6 Zero-Based Budget Habits That Will Transform Your Finances

Discover 6 practical habits to build a zero-based budget that gives every dollar purpose. Learn how to track income, hold budget meetings, and create realistic categories for complete financial clarity. Start taking control today.

7 Smart Cash Management Strategies to Build Wealth Faster

Discover 7 proven cash management strategies to build lasting wealth. Learn how to optimize emergency funds, automate transfers, and make idle money work harder. Start building financial freedom today. #WealthBuilding #MoneyManagement

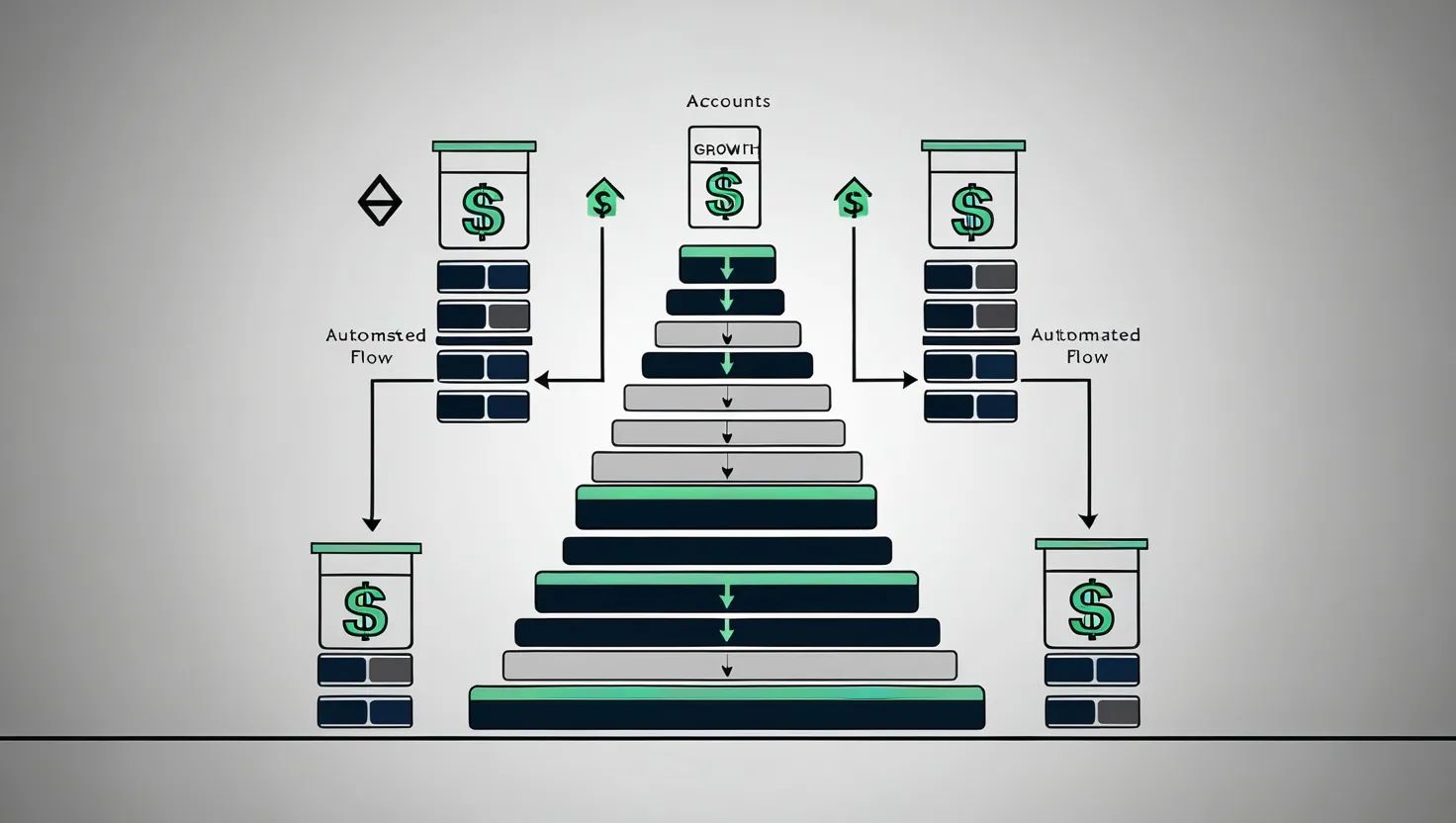

5 Automatic Savings Systems That Build Wealth While You Sleep

Discover 5 automatic savings systems that grow wealth without constant effort. Learn how to build financial security through smart automation that works quietly in the background. Start today and transform your future.

