In the world of finance, the way you perceive time can be a game-changer. Imagine having the ability to stretch and compress your perception of market time, allowing you to see patterns and opportunities that others might miss. This concept, which we can call “temporal elasticity investing,” is about developing a flexible mindset that lets you navigate market rhythms with unprecedented clarity and foresight.

To start, let’s consider how traditional investing strategies often fall into two broad categories: short-term and long-term. Short-term investors focus on daily or weekly fluctuations, trying to capitalize on immediate market movements. Long-term investors, on the other hand, look at years or even decades, hoping to ride out market cycles and benefit from steady growth. However, these approaches can be limiting because they don’t allow for a dynamic view of time.

When you adopt a temporally elastic mindset, you can zoom in and out of different time scales at will. For instance, you might see a stock’s daily fluctuations as a microcosm of its yearly trend. This means that instead of just looking at the stock’s performance over the past day or week, you’re also considering how those short-term movements fit into the larger picture of its annual performance.

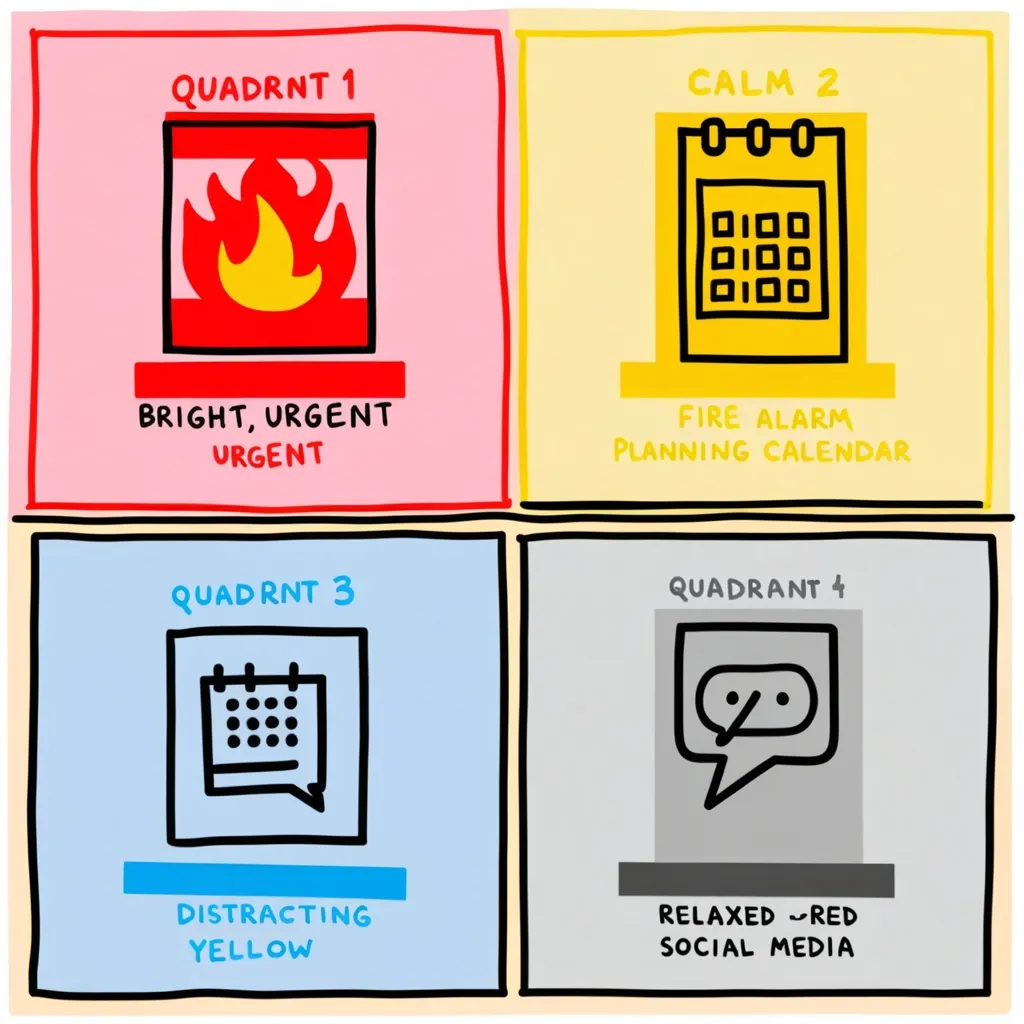

This approach is rooted in the concept of intertemporal substitution, which in economic terms refers to how individuals or households substitute their current consumption against future consumption in response to changes in interest rates or other economic factors. In investing, this translates to how you balance short-term gains with long-term goals. By mentally compressing or expanding time, you can better understand how different time frames interact and influence each other.

For example, if you’re analyzing a stock, you might notice that its daily price movements are influenced by news and market sentiment, but these movements also reflect broader trends that play out over months or years. By seeing these different time scales simultaneously, you can identify patterns that might not be apparent when looking at just one timeframe.

One of the key benefits of this approach is that it helps you avoid the pitfalls of myopic decision-making. When you’re only focused on short-term gains, you might miss out on significant long-term opportunities. Conversely, if you’re too focused on the long term, you might overlook immediate market conditions that could impact your investments. Temporal elasticity investing allows you to balance these perspectives, making more nuanced and context-rich decisions.

Another aspect to consider is the psychological component of time perception. Research has shown that people’s perceptions of time can be influenced by various factors, including their expectations and past experiences. For instance, if you’ve had success with short-term trades in the past, you might be more inclined to focus on short-term market movements. However, by training your mind to be more flexible, you can overcome these biases and develop a more balanced view.

