Cracking the Millionaire Code: The Ultimate Budget Hack

Let’s face it, budgeting isn’t exactly the most thrilling topic. But what if I told you there’s a secret budgeting hack that could set you on the path to becoming a millionaire? Stick with me, and I’ll spill the beans on how to turn your finances from meh to marvelous.

First things first, let’s ditch the idea that budgeting is all about penny-pinching and living on ramen noodles. Sure, being mindful of your spending is part of it, but a killer budget is really about making your money work for you. It’s like having a personal financial GPS, guiding you towards your money goals.

So, what’s the secret sauce? It’s called the 50/30/20 rule, and it’s simpler than you might think. Here’s how it works: Take your monthly income and divvy it up. Half goes to necessities (think rent, groceries, utilities), 30% is for fun stuff (hello, Netflix and tacos), and the remaining 20% is for savings and crushing debt.

Let’s say you’re bringing home $5,000 a month. That means $2,500 for the must-haves, $1,500 for the nice-to-haves, and $1,000 for your future self. Easy peasy, right?

But here’s where it gets interesting. To really supercharge your finances, you need to get visual. Remember those fundraising thermometers from school? Apply that same idea to your money goals. Whether it’s an app, a spreadsheet, or good old-fashioned pen and paper, tracking your progress visually can be a game-changer.

Imagine watching your debt shrink or your savings grow every single day. It’s like a real-life video game, only instead of virtual coins, you’re racking up actual cash. Talk about motivation!

Now, I know what you’re thinking. “But I’m not a money whiz!” Here’s a little secret: neither are most millionaires. What sets them apart is their mindset. They believe they can achieve their financial goals, and guess what? That belief becomes a self-fulfilling prophecy.

So, let’s work on that money mindset. Try this: Every morning, look in the mirror and say, “I’m on my way to financial freedom.” Feel silly? Maybe at first, but stick with it. Your brain is like a computer - feed it the right programs, and it’ll start working for you.

Speaking of free stuff, did you know many banks offer free financial consultations? It’s like having a money coach in your corner, minus the hefty price tag. They can help you spot opportunities to save, invest, or crush debt that you might have missed.

Here’s another pro tip: align your spending with your values. Love travel? Great, allocate more of your fun money to adventures. Can’t live without your daily latte? No problem, just make sure it fits in your budget. The key is to spend on things that truly bring you joy, not just temporary satisfaction.

Now, let’s talk investing. It’s not just for Wall Street bigwigs. In fact, the earlier you start, the better. Time is your best friend when it comes to growing wealth. Even small, consistent investments can snowball into a fortune over time, thanks to the magic of compound interest.

But here’s the kicker: as your income grows, resist the urge to upgrade your lifestyle. That new raise? Don’t use it to lease a fancier car. Instead, funnel it into your savings or investments. Your future self will thank you.