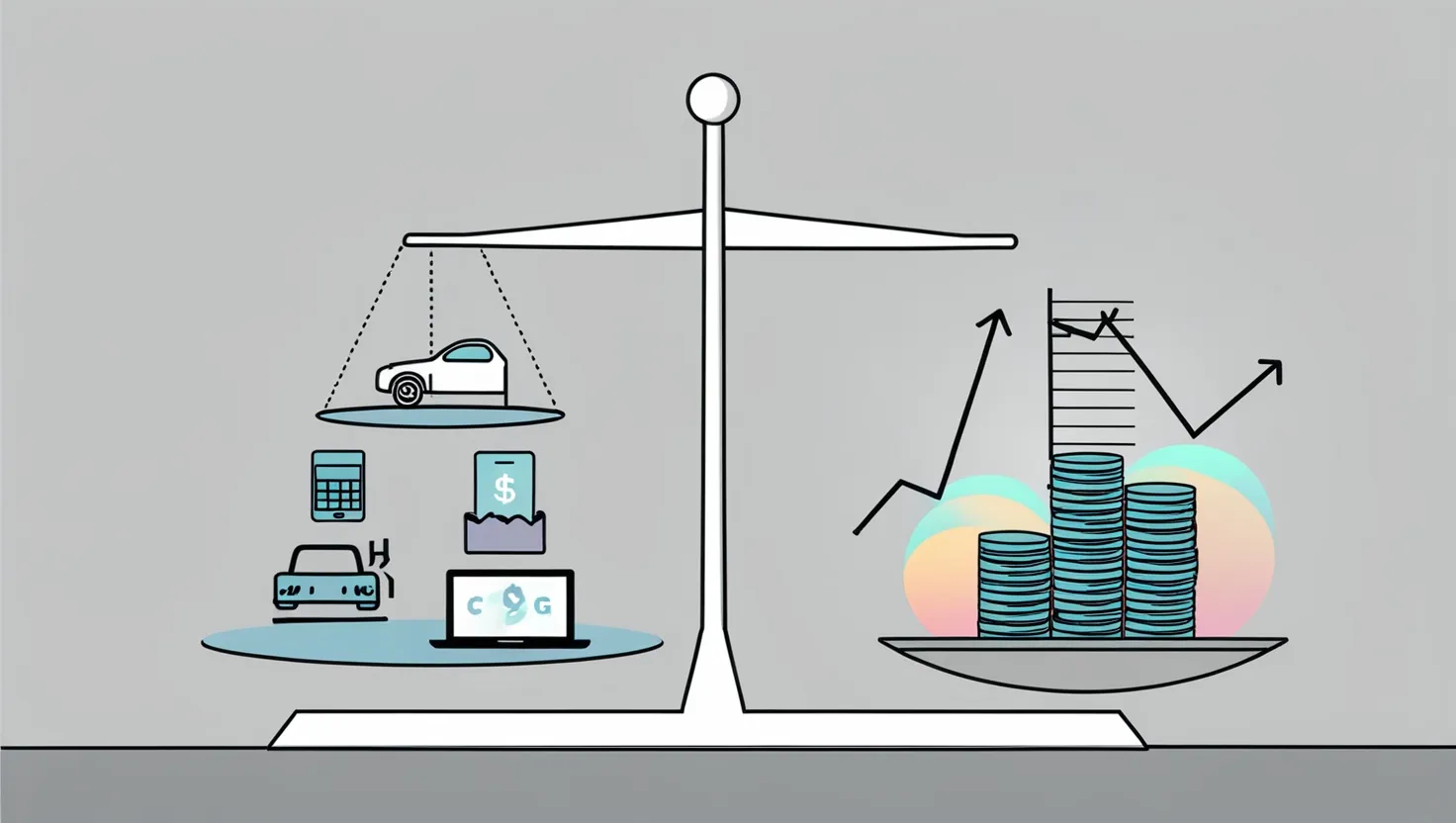

10 Micro-Budget Strategies to Build Wealth on Any Income Level

Discover practical micro-budget techniques to build wealth on any income level. Learn sustainable habits for saving, investing, and debt reduction that compound over time. Start your financial growth today.

How to Build a High-Yield CD Ladder: Maximize Savings While Maintaining Flexibility

Discover how to build a high-interest CD ladder to grow savings while maintaining flexibility. Learn proven strategies for staggered investments, online bank advantages, and specialized CD options. Start earning better returns today!

6 Ways to Create a Self-Maintaining Investment Portfolio That Grows While You Sleep

Learn six practical ways to automate your investment strategy for passive wealth growth. Discover recurring investments, threshold-based rebalancing, and dividend reinvestment plans that work while you sleep. Start building financial freedom today!

7 Financial Rules Worth Breaking: Unconventional Paths to Build Wealth Faster

Discover which common financial rules may be holding you back from building wealth. Learn when to strategically break traditional money advice to accelerate your financial success. Personalize your path to prosperity.

Tax Optimization Strategies: Building Wealth Through Strategic Tax Planning

Learn how to legally reduce taxes and build wealth faster. Discover strategic methods for retirement accounts, investment tactics, and real estate benefits that maximize savings. Start optimizing your tax strategy today for long-term financial success.

10 Proven Strategies to Accelerate Debt Payoff and Achieve Financial Freedom

Discover 10 powerful strategies to eliminate debt faster and achieve financial freedom. Learn practical methods to reduce interest, optimize payments, and stay motivated on your journey to becoming debt-free. Start today!

