If you asked most investors what really keeps a company strong through ups and downs, many would point to profits. But the true health often lies deeper—in a business’s knack for turning those profits into usable cash. That’s where cash flow conversion comes in, and it’s become my favorite tool for finding resilient, undervalued gems.

I spend a lot of time examining how companies move accounting profits off the page and into the bank. This skill isn’t just technical. It’s about how well a business manages its priorities, treats its partners, and navigates uncertainty. Are you wondering why some companies breeze through a recession while others falter with barely a bump in their reported earnings? The answer often sits in their cash flow statements, not their income sheets.

“Never invest in a business you cannot understand.” —Warren Buffett

Let’s start with the core strategy: focusing on free cash flow margins. To me, the numbers get interesting only after all the corporate dust settles—after suppliers are paid, inventories are built and sold, employees are staffed, and customers have handed over real money. Calculating free cash flow as a percentage of revenue helps me filter out companies that dazzle in good times but struggle to produce actual spendable cash.

Here’s a question I like to ask myself: if this company’s revenue vanished tomorrow, how many bills could they still pay with cash on hand? A business with high free cash flow margins relative to its industry signals pricing power, operational discipline, and an ability to weather storms. Watching these margins through different market cycles often spotlights businesses that simply outlast their competition.

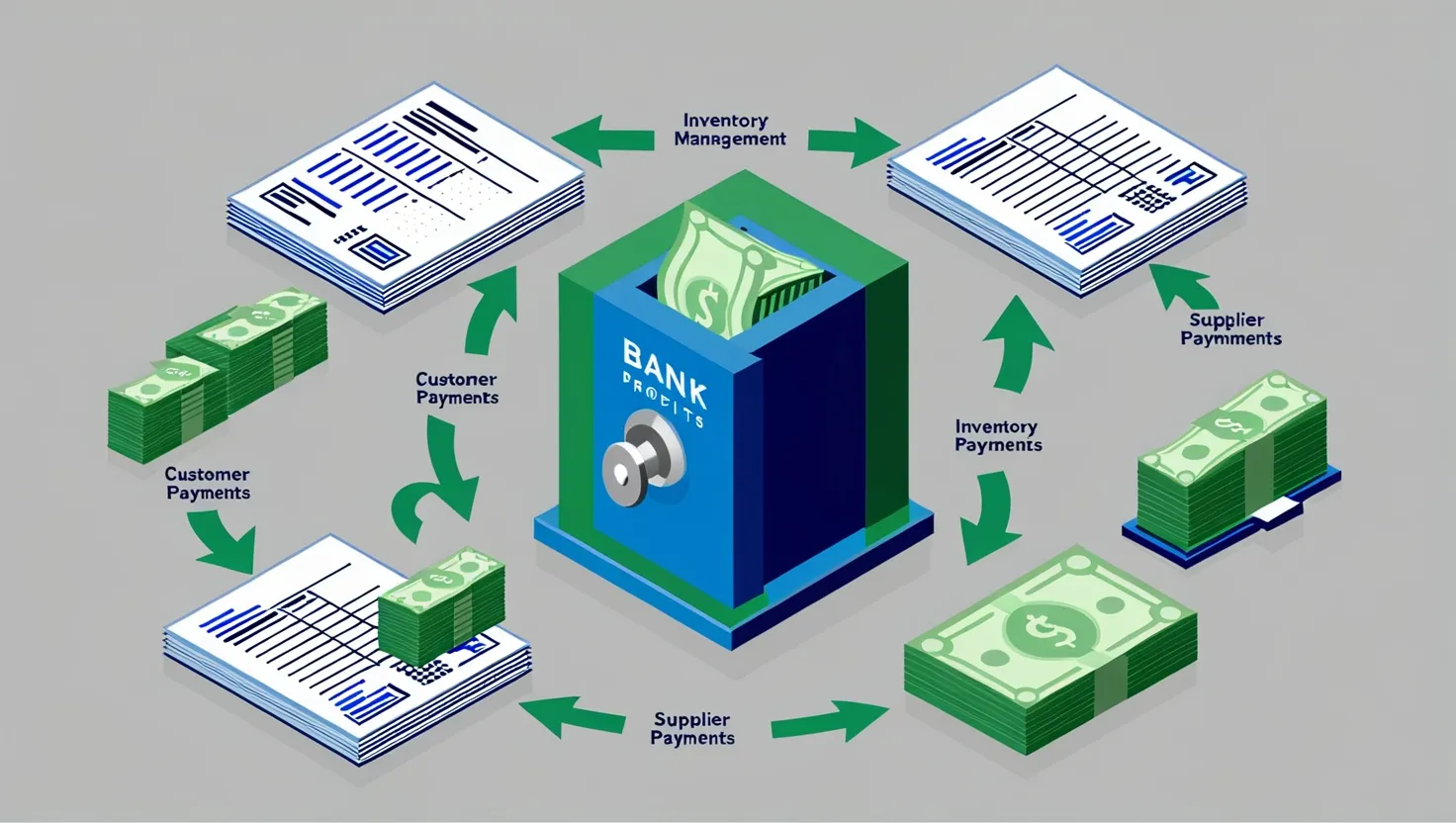

Where things get even more telling is in working capital management and the cash conversion cycle. The fastest cash converters I’ve seen are almost obsessive about collecting from customers fast, running lean on inventory, and smartly negotiating longer payment windows with suppliers. The metric here is Days Sales Outstanding, Days Inventory Outstanding, and Days Payable Outstanding—all coming together to form the company’s cash conversion cycle.

