Mastering Big Buys: Stress-Free Strategies for Financial Wins

Turning Financial Dreams into Reality: Budgeting Big Purchases Made Easy

Inflation's Sneaky Game: How to Keep Your Savings Safe

When Inflation Turns Your Savings Journey into a Treadmill Adventure

Unlock Your Dream Vacation Without Breaking the Bank

Stretching Your Travel Bucks Without Breaking a Sweat

Hidden Secrets to Financial Freedom: Mistakes to Avoid and Tips to Thrive

Nurture Your Finances and Watch Your Future Flourish

The Top 5 Passive Income Streams That Are Making People Rich!

Passive income: wealthy's secret. Real estate, stocks, digital products, rentals, and intellectual property generate ongoing revenue. Diversify streams, start small, and invest time upfront for long-term financial growth and flexibility.

Is Gold Still a Safe Haven Investment? - The Pros and Cons of Precious Metals in 2024

Gold remains a popular safe haven in 2024, with prices soaring due to global uncertainties. Investors seek it for inflation protection, but experts advise limited allocation in diversified portfolios.

Should You Pay Off Debt or Invest? - The Surprising Answer to One of Finance’s Biggest Dilemmas

Balance debt repayment and investing based on interest rates, goals, and risk tolerance. Prioritize high-interest debt, emergency fund, and employer matches. Start early to maximize compound interest.

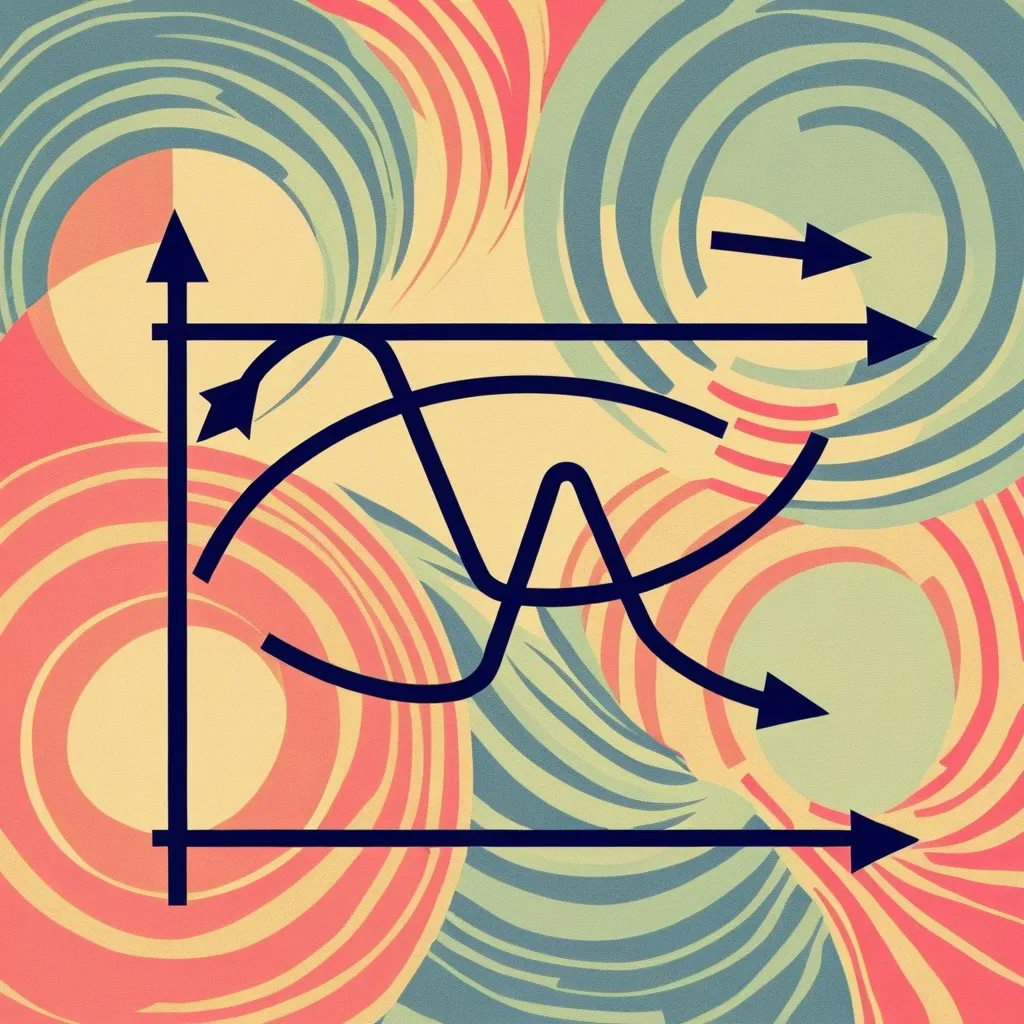

Why the Phillips Curve Might No Longer Explain Inflation and Unemployment - Challenging traditional economic theories.

The Phillips Curve, once a reliable economic theory, now challenges traditional thinking. Global labor markets, technology, and changing inflation expectations have disrupted the inverse relationship between unemployment and inflation, prompting economists to reassess their understanding.

Ride the Crypto Rollercoaster: Thrills, Spills, and Smarter Moves

Navigating the Wild West of Cryptocurrency: Thrills, Risks, and High Stakes

The AI Revolution in Finance - How Bots Are Beating Brokers at Their Own Game

AI revolutionizes finance with 24/7 chatbots for banking and personalized advice. Automated trading systems democratize investing, offering emotion-free decisions and risk assessment. AI enhances accessibility, predicts market trends, and improves financial services globally.

Discover the Art of Intentional Spending: Elevate Your Financial Well-Being

Guide Every Dollar Towards Happiness: Embrace Mindful Spending and Transform Your Financial Life

Is Social Media the New Stock Market? - How Twitter and Reddit Are Driving Investment Trends

Social media revolutionizes investing, providing real-time market insights through platforms like Twitter and Reddit. Tools analyze millions of posts, helping investors spot trends. However, balancing this data with traditional research remains crucial for informed decision-making.

What’s Really Behind Stock Market Surges? - The Untold Role of Corporate Buybacks

Stock buybacks drive market surges by reducing share count, boosting prices. Companies use them to return capital, but they can increase inequality and prioritize short-term gains over long-term growth. They're a key indicator of corporate strategy and economic confidence.