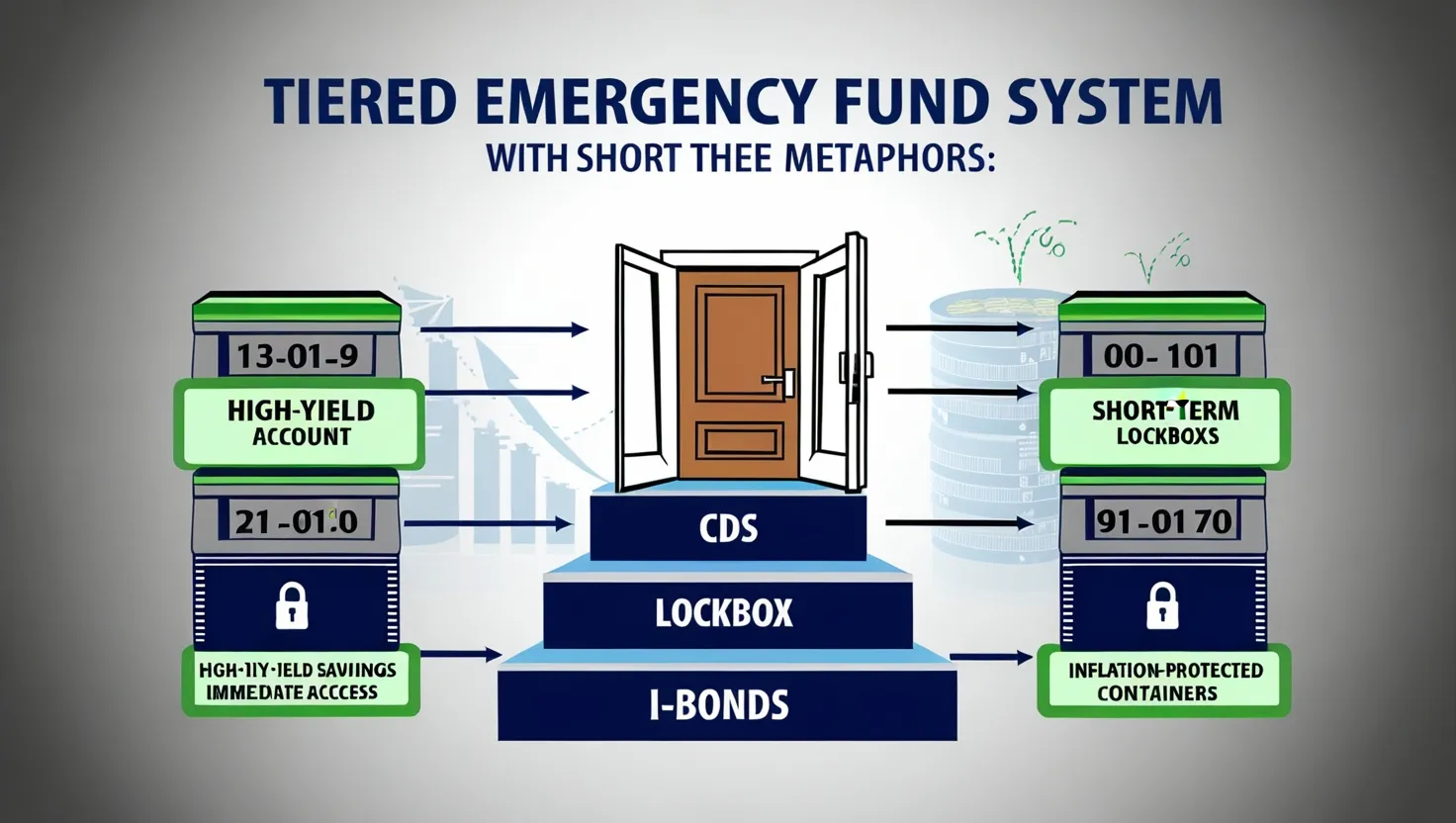

Creating a safety net is crucial too. Aim to stash away a few months’ worth of living expenses. It’s like having a financial airbag - you hope you never need it, but you’ll be glad it’s there if you do.

Now, I’m not saying you need to live like a monk. But embracing a bit of frugality can go a long way. It’s about being intentional with your spending. Do you really need the latest iPhone, or is your current one still doing the job? Small tweaks can add up to big savings over time.

The end goal? Financial independence. Imagine waking up every day knowing you don’t have to work unless you want to. That’s the power of smart budgeting and investing.

So, ready to start your journey to millionaire status? Here’s your game plan:

- Set up your 50/30/20 budget.

- Create a visual tracker for your financial goals.

- Work on your money mindset with daily affirmations.

- Take advantage of free financial consultations.

- Align your spending with your values.

- Start investing, even if it’s just a little bit.

- Resist lifestyle inflation as your income grows.

- Build up your emergency fund.

- Embrace frugality where it makes sense.

- Keep your eyes on the prize: financial independence.

Remember, becoming a millionaire isn’t about luck or being born with a silver spoon. It’s about making smart choices day in and day out. It’s about having a plan and sticking to it. And most importantly, it’s about believing in yourself and your ability to achieve financial freedom.

So, what are you waiting for? Your millionaire journey starts now. Take that first step, set up your budget, and watch as your financial future transforms. Trust me, future you will be doing a happy dance all the way to the bank.

Now go forth and conquer your finances! You’ve got this, future millionaire.