Saving for college is a journey that begins long before the first day of classes. As parents, we often find ourselves caught between the desire to provide the best education for our children and the reality of rising tuition costs. But fear not, for there are strategic methods to create a robust college fund using index funds that can make this daunting task more manageable.

Let’s start with the basics. Index funds are a type of mutual fund or exchange-traded fund (ETF) designed to track a specific market index, such as the S&P 500. These funds offer broad market exposure, low operating expenses, and low portfolio turnover. They’re the unsung heroes of the investment world, providing a simple yet effective way to grow your money over time.

The first step in our college savings strategy is to start early with low-cost broad market index funds. The power of compound interest is your ally here. By choosing funds with minimal expense ratios under 0.2%, you’re ensuring that more of your money stays invested and working for you. Remember, even small differences in fees can have a significant impact over the long term.

“Compound interest is the eighth wonder of the world. He who understands it, earns it… he who doesn’t… pays it.” - Albert Einstein

This quote from Einstein underscores the importance of starting early and letting your investments grow over time. But how early should you start? The answer is simple: as soon as possible. Even if your child is still in diapers, it’s not too early to begin thinking about their college fund.

As your child grows, so should your investment strategy. This brings us to our second method: using age-based asset allocation. This approach involves adjusting your investment mix as your child gets closer to college age. When they’re young, you can afford to be more aggressive with a higher percentage of stocks in your portfolio. As they approach college age, you’ll want to shift towards a more conservative mix with a higher percentage of bonds.

Here’s a simple guide to help you track your mix:

When your child is between 0-5 years old, aim for 90% stocks and 10% bonds. From ages 6-10, shift to 80% stocks and 20% bonds. As they enter their pre-teen and early teen years (11-15), move to 70% stocks and 30% bonds. Finally, in the last few years before college (16-18), settle into a 60% stocks and 40% bonds mix.

This gradual shift helps protect your savings from market volatility as you get closer to needing the funds for college expenses.

Now, let’s talk about 529 plans. These are tax-advantaged investment accounts designed specifically for education savings. They offer a powerful way to save for college while potentially reducing your tax burden. When selecting a 529 plan, opt for direct-sold plans to avoid broker fees. These plans allow you to invest directly without going through a financial advisor, saving you money on commissions.

