How do you spot value in financial services companies, when so much of what drives their profitability is hidden in balance sheet complexity and macroeconomic cycles? Over the years, I’ve found that approaching banks, insurers, and asset managers with a careful blend of skepticism and creativity pays off. When you look beyond headline numbers, you begin to notice persistent patterns and less obvious sources of strength—often overlooked by the crowd. Are you ready to look deeper and ask better questions?

“In the short run, the market is a voting machine but in the long run, it is a weighing machine.” — Benjamin Graham

I always start with net interest margins, but context is everything. Many investors simply scan the top line for fat margins, but the trick is understanding how banks earn those margins across changing interest rate environments. If a bank consistently delivers attractive spreads even during periods of rock-bottom rates, it suggests they have unique funding sources or robust asset selection processes—those are real advantages. Why chase businesses that thrive only when rates swing in their favor? Instead, I compare margin stability over both boom and bust cycles. It’s the only way to separate temporary windfalls from genuine structural resilience.

Now, credit quality—perhaps the trickiest cornerstone in banking and insurance. Many management teams talk a good risk game, but the truth reveals itself in underwriting discipline. Scrutinizing loan loss reserves versus the nature of the loan book can expose whose provisioning is truly conservative. The real test comes during credit expansions: while most are tempted to loosen standards, the exceptional firms consistently hold higher reserves and see lower charge-off rates over full cycles. That discipline pays off when the economic music stops. Have you ever looked at a bank’s charge-off trends and asked, “How did they fare last time things went south?” Consistency here is worth far more than a one-off profit spike.

“Risk comes from not knowing what you’re doing.” — Warren Buffett

Capital allocation in finance isn’t just about maximizing returns—regulatory constraints force management into difficult choices. I dig into how teams optimize shareholder value while maintaining sufficient capital buffers. The real winners are those that reliably generate returns above their cost of equity, year after year, and still clear all regulatory hurdles. That’s a delicate balance, given shifting rules and capital requirements globally. Building a dashboard to track return on regulatory capital across markets can tell you whether the leadership is prioritizing sustainable growth or swinging for the fences. Do you ever wonder why some banks sail through regulatory storms unscathed while others scramble for emergency capital infusions?

