Retirement is often painted as the golden years of life, a time to relax, travel, and enjoy the fruits of your labor. However, for many, this period can be marred by financial and emotional challenges that can be as unexpected as they are debilitating. One of the most insidious threats to a peaceful retirement is overconfidence, a behavioral bias that can lead even the most well-prepared individuals down a path of financial ruin.

The Overconfidence Trap

Imagine you’re at the peak of your career, having navigated the ups and downs of the market with what seems like ease. You’ve made smart investments, saved diligently, and perhaps even weathered a few economic storms. This success can breed a sense of invincibility, making you believe that the market will always favor you. This is the overconfidence trap, and it’s particularly perilous for retirees.

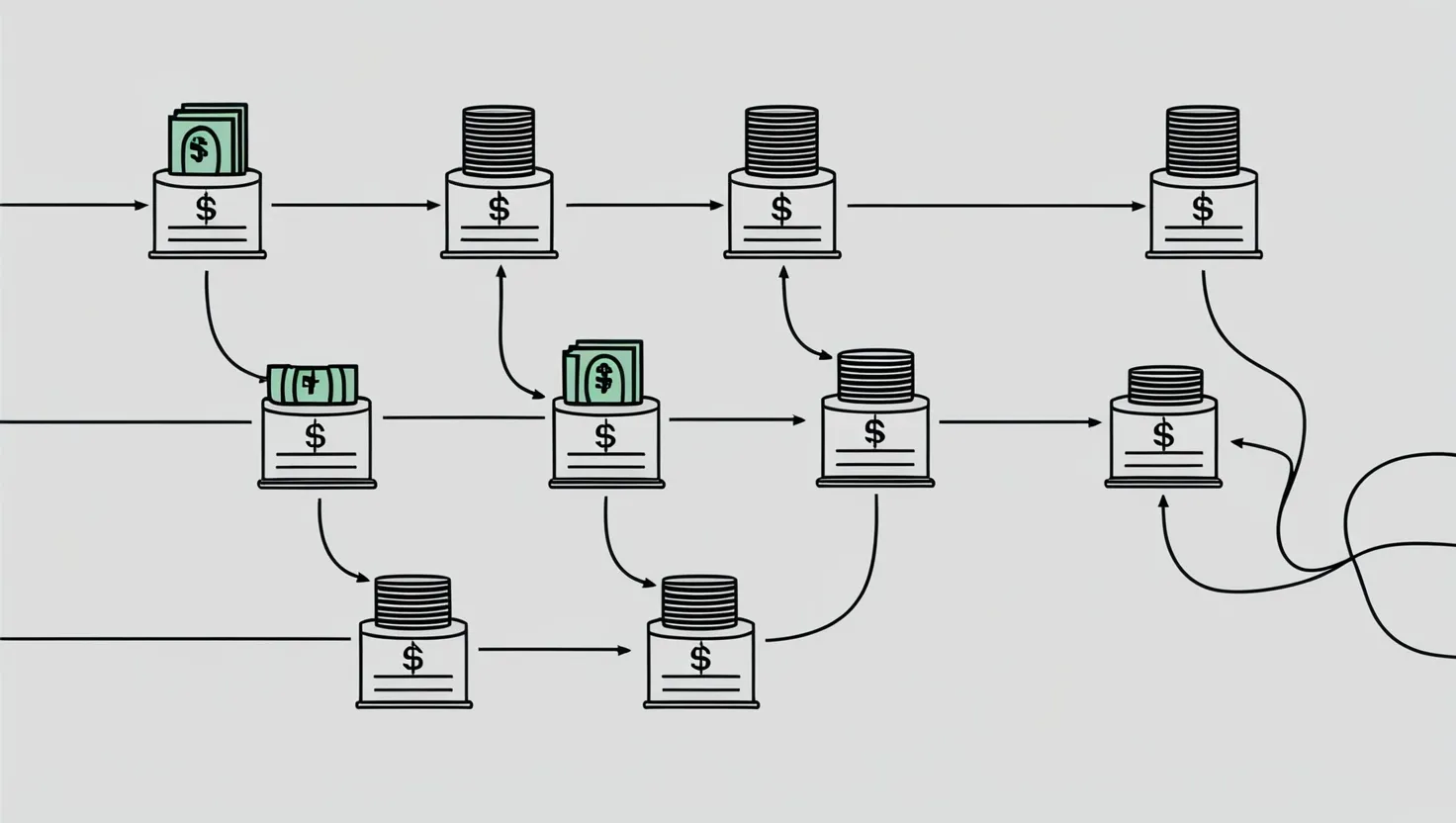

When you’re overly confident in your investment decisions, you might start taking on more risk than you should. You might allocate a larger portion of your portfolio to equities, ignoring the need for diversification and protection against market downturns. This was evident during the COVID-19 correction, where many retirees, having sold off during the crisis, later became overly optimistic about the market’s ability to rebound and grow indefinitely.