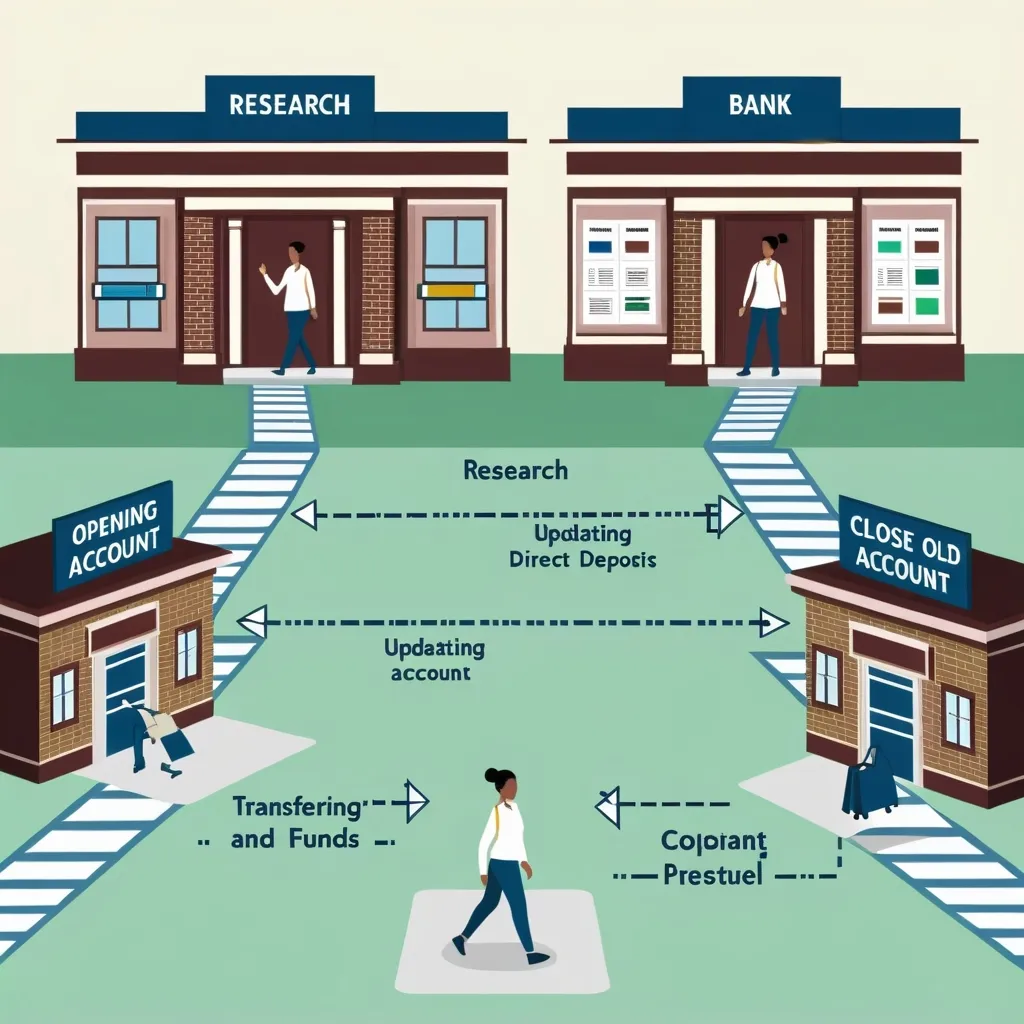

But how much should you be saving each month? This brings us to our fourth strategy: setting automatic monthly contributions based on college cost projections. Start by researching the current costs of colleges your child might attend. Then, use online calculators to project what those costs might be when your child is ready to enroll. Based on these projections, set up automatic monthly contributions to your college savings account.

Remember, consistency is key. Even small, regular contributions can add up significantly over time.

“The best time to plant a tree was 20 years ago. The second best time is now.” - Chinese Proverb

This proverb reminds us that it’s never too late to start saving. Whether your child is 2 or 12, the most important thing is to begin now and remain consistent.

As you progress on your college savings journey, it’s important to regularly reassess and adjust your strategy. This brings us to our fifth method: rebalancing your portfolio annually. Over time, some investments may grow faster than others, causing your asset allocation to drift from your target. By rebalancing annually, you ensure that your portfolio stays aligned with your goals and risk tolerance.

Lastly, don’t forget to increase your contributions as your financial situation improves. Did you get a raise at work? Consider allocating a portion of that increase to your college savings fund. Received a bonus? Think about making an extra contribution. These systematic increases can significantly boost your savings over time.

Have you considered how you might adjust your savings strategy if your child receives a scholarship? What if they decide to attend a community college for the first two years? These are important questions to ponder as you develop your college savings plan.

Remember, saving for college is not just about accumulating funds. It’s about creating opportunities for your child’s future. By implementing these strategic methods and using index funds as your primary investment vehicle, you’re setting the stage for your child’s educational success.

As we navigate this journey together, it’s important to stay informed and adaptable. The world of higher education is constantly evolving, and so too should our savings strategies. Keep an eye on trends in college costs, changes in financial aid policies, and new investment options that may become available.

“Education is the passport to the future, for tomorrow belongs to those who prepare for it today.” - Malcolm X

This powerful quote from Malcolm X reminds us of the transformative power of education and the importance of preparing for it. By taking proactive steps today to save for your child’s education, you’re not just investing in their future - you’re investing in the future of our society.

As we wrap up our discussion on strategic methods to create a college fund using index funds, I want to leave you with a final thought. Saving for college is a marathon, not a sprint. It requires patience, discipline, and a long-term perspective. There may be times when the task seems overwhelming or when market volatility causes anxiety. During these moments, remember why you started this journey in the first place - to provide your child with the gift of education and the opportunities it brings.

What steps will you take today to start or enhance your college savings plan? How might you involve your child in the process, teaching them valuable lessons about financial planning and the importance of education?

By embracing these strategies and maintaining a consistent approach, you’re not just saving for college - you’re investing in your child’s future. And that, perhaps, is the most strategic method of all.