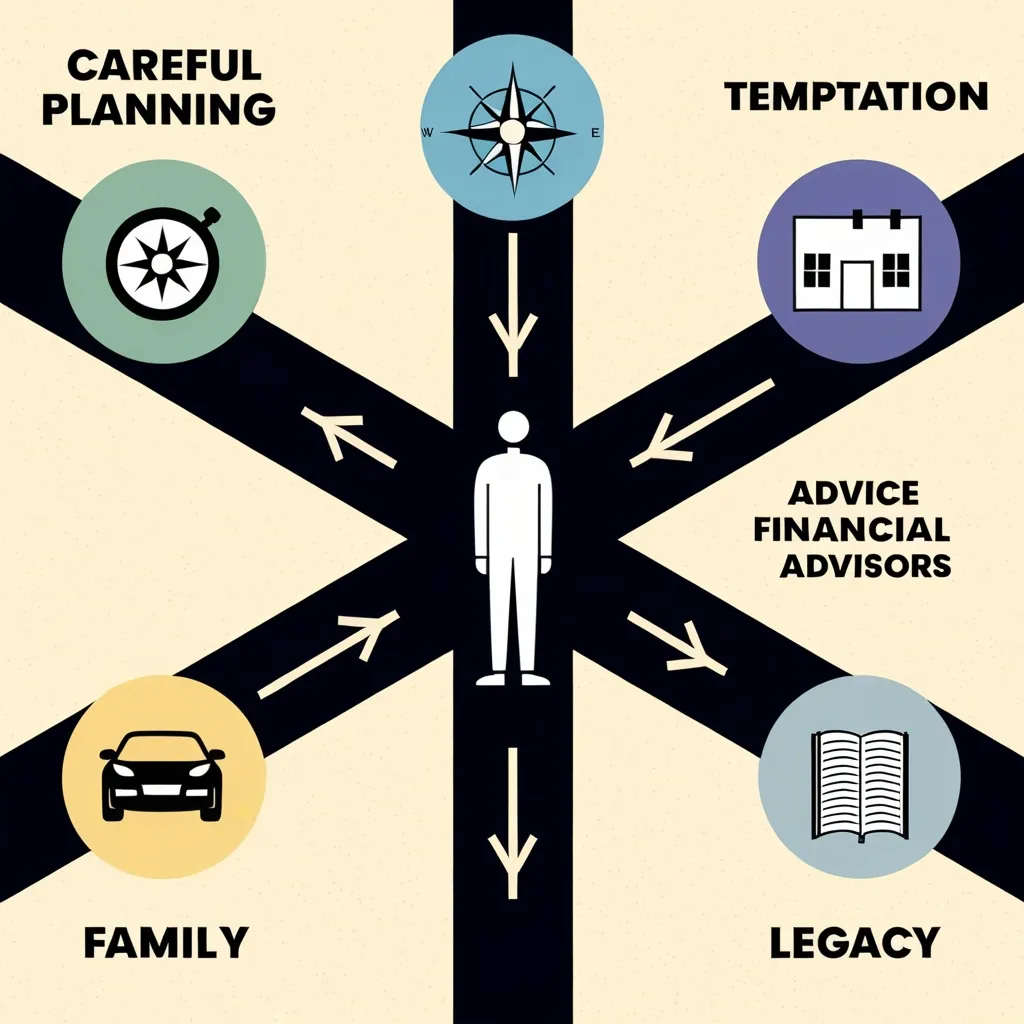

So how do we marry these two concepts to build wealth? Here’s a roadmap:

Start by setting up automatic monthly investments in a diverse REIT portfolio. Diversification is key here - don’t put all your eggs in one basket. Consider spreading your investments across different types of REITs: residential, commercial, healthcare, and data centers, for example. This approach helps mitigate risk and exposes you to various sectors of the real estate market.

When selecting REITs, focus on those with strong dividend histories and consistent occupancy rates above 90%. These metrics can indicate stability and good management. Remember, past performance doesn’t guarantee future results, but it can be a useful indicator.

One of the most powerful wealth-building tools at your disposal is dividend reinvestment. Many brokerages offer automatic dividend reinvestment programs (DRIPs). By reinvesting your dividends, you’re essentially practicing dollar-cost averaging with your returns, potentially accelerating your wealth accumulation.