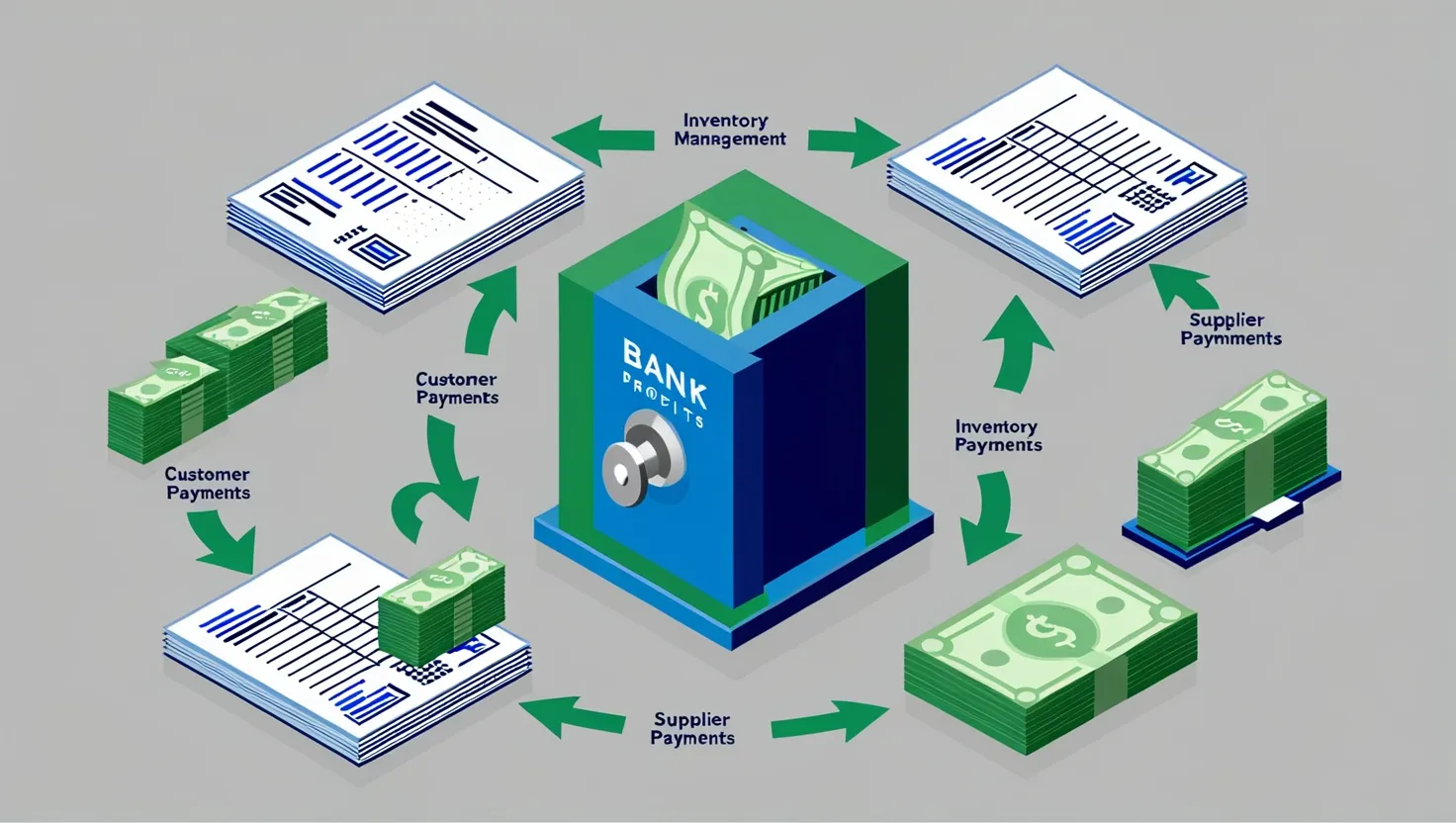

One of the most underappreciated avenues for value in financials lies in fee-based operations buried within larger balance sheet businesses. Many investors overlook the value of asset management, advisory, or payment processing arms when assessing banks and insurers holistically. These fee streams often trade at deep discounts because they’re consolidated with more cyclical lending operations. By calculating sum-of-the-parts valuations, you can sometimes identify valuable embedded franchises ignored by the market. It always pays to ask: “What’s this business really worth broken out into pieces?” Sometimes hidden gems sit within plain sight.

“The stock market is filled with individuals who know the price of everything, but the value of nothing.” — Philip Fisher

Case studies illuminate how these ideas work in practice. I remember researching a regional bank that traded below tangible book value despite a return on equity consistently north of 12% and peer-leading credit metrics. Its branch network operated with remarkable efficiency. As investors realized its credit quality wasn’t a mirage, the market repriced its shares upward by 150%. Another example was an insurer whose investment portfolio was marked correctly by the market, yet its underwriting business—profitable for years—was virtually ignored in valuation. The price gap didn’t last.

Practical tools make these strategies actionable. I use dashboards to monitor regulatory capital efficiency: keeping tabs on leverage across different jurisdictions and measuring how much capital banks can generate organically versus what’s needed by regulation. I pay close attention to how management teams communicate their strategic priorities—especially during times of regulatory change. Are their words consistent with their capital deployment actions? Mixed signals can be a red flag.

“The most important quality for an investor is temperament, not intellect.” — Warren Buffett

At the heart of all these strategies is the idea that financial companies aren’t just static piles of assets. They are living, adapting institutions. Risk management discipline, thoughtful capital allocation, and sustainable competitive positioning matter more than short-term noise. That’s why I never trade on quarterly earnings volatility alone. Instead, I search for signals of durability—traits that persist through cycles.

Here’s a question: How often do you examine the interplay between regulation and competitive advantage? Some firms shape their entire strategy to thrive under stricter rules, while others stumble. In financial services, regulatory agility is as much a competitive edge as any proprietary technology or prime location.

Over time, I’ve found that asking the unpopular, detail-oriented questions—about margin durability, credit consistency, capital priorities, and business mix—pays off. The market may overlook these signals for years, but patient, informed investors are well positioned to recognize genuine value when it eventually surfaces.

“If you don’t see yourself owning a stock for ten years, don’t even think about owning it for ten minutes.” — Warren Buffett

As you evaluate financial companies, challenge yourself to look deeper. Don’t take comfortable narratives at face value. Instead, investigate what makes a business resilient. Are its margin strengths explained by structure or by luck? Does its credit performance rest on robust underwriting or a fortunate cycle? Can it generate solid returns and satisfy regulators without cutting corners? What fee businesses might be undervalued inside a larger institution?

Most importantly, remember that true value investing in financial services requires the ability to think a bit differently. Trades born of patience, discipline, and a willingness to ask the extra question tend to outperform those driven by fleeting market sentiment. The next time you sift through a financial firm’s annual report, challenge yourself: What’s missing from the popular story, and what might just be hiding in plain sight?