In practice, this might involve setting up multiple screens or charts that show different time frames for the same market or stock. You could have one screen showing real-time data, another showing weekly trends, and another showing yearly or even decade-long trends. By constantly switching between these views, you can develop a deeper understanding of how different time scales interact.

Moreover, this approach can help you better anticipate market cycles. Economic cycles, such as those described in macroeconomic models, often play out over long periods but are influenced by short-term factors. By seeing these cycles in a more flexible timeframe, you can anticipate when a market might be about to shift from one phase to another.

For instance, if you notice that a particular stock or market index is experiencing daily fluctuations that are consistent with a larger yearly trend, you might anticipate that this trend is likely to continue unless there are significant changes in market conditions. This foresight can be invaluable in making strategic investment decisions.

Additionally, this method can help you manage risk more effectively. When you see market movements in multiple time frames, you’re better equipped to identify potential risks and opportunities. For example, if you notice that a stock’s daily volatility is increasing while its yearly trend remains stable, you might conclude that the short-term volatility is just noise and not a sign of a larger issue.

Incorporating subjective expectations into your analysis is also crucial. Studies have shown that people’s subjective expectations about future market conditions can significantly influence their investment decisions. By combining these expectations with a flexible view of time, you can make more informed decisions that account for both objective data and subjective insights.

For example, if you expect interest rates to rise in the future, you might adjust your investment strategy to favor stocks or assets that historically perform well in such conditions. However, by also considering the short-term implications of such a rise, you can make more precise adjustments that balance immediate needs with long-term goals.

Ultimately, the key to successful temporal elasticity investing is practice and patience. It takes time to develop the mental flexibility to see market movements in multiple time frames simultaneously. However, the rewards are well worth the effort. By turning time itself into a powerful analytical tool, you can gain a unique edge in the market, enabling you to navigate its rhythms with clarity and foresight.

In this world of temporal elasticity, your perception of time is not fixed; it’s a dynamic tool that you can use to uncover hidden patterns and opportunities. It’s about seeing the market as a complex, interconnected system where different time scales influence each other in profound ways. By mastering this approach, you can make more nuanced, context-rich investment decisions that set you apart from other investors.

So, the next time you’re analyzing the market, try to see it through the lens of temporal elasticity. Zoom in on the daily fluctuations, but also zoom out to see the yearly trends. View a decade-long market cycle as a single moment in a grander economic story. By doing so, you’ll unlock a new level of market insight that can guide you to smarter, more strategic investment decisions.