“Compound interest is the eighth wonder of the world. He who understands it, earns it… he who doesn’t… pays it.” - Albert Einstein

This quote underscores the power of reinvesting dividends. Over time, the compounding effect can be substantial.

Now, let’s talk taxes. REITs can be tax-efficient investments, but to maximize their benefits, consider holding them in tax-advantaged accounts like IRAs. This strategy can help minimize the tax impact of the high dividends typically associated with REITs.

How much of your portfolio should you allocate to REITs? While individual circumstances vary, many financial advisors suggest keeping REIT allocations between 5% and 15% of your total investment portfolio. This provides exposure to real estate while maintaining overall portfolio balance.

Regular monitoring is crucial. Review quarterly reports to keep an eye on key metrics like funds from operations (FFO) and debt levels. FFO is particularly important for REITs as it provides a clearer picture of a REIT’s operating performance than traditional earnings per share.

Here’s a question to ponder: How might changes in interest rates affect your REIT investments? It’s worth considering, as REITs can be sensitive to interest rate fluctuations.

Remember, the essence of dollar-cost averaging is consistency. Continue your regular investments regardless of market conditions. This discipline can help you avoid the pitfalls of emotional investing and potentially benefit from market volatility.

“The individual investor should act consistently as an investor and not as a speculator.” - Benjamin Graham

This wisdom from the father of value investing encapsulates the philosophy behind dollar-cost averaging into REITs. You’re investing for the long term, not speculating on short-term price movements.

As you embark on this wealth-building journey, keep in mind that REITs, like all investments, come with risks. Property values can fluctuate, and economic downturns can impact rental income. However, by diversifying across different types of REITs and consistently investing over time, you can potentially mitigate some of these risks.

Consider this: How might technological advancements or changing demographics impact different types of REITs in the future? For instance, the rise of e-commerce has boosted industrial REITs that own warehouses, while potentially challenging retail REITs. Keeping an eye on these trends can inform your investment decisions.

It’s also worth noting that not all REITs are created equal. Some specialize in niche markets or employ unique strategies. For example, some REITs focus on properties with triple net leases, where tenants are responsible for most property expenses. Others might specialize in data centers or cell towers, tapping into the growing demand for digital infrastructure.

As you build your REIT portfolio, consider how these different specializations might complement each other and align with your investment goals. Are you primarily seeking income, growth, or a balance of both?

Dollar-cost averaging into REITs can be particularly beneficial during market downturns. When REIT prices fall, your fixed investment amount buys more shares, potentially setting you up for greater gains when the market recovers. This systematic approach can help you avoid the common investor pitfall of buying high and selling low.

But what about market timing? You might be tempted to try to predict the best time to invest in REITs. However, numerous studies have shown that even professional investors struggle to consistently time the market. Dollar-cost averaging removes this pressure, allowing you to focus on long-term wealth building rather than short-term market movements.

“The best time to plant a tree was 20 years ago. The second best time is now.” - Chinese Proverb

This proverb aptly applies to investing. While it’s easy to regret not starting earlier, the key is to begin now and remain consistent.

As you progress in your REIT investing journey, you might consider expanding your strategy. For instance, you could allocate a portion of your investment to international REITs, providing exposure to real estate markets beyond your home country. This global diversification can potentially offer additional growth opportunities and help spread risk.

It’s also worth exploring the world of specialty REITs. These might include REITs focused on self-storage facilities, timberland, or even farmland. Each of these niches comes with its own set of dynamics and potential benefits.

Remember, building wealth through REITs is not a get-rich-quick scheme. It’s a long-term strategy that requires patience, discipline, and a willingness to weather market fluctuations. By consistently investing, reinvesting dividends, and maintaining a diversified portfolio, you’re positioning yourself to potentially benefit from both income and capital appreciation over time.

As you move forward, keep educating yourself about the real estate market and the specific REITs in your portfolio. Understanding the underlying properties, market trends, and management strategies of your investments can help you make more informed decisions and feel more confident in your wealth-building journey.

In conclusion, dollar-cost averaging into a diversified REIT portfolio offers a structured approach to building wealth through real estate investment. It combines the potential benefits of real estate ownership with the discipline of systematic investing. While it’s not without risks, this strategy can provide a path for patient investors to potentially grow their wealth over time, all while gaining exposure to the dynamic world of real estate.

So, are you ready to start building your real estate empire, one REIT at a time?