7 Proven Strategies to Build Wealth in the Gig Economy: A Systematic Approach

Discover proven strategies to build wealth in the gig economy. Learn how to diversify income streams, optimize your earnings, and create financial stability while enjoying flexibility. Transform your gig work into a wealth-building engine. #GigEconomy

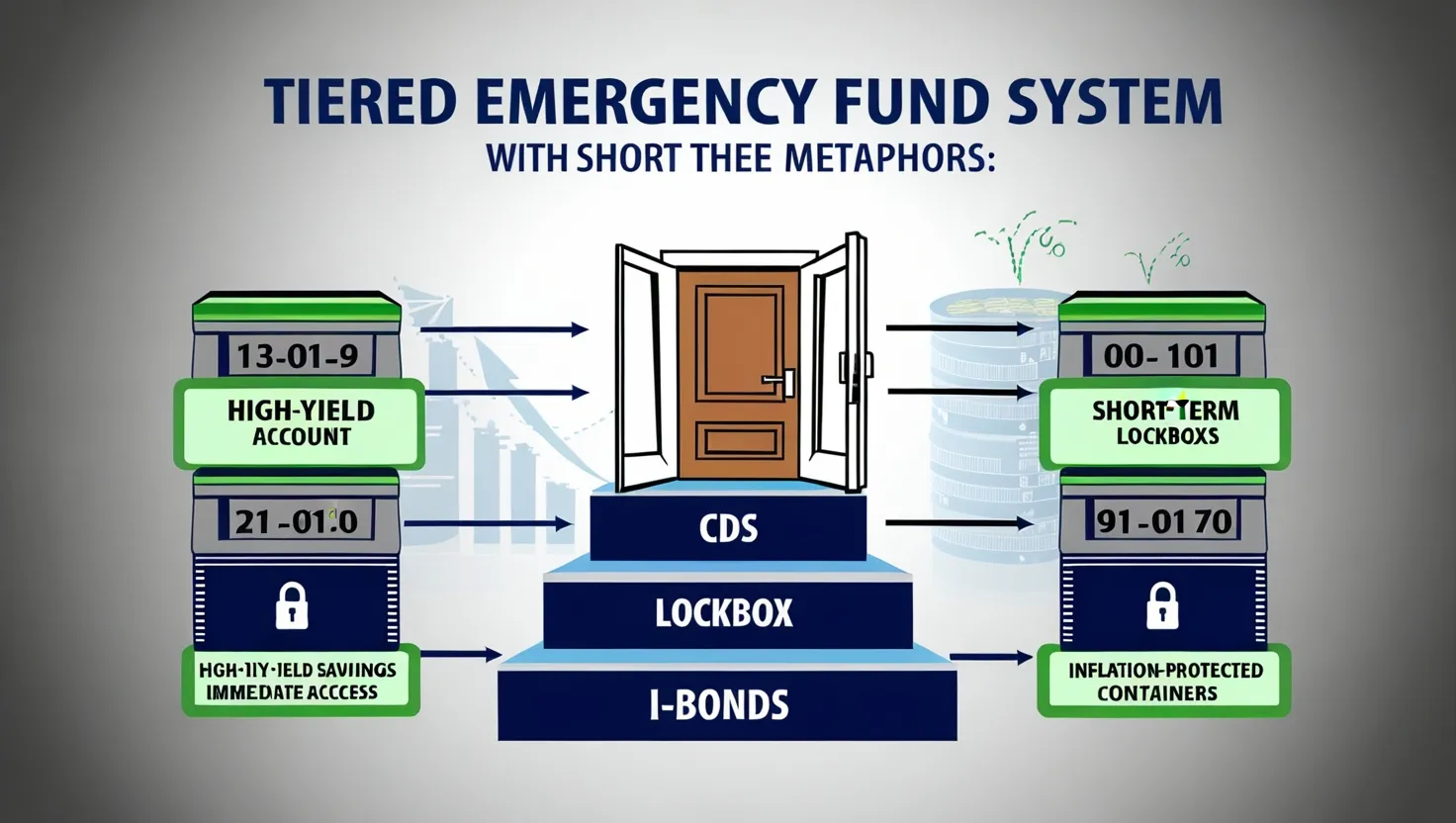

10 Smart Strategies to Build an Emergency Fund Without Sacrificing Financial Goals

Learn practical strategies for building a tiered emergency fund that maximizes returns while maintaining liquidity. Discover high-yield savings, CD ladders, and I-Bonds to protect your financial future. Start building your safety net today.

How to Build Wealth with REITs: A Dollar-Cost Averaging Strategy for Real Estate Investment

Learn how to build wealth through real estate without being a landlord. Discover the power of combining REITs with dollar-cost averaging for steady investment growth. Get practical tips for smart REIT investing today. #RealEstate #Investing

10 Best Cash Flow Investments for Monthly Income in 2024: Complete Guide

Learn how to build wealth through cash flow investments. Discover proven strategies for generating monthly income from dividend stocks, real estate, P2P lending, and more. Start creating passive income streams today.