**Behavioral Mispricing: How Smart Investors Profit When Fear Drives Stock Prices Below Fair Value**

Discover proven strategies for finding undervalued stocks during market panic. Learn to identify behavioral mispricings using quantifiable signals and disciplined analysis. Master contrarian value investing today.

Family Business Investment: How to Identify Winners Worth Your Capital

Discover proven strategies to identify profitable family-owned businesses worth your investment. Learn to evaluate governance, succession planning, and generational value for smarter investing decisions.

**How Value Investors Can Profit from Leadership Transitions and CEO Changes**

Discover smart investment strategies during leadership transitions. Learn to spot mispriced opportunities when CEO changes create market uncertainty. Expert tips for value investors.

Value Investing During Technological Disruption: How to Spot Winners Among Legacy Companies

Discover how to find hidden value in disrupted industries. Learn to identify genuine investment opportunities when technology threatens traditional businesses. Start investing smarter today.

7 Smart Value Investing Strategies During Economic Uncertainty

Discover 7 proven techniques for value investing during economic shifts. Learn to identify companies with strong balance sheets, operational flexibility, and strategic vision that will emerge stronger from market turbulence. Start finding hidden opportunities today.

5 Proven Strategies for Finding Value in Small-Cap Stocks with High Insider Ownership

Discover how small-cap value investing with high insider ownership creates exceptional returns. Learn 5 proven strategies to find companies where management's interests align with yours for maximum long-term growth potential. Start investing smarter.

Master Strategic Capital Allocation: Value Investor's Guide to Superior Returns

Learn the art of strategic capital allocation with this value investor's guide. Discover how to evaluate management's deployment decisions, assess return thresholds, and identify superior capital allocators for long-term investment success. #ValueInvesting #Investing

Inflation-Proof Investing: How Value Strategies Build Wealth During Rising Prices

Discover how value investing can protect your wealth during inflation. Learn to identify businesses with pricing power and low capital needs that thrive when prices rise. Build a resilient portfolio that preserves and grows real returns.

Value Investing: Profiting from Corporate Special Situations and Market Inefficiencies

Discover time-tested value investing strategies for special situations like spin-offs, restructurings, and corporate events. Learn how to identify hidden opportunities others miss and capitalize on market inefficiencies for superior investment returns.

The Investor's Guide to Identifying Durable Competitive Moats in Value Investing

Discover how to identify durable competitive advantages in value investing. Learn to assess network effects, switching costs, and intangible assets that create lasting moats for long-term investment success. #ValueInvesting #CompetitiveAdvantage

Value Investing in Cyclical Industries: Timing Opportunities Through Market Cycles

Learn to find hidden value in cyclical industries by focusing on normalized earnings, balance sheet strength, and asset values. Discover how patience and contrarian thinking can yield exceptional returns when others panic. Read our expert guide now.

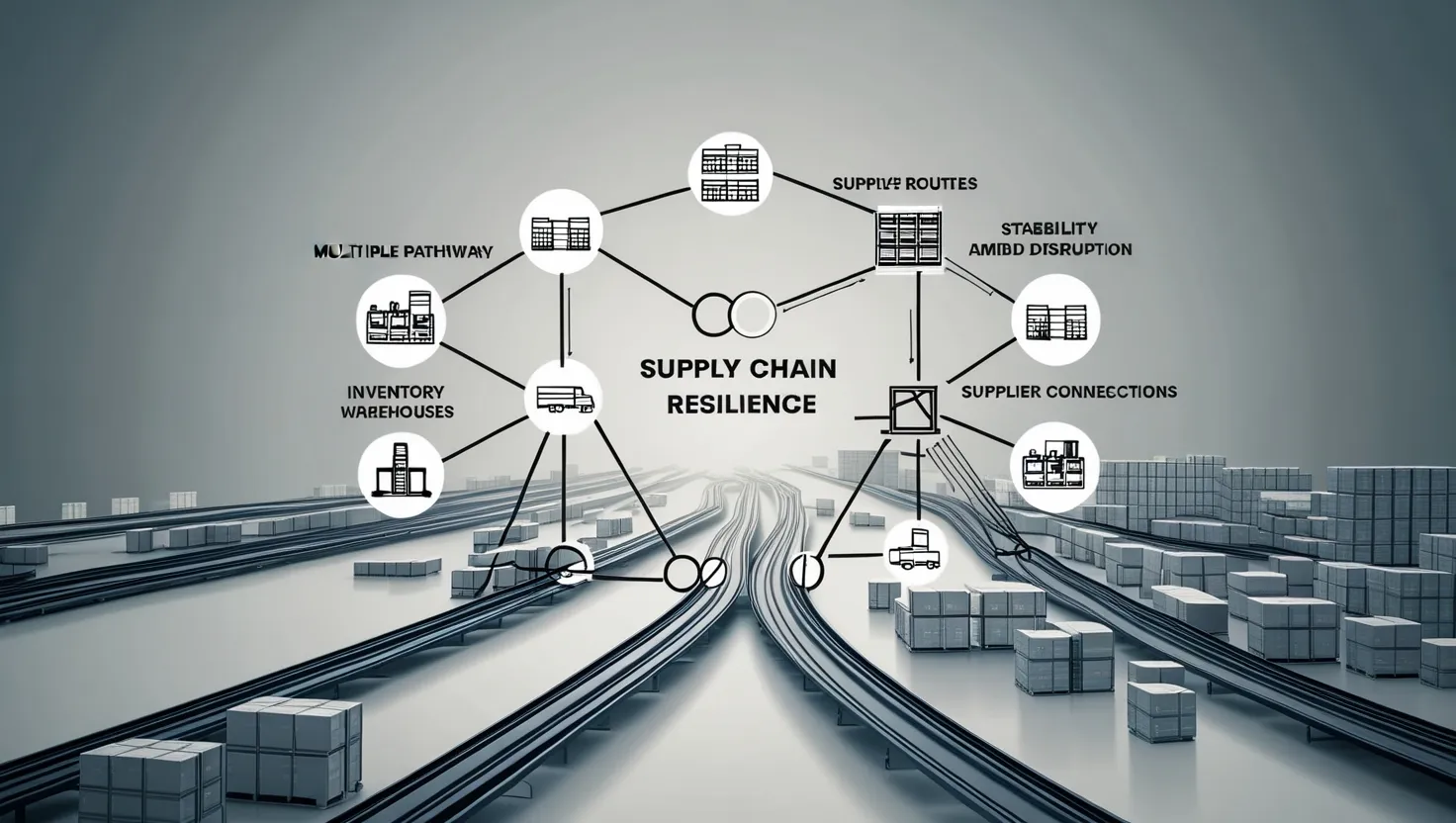

Supply Chain Resilience: 3 Value Investment Strategies During Disruptions

Discover how value investors find opportunity in supply chain chaos. Learn 3 proven strategies to identify resilient businesses with competitive advantages during disruptions. Invest smarter today.

Financial Statement Analysis: 10 Critical Keys for Value Investors

Discover the hidden value of financial statements in value investing. Learn how to spot red flags, analyze footnotes, and avoid value traps. Find real company worth beyond surface numbers. Start investing smarter today.