**5 Value Investing Strategies That Exploit Market Psychology for Massive Returns**

Master value investing psychology with 5 proven strategies to buy quality businesses when fear creates discounts. Learn to profit from crowd emotions, forced selling, and market extremes for long-term wealth building.

**How to Profit From Disrupted Industries: Value Investing During Tech Transformation**

Find undervalued gems in disrupted industries with this value investor's guide. Learn to spot hidden assets, assess management responses, and build safe margins in falling tech sectors. Start hunting today!

**Value Investing Secrets: How to Profit from Distressed Companies Others Avoid**

Learn value investing in distressed companies. Find undervalued stocks with temporary problems, analyze survival odds, and capitalize on market fear. Expert guide to crisis investing.

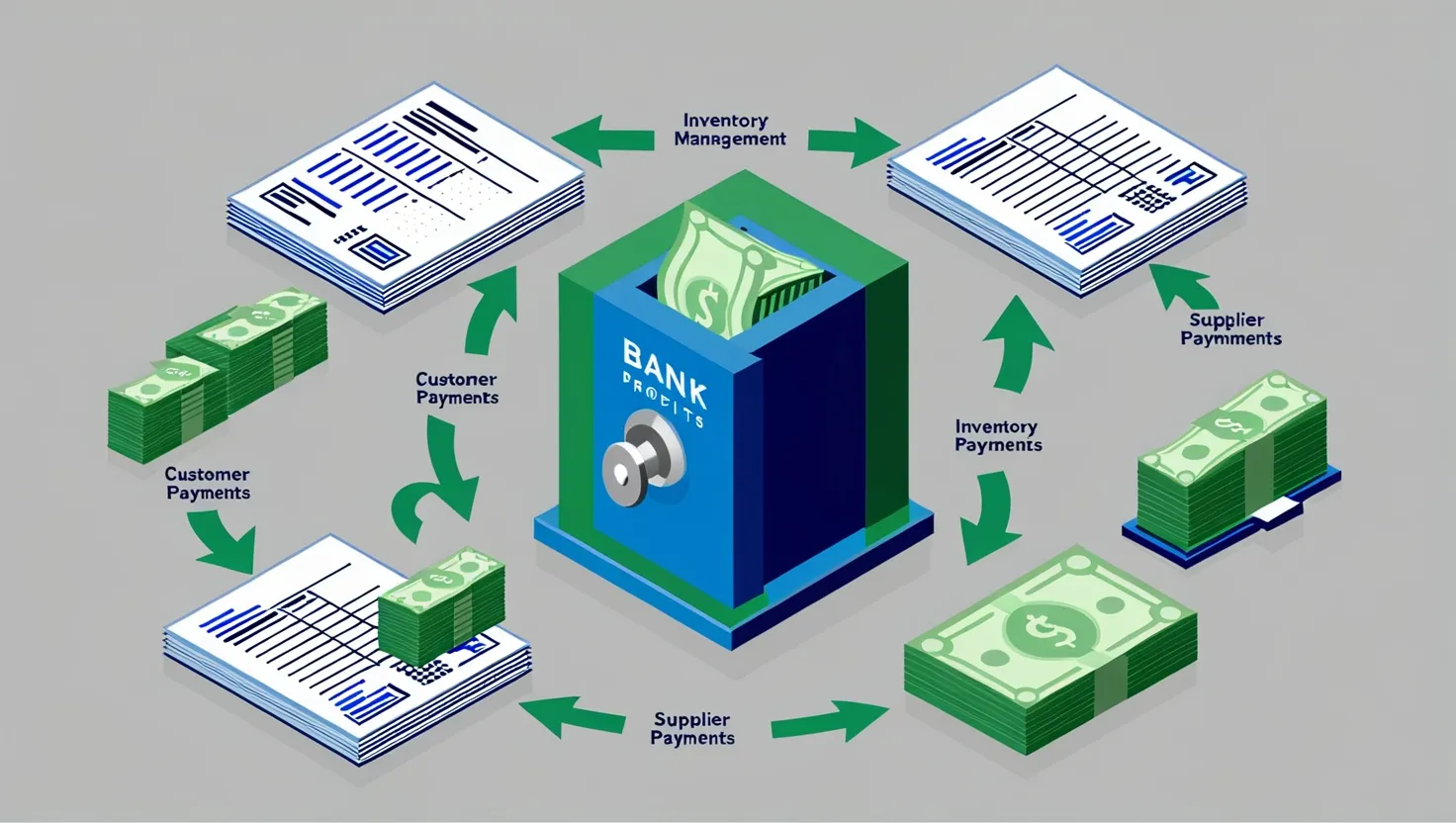

**How to Find Hidden Value in Financial Companies: A Professional Investor's Strategic Guide**

Discover proven strategies for finding value in financial services stocks. Learn to analyze net interest margins, credit quality, and capital allocation beyond headline numbers to spot hidden opportunities.