Ignoring Past Mistakes

Overconfidence can also make you overlook past mistakes. If you sold off during the COVID-19 correction and then jumped back into the market, you might forget the emotional and financial toll that volatility can take. This amnesia can lead you to repeat the same mistakes in future downturns, exacerbating your financial losses.

Moreover, this bias can drive you to hop from one investment advisory firm to another, seeking the holy grail of consistent, high returns. Each move is driven by dissatisfaction and restlessness, rather than a calm, informed decision-making process. This constant switching can result in higher fees, unnecessary complexity, and a lack of long-term strategy.

Recency Bias

Another closely related bias is recency bias, where you give too much weight to recent events and ignore the broader historical context. If the market has been performing well recently, you might assume this trend will continue indefinitely. However, markets are cyclical, and what goes up can just as easily come down. Ignoring this reality can leave you unprepared for the inevitable downturns.

The Psychological Impact

Retirement isn’t just about finances; it’s also a significant psychological and emotional transition. Many retirees struggle with feelings of loss of purpose, identity, and social isolation. When you’ve spent decades defining yourself by your job, retirement can leave a void that’s hard to fill.

For instance, you might find yourself waking up with nothing to do, feeling lonely because your friends are still at work, or bored because the activities you planned don’t challenge or engage you as much as you thought. This sense of disorientation is common, but it doesn’t have to be permanent. Engaging in new activities, volunteering, or even taking up a new hobby can help you find a new sense of purpose.

Practical Strategies to Manage Overconfidence

So, how can you avoid falling into the overconfidence trap and ensure a more secure financial future in retirement?

First, it’s crucial to recognize and manage your behavioral biases. Implementing a structured investment strategy, such as the S.M.A.R.T. Retirement Strategy, can help. This involves segmenting your assets based on your spending needs, reducing the temptation to make impulsive decisions based on market fluctuations.

Working with a financial advisor can also be invaluable. An advisor can provide objective advice and help you stay on track with your retirement goals, preventing you from making rash decisions driven by overconfidence.

Avoiding Over-Saving

While it’s important to save enough for retirement, saving too much can also be a mistake. Over-saving can lower your quality of life during your working years and cause undue financial stress. For example, if you’re saving so much that you’re struggling to pay your mortgage or cover unexpected expenses, you’re likely saving too much.

The key is to personalize your retirement planning. Don’t rely on general assumptions or standard replacement rates. Calculate your actual expenses, subtract those you won’t have in retirement, and add in new ones. For instance, if you plan to travel more in retirement or relocate, these costs need to be factored into your savings plan.

Healthcare and Housing Costs

Healthcare and housing are two of the biggest costs you’ll face in retirement. Researching and planning for these expenses can help you avoid over-saving. Understanding your options for Medicare, long-term care insurance, and assisted living costs can give you a clearer picture of what you’ll need.

Similarly, if you plan to stay in your own home as long as possible, your housing costs will be lower than if you were to move to an assisted living facility. These considerations can significantly impact how much you need to save.

Tallying Expected Income

Finally, tally up what you expect to receive from pensions and Social Security. The more you have from these resources, the less you’ll need to save in retirement accounts. This can help you strike the right balance between saving enough for retirement and enjoying your working years.

Finding Purpose and Engagement

Retirement is not just about financial security; it’s also about finding purpose and engagement. Before you retire, try out new activities that don’t command a full-time commitment. This could be volunteering, joining a book club, or taking up a new hobby. When you actually leave your job, you can increase your time commitment to these activities to see what truly resonates with you.

It’s also important to anticipate what might be called “false starts.” Not everything you try will turn out to have lasting impact or attractiveness. Be patient and open to trying new things until you find what brings you fulfillment.

Conclusion

Retirement planning is complex, and overconfidence can be a significant obstacle. By recognizing and managing behavioral biases, maintaining a diversified portfolio, and seeking professional guidance, you can navigate your financial future with greater confidence and security.

Remember, retirement is a journey, not a destination. It’s a time to enjoy the fruits of your labor, but also to find new purpose and engagement. With the right strategies and mindset, you can avoid the dark side of retirement and make the most of your golden years. So, take a step back, assess your situation, and make informed decisions that will ensure a retirement that is both financially secure and personally fulfilling.