But have you ever noticed how some tech companies or subscription businesses actually collect cash before providing the service? That’s deferred revenue—a piece often skipped in classic analysis but one I always factor in. Companies holding customer money upfront have an edge. They can operate almost like tiny banks, funding their growth on other people’s cash. Of course, if their growth stalls, the risk reverses. But spotting businesses using this dynamic responsibly has led me to more than one overlooked opportunity.

“If you don’t know how to read the scorecard, you can’t tell the winners from the losers.” —Jack Welch

Capital expenditure discipline is another crucial area. It’s tempting to believe that companies must spend big to grow, but I tend to gravitate toward those able to do more with less. That’s not to say I dislike growth investments—on the contrary, strategic spending can be powerful. Still, companies that only need modest annual reinvestment to maintain (or even expand) their position are often quietly compounding shareholder returns. They send the excess cash my way as dividends, share buybacks, or internal growth, without the constant need to issue new stock or pile on debt.

Have you ever wondered what happens when this excess cash builds up? It gives managers options. They can time acquisitions when markets are weak, invest in R&D without tapping external funds, or shore up the balance sheet ahead of a downturn. This optionality, funded by real, recurring cash, is one of the silent engines of value creation I look for.

“Risk comes from not knowing what you’re doing.” —Warren Buffett

Not all cash flows are created equal, though. That’s why sustainability over business cycles matters so much to me. If a company’s cash flow holds steady or even grows during an industry slump, I take note. This tells me the business model has built-in shock absorbers—perhaps recurring customer relationships, a dominant market position, or ultra-efficient operations. I like to map cash flow performance alongside industry trends; companies that maintain their flow when peers falter often command better long-term valuations.

On the flip side, if cash flows are lumpy, I ask myself: is this an unavoidable industry trait or a sign of poor management? Sometimes, a temporary dip is a buying opportunity if I have confidence in the underlying economics. But if cash dries up at the first sign of trouble, I stay away, no matter what the earnings say.

This leads me naturally to cash flow-based valuation. The classic price-to-earnings ratio often gets headlines, but I prefer something like free cash flow yield or cash return on invested capital. These measures are harder to manipulate and tie directly to what shareholders actually receive.

Have you ever noticed how some stocks seem expensive on earnings but cheap on cash flow? That’s often a market mispricing, waiting for patient investors. Businesses with depressed accounting earnings—maybe due to heavy upfront investments or non-cash charges—but strong cash generation can offer a large margin of safety.

Here’s a story that stuck with me: an industrial firm, battered by a cyclical downturn, was trading at very low earnings multiples. Most ignored it. But the cash flow statements showed robust conversion—working capital and capex were tightly managed, sales were collected promptly, and operations stayed lean. Those who dug deeper and waited reaped outstanding returns when the sector recovered and the cash generation became too obvious to ignore.

“It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.” —Warren Buffett

To apply these lessons, I use a cash conversion efficiency scorecard. This simple tool lets me track trends in free cash flow margins, working capital intensity, and capital allocation. It keeps me honest and forward-looking, not just backward-glancing. I listen closely to management calls or letters for clues about cash priorities—are they hoarding, reinvesting smartly, or returning capital thoughtfully? If their words and actions align, my confidence rises.

One neglected area is how cash flow quality links to company culture. I’ve noticed that disciplined cash converters often have cultures of frugality, process focus, and sober self-assessment. They reward efficiency without cutting corners. And these traits, though rarely discussed in the headlines, often prove more durable than any technical advantage.

So, what hidden risks can even strong cash generators face? Regulatory upheavals, customer concentration, and sudden drops in demand can all interrupt the smoothest cash cycles. That’s why I always balance historical metrics with ongoing industry intelligence and management interviews. No single number tells the whole story.

If you’re building a portfolio and want something truly resilient, I urge you to look beyond reported profits. Ask: Can this company consistently turn its earnings into real money, year in and year out? Do they need major new borrowing just to keep the lights on? Will operational discipline hold when times get tough, or is it just talk for presentations?

Ask yourself: Is management obsessive about the details—pushing for faster collections, negotiating supplier terms, running leaner inventories, and scrutinizing every capital outlay? It’s in these mundane rhythms that you find the roots of endurance and lasting wealth.

“The stock market is filled with individuals who know the price of everything, but the value of nothing.” —Philip Fisher

In the end, prioritizing cash flow conversion does more than safeguard you from downturns—it helps you quietly compound wealth over years, sometimes unnoticed. That’s the real secret behind many legendary investment records.

After all, compounding isn’t just about numbers on a spreadsheet. It’s about identifying those few companies that can take today’s profits and turn them into tomorrow’s options, all while maintaining the discipline to let nothing slip through the cracks. Isn’t that the company you’d want to own for decades, through every market twist and turn?

I encourage you to start looking at your portfolio through this cash-centric lens. You might be surprised by what you find—and by how much more confident you feel when the next storm rolls in.