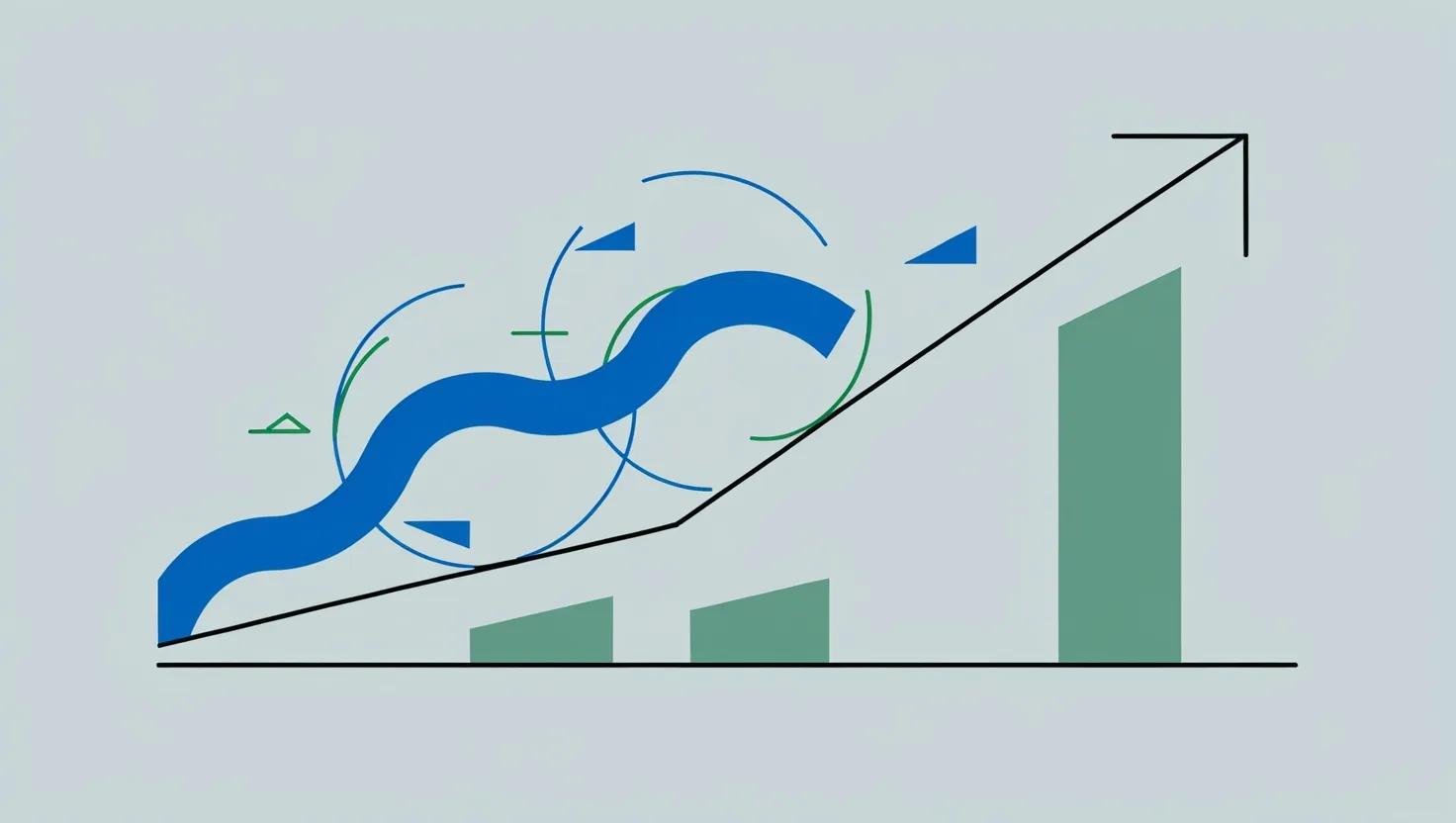

Why Smart Investors Focus on Cash Flow Conversion Over Profits for Long-Term Success

Discover how cash flow conversion reveals undervalued stocks that outperform during market downturns. Learn key metrics and strategies for finding resilient companies.

**Value Investing in Founder-Led Companies: Hidden Signals Smart Investors Use to Find Gems**

Discover proven strategies for value investing in founder-led companies. Learn to identify signals, evaluate succession plans, and spot opportunities others miss. Get insights now!

**6 Hidden Asset Value Investing Strategies That Beat The Market By 11% Annually**

Discover 6 hidden asset value investing strategies that uncover undervalued companies with real estate, patents, and buried assets trading below true worth. Find market-beating opportunities now.

How to Find Value Investing Opportunities During Regulatory Upheaval and Market Panic

Find value opportunities when regulatory changes hit industries. Learn practical strategies to identify winners while others panic-sell. Master value investing during market turmoil.

**5 Value Investing Strategies for Recurring Revenue Businesses That Generate Consistent Returns**

Discover 5 value investing strategies for recurring revenue businesses that deliver predictable cash flows and compound returns. Learn retention analysis, capital efficiency, and hidden opportunities others miss.

International Value Investing: Finding Hidden Gems in Global Markets Most Investors Ignore

Learn proven strategies for finding undervalued international stocks through value investing. Discover how to spot hidden gems in global markets, assess governance risks, and profit from market inefficiencies. Start building your international value portfolio today.

**Behavioral Mispricing: How Smart Investors Profit When Fear Drives Stock Prices Below Fair Value**

Discover proven strategies for finding undervalued stocks during market panic. Learn to identify behavioral mispricings using quantifiable signals and disciplined analysis. Master contrarian value investing today.

Family Business Investment: How to Identify Winners Worth Your Capital

Discover proven strategies to identify profitable family-owned businesses worth your investment. Learn to evaluate governance, succession planning, and generational value for smarter investing decisions.

**How Value Investors Can Profit from Leadership Transitions and CEO Changes**

Discover smart investment strategies during leadership transitions. Learn to spot mispriced opportunities when CEO changes create market uncertainty. Expert tips for value investors.